Would you consider yourself ‘rich’? Here’s how much more you need to earn to be considered wealthy in every state compared to 5 years ago

The salary that can be considered “rich” has risen in every state over the past five years — as soaring inflation means everyday spending is eating up a larger share of wages.

In fact, new data shows that the income needed to be among the wealthiest has increased by more than 40 percent in some states.

According to Washington data, the definition of wealthy has changed the most in Washington state GOBanking Rateswhere Americans now need to earn $544,518 to be among the richest, up from $378,374.

The personal finance site defined “wealthy” as those in the top 5 percent of earners in each state.

To fall into this category, workers in 12 U.S. states must earn salaries of more than $500,000, as household purchasing power has eroded.

Washington is home to major paying companies such as Microsoft and Amazon, as well as Starbucks and T Mobile (photo: Amazon headquarters in Seattle)

GOBankingRates compared the U.S. Census Bureau’s 2017 salary data with the latest available 2022 data to see how the income threshold for being in the top 5 percent had changed over five years.

In Washington, residents had to earn $378,374 in 2017 to be in the top 5 percent of earners. But by 2022, the average income of the top 5 percent had risen to $544,518.

Washington is home to major paying companies such as Microsoft and Amazon, as well as Starbucks and T Mobile – all based in and around Seattle. It’s a far cry from its time as the birthplace of grunge and bands like Nirvana.

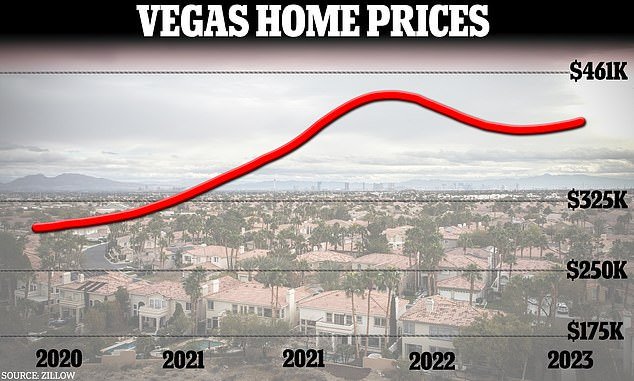

Nevada saw the second-largest jump over the period: a 40.41 percent increase, from $320,403 in 2017 to $449,872 in 2022.

Las Vegas residents say they have been priced out of the once affordable city as wealthy Californians have moved to Nevada, driving up housing costs.

Rents in Sin City, known for its glitzy casinos and glamorous hotels, have risen 35 percent since before the pandemic, according to one study. report earlier this year from Las Vegas Realtor.

Las Vegas residents say they have been priced out of the once affordable city as wealthy Californians have moved to Nevada, driving up housing costs

Housing costs in Las Vegas have been rising since before the pandemic

Third on the list was Idaho, where the salary had to be among the richest at 40.34 percent from $286,974 to $402,743 over five years.

Idaho, and especially its capital Boise, has seen an influx of visitors during the Covid-19 pandemic, which has driven up housing and living costs in the state.

South Carolina ranked fourth in terms of the largest change in income needed to be “rich,” and California ranked fifth.

Golden State residents needed to earn $613,602 to be in the richest 5 percent in 2022 — an increase of 37.21 percent from $447,207 in 2017.

Los Angeles is home to some of the wealthiest Americans, including celebrities like the Kardashians and movie stars like Leonardo DiCaprio, who are drawn to the entertainment capital of the world.

Meanwhile, typical wages in the San Francisco Bay Area are being pushed up by the hundreds of thousands of people working in high-paying jobs in the tech sector.

Silicon Valley is home to companies like Apple, Google, Meta, Netflix and Uber, where even average salaries are around $300,000 and top executives earn tens of millions of dollars per year.

In other states with high costs and a large percentage of wealthy residents, the change was less pronounced.

In New York, for example, the threshold increased by only 29.23 percent over the past five years, and in Connecticut and the District of Columbia by only 24 percent and 23.57 percent, respectively.

The state with the lowest percentage increase in five years was North Dakota, where the average income of the top 5 percent rose only 14.68 percent.

North Dakota has seen an influx of immigrants from outside the US, NPR reported, with the share of the population born outside the country increasing by more than 13 percent between 2021 and 2022.

But these new residents tend to be lower-income workers, so they haven’t driven up the cost of housing and living in the same way as in other states.

It rose from $364,954 in 2017 to $418,541 in 2022, according to GOBankingRates.

Los Angeles is home to some of the richest Americans, including celebrities like the Kardashians (photo Kris Jenner and Kim Kardashian)

Silicon Valley is home to Apple, Google, Meta, Netflix and Uber (photo: Meta founder Mark Zuckerberg)

In 2017, only Connecticut and the District of Columbia needed an income of more than $500,000 to be among the wealthiest residents.

But in 2022, the average income of the top 5 percent in Washington, California, Massachusetts, Hawaii, Virginia, Colorado, New York, New Jersey, Illinois, Maryland, Connecticut and the District of Columbia was more than $500,000 per year.

The rich are the richest in Connecticut and the District of Columbia, where top earners must have incomes of $656,438 and $719,253, respectively.

According to Labor Bureau data, the average income of one full-time worker in the US is about $60,000.

The study exposes the effect of rampant inflation and rising interest rates on household purchasing power.

The increase in costs for groceries, housing, childcare and transportation has affected the entire US.

Idaho, and especially its capital Boise, has seen an influx of visitors during the Covid-19 pandemic – which has driven up housing and living costs in the state

Inflation rose to 3.5 percent in March as prices were pushed up by high housing and gas costs

New data earlier this month showed how inflation has eroded the purchasing power of a $100 grocery store in five years.

In 2019, the amount would have bought shoppers a healthy 32-item bag, complete with milk, eggs, cereal, dish soap and more. However, today, customers would have to remove at least 10 of these products from their shopping cart to maintain the same budget.

Interest rates remain at a 23-year high, between 5.25 and 5.5 percent, and a higher-than-expected inflation report earlier this month has put cold water on hopes of a rate cut in the coming months.

Speaking earlier this month in Washington DC, Federal Reserve Chairman Jerome Powell said it will take “longer than expected” to return inflation to the central bank’s target of 2 percent – signaling that it it will probably also take longer to reduce interest rates.