JEFF PRESTRIDGE: Has Santander found the answer to the UK’s bank closure crisis?

Nothing, it seems, can stop the tide of bank branch closures that are sweeping across the country like a huge wave.

Since the start of 2022, nearly 1,500 establishments have been wiped out – or placed on death row – and I wouldn’t be surprised if the total exceeds 2,000 by the time we ring in the new year.

Unfortunately, physical and personal service no longer counts for anything in the eyes of those who run our banks.

Welcome: a work café in Santander

Digitization – banking by telephone or computer – is the only way forward. Shocking, discriminatory behavior.

Almost everywhere I go I see evidence of the banks’ withdrawal from the high street.

In my current home town of Wokingham in Berkshire, a sign at the entrance to the Lloyds branch informs passers-by that it will close on July 8.

It means that since I moved to the city in 2020 it will have lost four banks: Barclays, NatWest, Santander and now Lloyds.

For now, only HSBC, building societies Nationwide and Newbury and a post office at the back of a derelict WHSmith remain.

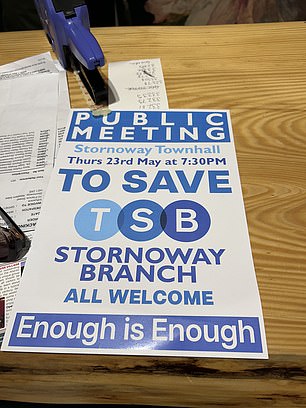

Protest: the poster of the protest meeting in Stornoway

Meanwhile, my colleague Rachel Rickard Straus has just returned from a glorious train/road/ferry trip to the Outer Hebrides.

When she stopped in the picturesque town of Stornoway, she saw a notice urging residents to attend a meeting about the closure of the TSB branch in September – one of 36 to be closed by the Spanish bank across the country.

“Enough is enough,” the poster shouted. The mood among customers and councilors has hardly been helped by the branch overview the bank has published explaining its decision (all banks must provide such documents when closing a branch).

It is stated that TSB customers in Stornoway can use ‘a number of other branches’. The only two mentioned are TSB branches in Inverness and Elgin – just 110 and 140 miles away respectively and both require a ferry crossing.

There is also talk of a banking ‘pop-up’ it will open in the city, presumably to convince as many customers as possible to switch to mobile or internet banking.

The branches run in Stornoway by rivals Bank of Scotland, Royal Bank of Scotland and Virgin Money (now part of Nationwide) are not mentioned in the review. Naughty.

Amid all this doom and gloom, are there any crumbs of comfort that personal banking enthusiasts can draw from? A few, thank goodness.

Firstly, Nationwide has committed to maintaining a presence in all towns and cities where it currently has a presence until at least 2028.

This is brilliant, but it begs the question: if Nationwide believes it can afford to maintain such a large branch network (605), why can’t its rivals?

Reply to postcard for me at 9 Derry Street, London W8 5HY, or via email at: jeff.prestridge @mailonsunday.co.uk.

Second, we are seeing the slow rollout of banking centers in communities that have remained unbanked.

Funded by the big big banks, these hubs may only provide basic services, but they are run by empathetic staff who care about their customers.

So far, 131 hubs have been recommended, although only 41 are operational.

Third, I really like what Santander is doing with a select number of locations.

Rather than closing them or turning them into soulless places where machines dominate (an approach adopted by rivals), it has turned key sites in Leeds, London and Milton Keynes into work cafes.

In addition to offering banking services (both automated and personal), the cafes offer people the opportunity to come in and buy a coffee and a cake – relax or do some work (free high-speed Wi-Fi is available).

There are even private meeting rooms that can be booked by the hour – popular with small businesses, and you don’t have to be a client to use them.

A few days ago I was poking around the work café on the ground floor of the company’s London office (near Euston).

It was all quite uplifting, with a buzz not often found in most bank branches.

It has a real community feel: people work alone on laptops, have coffee with friends or attend meetings in a designated area.

There is a ‘cardshare’ facility where people can leave details of their services – from a mental health coach to therapy.

And for those interested in background music, there is a playlist to choose from.

There are also toilets for those indulging in coffee, which is served by The Colombian Coffee Company (prices are discounted for Santander customers).

For banking, there are private areas where you can speak to an employee. The branch has a manager, the friendly Sarah Hicks, who kindly showed me around and told me about community events taking place in the cafe (a lecture, for example, from the Metropolitan Police on local street crime and protection from scammers).

Santander says work cafes will be launched at branches in Kensington and Cheapside in London later this year.

Great, but it would be brilliant if the idea actually took off – and was introduced in a majority of Santander’s 444 UK branches.

Maybe I’m too optimistic, but Santander’s work cafes have proven successful in other parts of the world, especially Chile and Spain.

And maybe I’m old-fashioned, but banks really should serve the communities from which they draw their customers – and make their profits.

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.