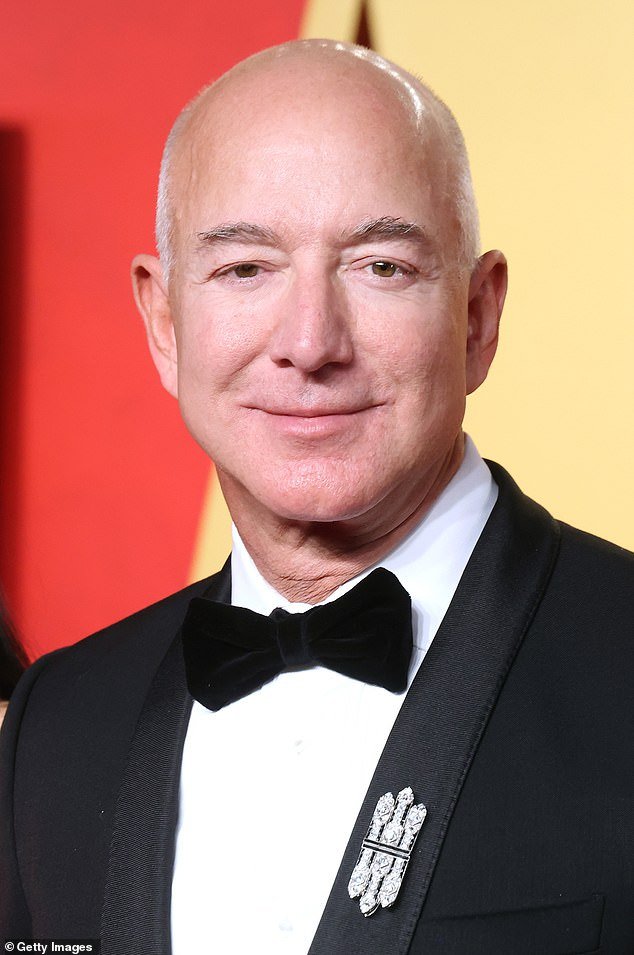

Jeff Bezos-backed automaker Rivian plans second round of layoffs this year – days after Elon Musk laid off 14,000 Tesla workers

EV maker Rivian is planning a second round of layoffs this year due to declining demand for electric vehicles.

The Jeff Bezos-backed company laid off 10 percent of its 16,790 employees in North America and Europe in February and now plans to let go another one percent.

Bezos has invested $700 million in the automaker, making him its largest shareholder, with Amazon owning a 17 percent stake in the company.

The latest round of layoffs follows Tesla owner Elon Musk’s decision to cut as many as 14,000 jobs at factories across the country this week.

The Rivian R1T pickup (pictured) has seen a $3,100 price cut as global EV sales fall and companies rush to introduce cost-cutting measures

Amazon founder Jeff Bezos invested $7 billion in Rivian in 2019 to have a fleet of 100,000 electric vans by the end of the decade

Despite Rvian’s revenue doubling by 2023, it is reportedly facing the same setbacks as other companies after electric vehicle enthusiasts have already purchased their cars, meaning less enthusiastic car buyers won’t join the crowds to adopt their gas-guzzling alternative. to give.

After Rivian’s job cuts, shares fell from 3.4 percent on Wednesday to just one percent by the end of the next day.

“This was a difficult decision, but necessary to support our goal of achieving positive gross margin by the end of the year,” Rivian said. Business insider.

Rivian laid off six percent of its workforce in February 2023 to reduce costs and laid off 20 battery cell development workers in December of the same year.

The company has taken steps to reduce costs by building some of its auto parts in-house and renegotiating its supply contracts.

This comes as Rivian has lowered prices on its all-electric R1T pickup and R1S SUV by $3,100 each in response to an ongoing trend of other companies lowering their EV prices.

Data showed that the company delivered a total of more than 50,000 electric vehicles last year.

Last month, Rivian also announced it would halt construction of its $5 billion factory, set to open in Georgia in 2026.

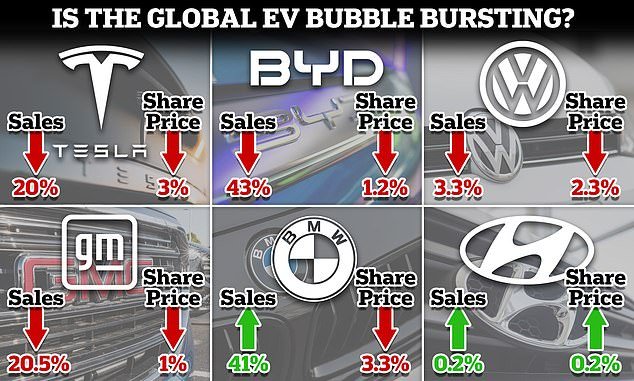

Of the major electric vehicle makers, only BMW saw a sales increase in the first quarter compared to the same period last year, but the German auto giant’s share price still fell.

Tesla has seen a significant decline in sales in the first quarter of this year, selling 20 percent fewer electric vehicles than in the previous quarter and eight percent year-over-year

Tesla CEO Elon Musk this week laid off 10 percent of the company’s workforce, amounting to 14,000 workers at factories in the US.

Instead, the company opted to move production of its more cost-effective R2 EV to its existing factory in Normal, Illinois, saving $2.25 billion.

The R2 is a smaller, cheaper SUV that costs $45,000, compared to the R1’s price tag of $76,700.

Rivian’s cost-cutting initiatives mirror Elon Musk’s decision to lay off 10 percent of Tesla’s workforce, citing the company’s rapid growth and doubling of certain positions as the reason for the layoffs.

“As we prepare the company for our next phase of growth, it is extremely important to look at every aspect of the business to reduce costs and increase productivity,” Musk said in a letter to employees.

Tesla has suffered a sales decline this year, according to its 2024 Q1 report, which showed it shipped 20 percent fewer electric vehicles compared to the previous quarter, sending its shares down 4.9 percent after the announcement.

“Let’s call this what it is: While we expected a bad first quarter, this was an unmitigated first-quarter disaster that’s hard to explain away,” Wedbush Securities analyst Dan Ives told me. The Washington Post.

If Tesla doesn’t reverse the decline in sales, Ives added: “There could clearly be dark days ahead that could disrupt the longer-term Tesla story.”

DailyMail.com has contacted Rivian and Tesla for comment.