When to Sell Your Forever Home – Our Definitive Guide to the Right Time to Downsize for Retirement

It’s the home where you watched your kids grow up, celebrated milestone birthdays – and the home you refined over two decades or three into the best property you’ve ever owned. Filled with family heirlooms and fond memories, it can be difficult to give up your forever home.

But if you leave it too late, you’ll struggle to manage the stress, the logistics and the whole administrative process that comes with it – as I know all too well after studying the process for parents back in the day. eighty.

So when is the ideal age to give up and downsize the forever home? Or, to remove the negative implication of the word: ‘the right size’.

While everyone faces different triggers (or obstacles) at the stage of life, the country’s financial landscape convinces some to think about this sooner or later.

A recent report from estate agent Savills shows that the number of downsizers active in the housing market increased by 53 percent last year.

Bittersweet: Robert Dance is sad to leave his £1.7million Surrey home, also pictured, but now needs a more practical location

Harry Gladwin of The Buying Solution says: ‘When it comes to downsizing, the 1960s are the new 1970s. With higher interest rates and inflation on household, electricity, heating and wage costs, people are finding more and more reasons to move ten years earlier.’

Your sixties are the ideal time, agrees Jennie Hancock, of Property Acquisitions, a property finder in West Sussex.

‘Once the children have left home, it’s time to think about it. People often put it off saying they’ll wait until after a wedding or a 21st, and then something else – but 70 to 75 is a serious limit.

‘People will have the energy to embrace an exciting new chapter instead of settling for an old, dilapidated bungalow.’

Because our children left home, we downsized early

Claudine Frost, 55, and her partner Daniel, 47, are leading the way – and are certainly not bungalow-bound.

Last July they moved into an art deco apartment with co-working spaces and arts center in a classic building, Hornsey Town Hall, in north London.

By freeing up funds and keeping living costs low, they were persuaded to move from their five-bedroom Victorian home in nearby Highgate.

‘When the children (aged 25, 20 and 18) left home, it seemed too big without them. I felt a bit lost and realized the costs of maintaining a large Victorian house,” says accounting assistant Claudine.

‘We loved the area, but wanted an energy-efficient new-build home with much lower operating costs. This step has given us a new zest for life. It feels like a new beginning, rather than giving up something that ‘downsizing’ implies.’

If you stop using the space, that’s a good time and reason to downsize, says Paul Cosgrove, of estate agent Finlay Brewer, adding: ‘But for most people, something has to happen to make them sink – or to get a suitable alternative.

“If they don’t have this, the lack of a plan can leave them inactive.”

I don’t want to leave it too late

One of his salespeople doesn’t want to leave it too late and risk being a burden to her family.

At 64, Emily Fletcher has put her four-bedroom townhouse in Brook Green, west London, on the market and wants a cozy two-bedroom cottage close to the Thames in Barnes.

“After many happy years here and the children now in their thirties, it is time to let another family enjoy the house,” says the former school secretary, who retired a year ago.

Installing a stair lift (or three) to her fourth-floor bedroom would also not have been practical, but some people prefer to adapt their home rather than move.

Only 91 percent of British homes are accessible to everyone, and the number of stair lifts installed has increased tenfold in the last twenty years.

In cities, where many older houses have more than three or four floors, it is also not always practical.

Retirees who are rich in assets, but poor in money

“Many retirees are asset-rich but cash-poor, so spending thousands on updating their homes isn’t an option,” says Marc Schneiderman of Arlington Residential. Weighing the costs of adjustment against the costs (and anxiety) of moving is something to think about.

As the cost of installing a stair lift is £3,000 to £10,000, and the cost of adapting a downstairs bathroom or installing a wet room is a similar amount, this could be less than the cost of moving if legal costs, estate agent fees, stamp duty and moving costs are combined.

“These are relatively simple changes that extend people’s independence in their own home, but larger homes that are desperately needed for young families are not coming onto the market,” says Mark Manning of estate agent Manning Stainton in Yorkshire. implications.

‘The number of questions to us about cuts has decreased in recent years, as people become frustrated by the lack of alternatives.

‘Last year we had 1,700 buyers asking to buy a bungalow, but in 2023 only 1,295 bungalows went onto the market in the Leeds-Wakefield region.

“Homeowners say there’s no point in moving if they can’t find what they’re looking for.”

The amount of stamp duty to be paid is another hurdle – especially on homes above the £925,000 threshold, when the 10 per cent rate kicks in.

“I have sellers who are moving from a £2 million house but are only downsizing by £500,000,” adds Hancock. ‘For some, paying £90,000 in stamp duty is a deterrent.’

Empty from nest to nest: Claudine Frost and partner Daniel sold a five-bedroom house to free up cash

Owner-occupiers aged 65 and over own homes worth as much as £2.735 trillion, most of which are mortgage-free, according to Savills Research.

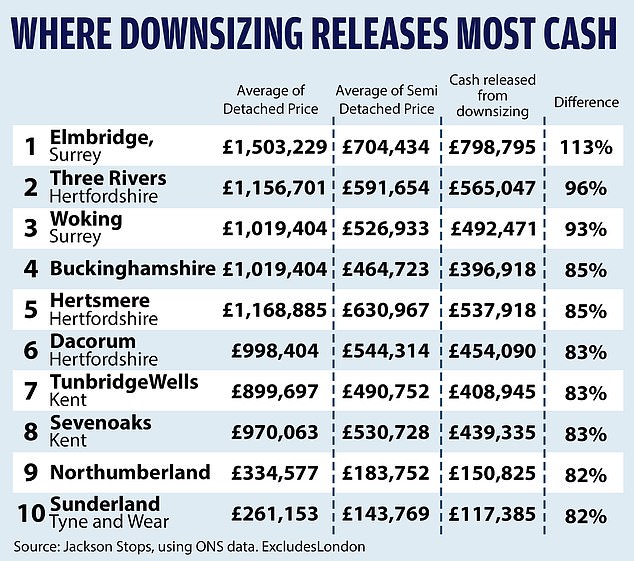

Meanwhile, in Jackson Stops’ annual study into the ‘downsizer gap’ – the money left over when moving from a detached house to a semi-detached house in England and Wales – the estate agent reports that the amount of capital released has increased by £ has increased. 5,467 to £209,215 between 2022 and 2023.

With the average deposit paid by a British first-time buyer for a three-bedroom home last year reaching £34,500 last year, many homeowners are desperate to free up equity to help children or grandchildren get into the housing market, according to Zoopla.

This – or funding retirement activities such as cruises – is the top priority for one in five downsizers and empty-nesters surveyed by Savills at the end of last year. The broker estimated that in 2023, 164,000 first-time buyers would receive family assistance when obtaining their mortgage.

At the age of 60 we switched to pension development

Making the most of early retirement with cruises and overseas holidays was perfect for Mandy and David Cobbs, but it did raise safety concerns and the impact of extreme weather on their five-bedroom Oxfordshire home while they were away.

So at the relatively young age of 60 they made the choice to move to a retirement development: Audley Cooper’s Hill, in Englefield Green, Surrey.

‘We spend a lot of time in California where one of our children lives and is considering retiring there as the ‘lifestyle’ developments for the over 55s have a much younger population than here in Britain,’ says David , who previously worked for Deloitte. ‘But we love the gym and restaurant on site and now enjoy much more freedom.’

Moving to a more practical location is another incentive. Downsizers can be more flexible in their search compared to a few years earlier in life, when they had to be in a school catchment area or near a train station to commute – but proximity to healthcare facilities is becoming increasingly important.

The best locations to retreat to for this are Exeter, Worcester and Cheltenham, in addition to the London suburbs of Merton, Richmond and Epsom, Savills said.

I’m moving from the country to London

Robert Dance, 74, is making the move to London for such reasons, but an emotional bond with the family home – an 18th century farmhouse on nine acres in Hindhead, Surrey – makes the move bittersweet.

‘We moved here because my wife loved horses and wanted stables. When she died 10 years ago, I wanted to stay here and keep her dream alive,” he says.

‘Now I am suddenly aware that time is ticking, and I have decided to move to Battersea to be closer to my partner and my son. I’m ready for more hustle – and one last adventure!”

He doesn’t want to leave it too late and be unable to maintain his house – which is for sale through Winkworth for £1.7 million – especially as building costs are higher than ever.

Carol Peett, of West Wales Property Finders, said: ‘I come across far too many people struggling to manage the house and garden while the property falls into disrepair.

‘At that stage they don’t reach the full price they would have paid in the best years, leaving less money for further purchasing and living.’

Lindsay Heydon, 62, moved last week when her seven-bedroom, multi-generational family home on an acre of land became too “overwhelming” to manage.

The family’s new five-bedroom home near Fishguard, in Pembrokeshire, Wales, needs some work so she wouldn’t have left it later. “It took months to find the house, resolve the transfer issues and then physically move. I wouldn’t want to experience that again at the age of seventy.’

Charlie Wells, from purchasing agency Prime Purchase, likens the decision to cut back to selling shares. ‘Stop trying to find out when the top of the market is because you might miss it; it is much better to sell when it suits you best.

‘Whatever you want to do, it is important to avoid a forced sale as your health will deteriorate quickly. It’s not a good idea not to have control over the timing. Make the move five years before it is really necessary.’

In fact, today’s slower real estate market could be a good time to do this – despite higher mortgage rates and election uncertainty.

“A few years ago, when the property market was abnormal and frenetic, it was more challenging for sensitive moves such as downsizing for an elderly couple,” says Simon Roberts of Strutt & Parker.

“Today’s less competitive market is easier to navigate.”

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.