Rate cuts are still ‘a long way off’ despite falling inflation, a top Bank of England official has warned

Rate cuts should still be ‘a long way off’ despite falling inflation, a key Bank of England official has warned.

Jonathan Haskel said the drop to 3.4 percent was “very good news” but that rate setters were instead focusing on “persistent and underlying inflation.”

“I think austerity is still a long way off,” he told the Financial Times. The comments will dampen hopes about the timing of an interest rate cut.

Caution: Rate-setting committee member Jonathan Haskel said the drop in inflation to 3.4% was “very good news” but “not informative about what we really care about”

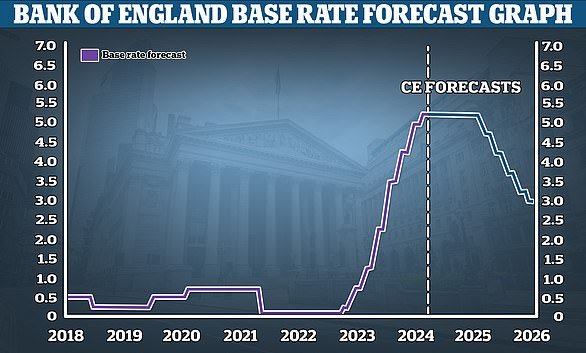

Interest rates have been raised to 5.25 percent as the Bank of England battles inflation.

But hopes for a cut have increased as inflation falls and bank governor Andrew Bailey said “things are moving in the right direction.”

They are also excited by the withdrawal of the two most aggressive members of the rate-setting committee – Haskel and Catherine Mann.

This week, Mann said markets were “pricing in too many cuts.” By last night, bets on a June rate cut had faded and August was seen as more likely.

Figures from the Office for National Statistics confirmed yesterday that the economy shrank for two consecutive quarters at the end of last year, meeting the technical definition of a recession.

Over a six-month period the decline was 0.4 percent.