Melrose bosses bag a £300million bonus bonanza

- The private equity-style windfall will be activated on Friday

Engineer Melrose’s top bosses will share a bonus bonanza worth more than £300m in one of the biggest payouts of its kind in British corporate history.

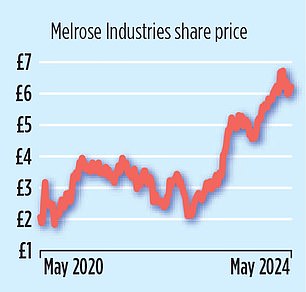

The private equity-style windfall will be activated after Ashes on Friday sharp rise in the value of the FTSE 100 company’s shares since 2020, when the incentive scheme was introduced.

The biggest winners are recently departed co-founders Simon Peckham and Chris Miller, and chief financial officer Geoffrey Martin, who has also just left.

In the money: the biggest winners are the recently deceased co-founders Simon Peckham (pictured) and Chris Miller

They win almost half of the jackpot, while the rest is divided among up to twenty other managers.

Melrose’s fortunes have been transformed by a series of deals, including the controversial purchase of defense giant GKN in 2018.

It is now a pure aerospace company following the split last year of GKN’s automotive arm into another listed company, Dowlais, which further boosted its share price.

The company is now worth more than £8 billion, having almost tripled since the executive bonus scheme was agreed with shareholders four years ago.

The settlement, which will be paid in shares, is equivalent to 7.5 percent of the increase in Melrose’s stock market value since then.

It was valued at £302 million at the end of last year, but sources say it may now be worth as much as £320 million.

The size of the prizes will reignite the debate over the ‘fat cat’ reward. However, sources close to Melrose emphasize that this plan rewards real wealth creation in the long term.

They point out that £1 invested when Melrose in 2005 would be worth £31.39 today, with a total shareholder return of £8.2 billion at that time.

Melrose, which specializes in reviving ailing industrial companies, has made its co-founders millionaires many times over.

In 2017 alone, Peckham, Miller, Martin and co-founder David Roper each raked in more than £42 million, which former business secretary Sir Vince Cable labeled ‘an absolutely outrageous amount’.

Peckham, 61, has no plans to retire. He is said to be setting up his own investment vehicle to buy undervalued British companies and revive them.

Under Peckham, Melrose bought GKN for £8 billion after a bitter takeover battle.

During the pandemic, around 1,000 jobs were cut, more were laid off and GKN’s automotive division was spun off. But the company still has 3,500 employees in Britain and is a leading supplier of aircraft wings and fuselages to Airbus and Boeing.

Melrose recently raised its profit forecast after doubling profits to £420 million by 2023, as the company benefits from a global aviation recovery.