Labour government must ‘herald period of stability’, says Liontrust boss

John Ions, CEO of Liontrust Asset Management

The chief executive of one of Britain’s largest asset managers has said a new government with a significant majority could breathe new life into the country’s flagging stock market.

John Ions, director of Liontrust Asset Management, told shareholders on Wednesday that Labour’s victory in last week’s general election “should usher in a period of stability which will be positive for financial markets”, and praised the party’s “pro-growth agenda”.

Earlier this year, Ions cited the “out of favour” status of UK equities, particularly small and mid-cap companies, as a reason for the exodus of investors from Liontrust funds.

Of the £6.1 billion withdrawn from Liontrust funds last year, around £4 billion came from UK equity vehicles.

The fund manager, which was forced to abandon a takeover attempt by Swiss rival GAM last year, saw outflows from new investors fall to £923m in the three months to June 30, from £1.6bn in the same period last year.

Total assets under management fell 2.8 percent to £27 billion.

However, the vast majority of these outflows – around £770m – came from UK retail funds and managed portfolio solutions, suggesting that domestic investors have yet to renew their interest in the market.

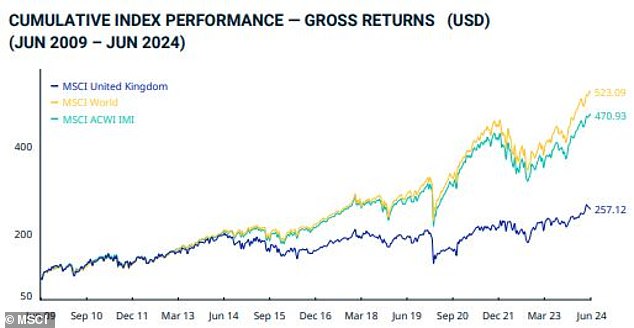

The UK stock market has been underperforming its international peers for some time

Ions said: ‘Labour’s large majority in last week’s election should herald a period of stability, which will be positive for financial markets.

‘It is encouraging that the new government has a pro-growth agenda and is committed to simplifying pensions.’

The MSCI UK index, which measures the performance of the large and mid-sized segments of the British market, has risen by 6.94, 5.74 and 2.7 percent over three, five and 10 years respectively.

The MSCI World rose by 7.38, 12.32 and 9.73 percent respectively over the same period.

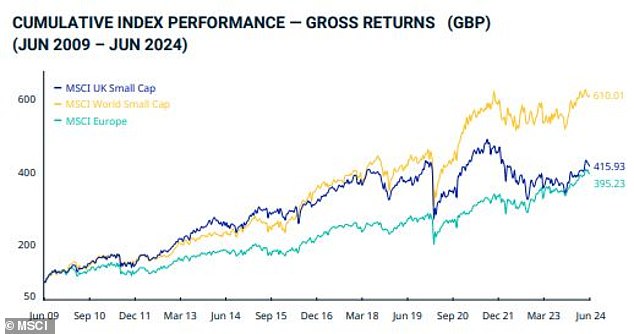

Data shows the gap between the performance of smaller UK companies and that of their international competitors is even wider.

The MSCI UK Small Cap index has fallen by 2.67 percent over three years, while it has risen by only 1.97 and 5.03 percent over three and ten years respectively.

International small-cap competitors saw their returns increase by 2.15, 7.5 and 10.04 percent respectively over a period of three, five and ten years.

But Ions said greater political stability “together with falling inflation and expectations of a reduction in interest rates” should “encourage” international investors to return and “stimulate capital flows into the stock market”.

He added: ‘Given the increasing need for individuals to also save more for their retirement, this will significantly improve the outlook for asset managers.

‘Liontrust is well positioned for this improving environment as we have a strong brand, distribution, robust investment processes and a leading reputation for UK equity management.

‘Liontrust will also benefit from the progress we are making in positioning the Group for the future, including further expanding our investment and distribution capabilities, increasing customer engagement and improving our business operations.’

Liontrust shares rose 2.3 percent to 617.6p on Wednesday afternoon, having lost almost 75 percent since peaking at 2,455p in September 2021.

UK small caps struggle, but European rivals also miss the global index

DIY INVESTMENT PLATFORMS

AJ-Bel

AJ-Bel

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive investor

interactive investor

Fixed investment costs from £4.99 per month

eToro

eToro

Stock Investing: 30+ Million Community

Trading 212

Trading 212

Free stock trading and no account fees

Affiliate links: If you purchase a product, This is Money may earn a commission. These deals are chosen by our editorial team because we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investment account for you