Spring property boom is hypocritical – Rics agents say high mortgage rates are keeping buyers at bay

Real estate agents and surveyors report that the usual spring upturn in the real estate market has failed to materialize.

Rising mortgage rates appear to have put many buyers off, according to the latest research from the Royal Institution of Chartered Surveyors (Rics).

The closely watched monthly survey takes the temperature of Rics members and provides a snapshot of what’s happening in the property market across the country.

It said its members saw the recent recovery in buyer demand falter somewhat. This comes at a time when mortgage rates have risen.

– READ: Experts say interest rates could stay high for longer than expected

Buyer numbers fall: The recent recovery in buyer demand has weakened somewhat, with the market impacted by the rise in mortgage rates in recent weeks

Cheryl La, a Rics member based in Wolverhampton, said: ‘The mortgage market is causing chaos and creating instability for buyers and home movers.’

Andrew Wallis, a member of Rics on the Isle Of Man, added: ‘Buyers are still waiting for mortgage rate cuts and are therefore slowly joining in.’

However, according to Rics, the loss of purchasing power is mainly concentrated in London and the southern parts of England, where house prices are generally higher.

Tim Green, a Rics member based in South Oxfordshire, said: ‘We have seen a step back in market activity this month.

“The spring rebound was short-lived and even if transactions continue, there will be no real catch-up in activity as hoped.

“Delayed rate cuts and future economic uncertainty are still on buyers’ minds.”

David Robinson, a Rics member for Cornwall West Devon and Torridge, said: ‘Much better level of instructions and inquiries with better weather, but a real shortage of affordable buyers. An actual interest rate cut would help.

And Jonathan King, a Rics member based in Swindon, added: ‘The number of new buyers has slowed again after a promising first quarter.’

Meanwhile, while buyers appear to be postponing their plans, more and more homes are coming onto the market, according to Rics members.

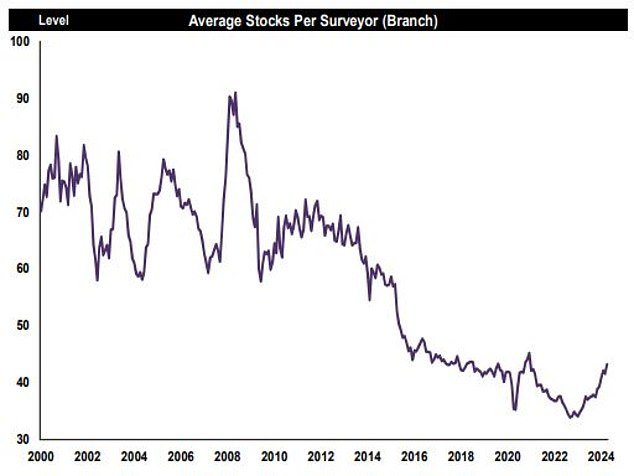

Rics members reported an increase in the number of instructions in April. This was the highest figure for new offers since the end of 2020, when the cheapest mortgage rate happened to hover around 1.5 percent.

The average stock level has now risen to the highest level in three years, namely 43 homes per location.

More homes are likely to come onto the market in the future, with the pipeline for new instructions appearing solid, Rics members said.

More homes for sale: The number of new offers from sellers was the most positive since September 2020, according to Rics

Colin Townsend, a Rics member based in Malvern, said: ‘There’s a lot more property coming onto the market so buyers now have a lot more choice, but it’s taking longer to close deals and a lot longer to get them through the legal process. pilots. Prices seem static.’

Andrew Oulsnam, a Rics member based in Birmingham, said: ‘After a strong March for both instructions and sales, the first two weeks of April have been very slow and the last two weeks have been very slow. May looks promising for instructions, but sales are still difficult to arrange.”

James Wilson, a Rics member based in Shaftesbury, added: ‘New instructions are increasing, but buyers remain cautious.’

House prices remain in equilibrium, but depend on where in the country someone is located.

Last week, Nationwide reported that the average British home has fallen in value for the second month in a row, remaining 4 percent below its summer 2022 peak.

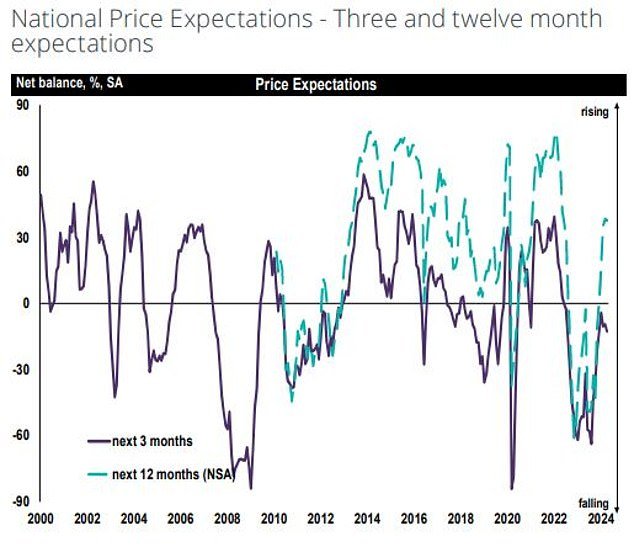

Prices will rise around this time next year: general sentiment among Rics members points to a more positive picture for the next twelve months

In almost all parts of England, the general consensus is that house prices are likely to remain flat or fall slightly in the short term.

However, house prices in both Northern Ireland and Scotland are expected to continue their upward trajectory.

That said, estate agents and surveyors generally remain optimistic about the year ahead, with many more expecting house prices to exceed expected falls in twelve months’ time.

James Perris, a Rics member based in London, said: ‘Mortgage applications have certainly increased, but buyers are struggling with affordability at most levels of the market, hence the recent Nationwide report that prices have fallen.

‘We need the Bank of England to cut rates faster than they indicate to prevent further falls.’

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.