Finance guru Dave Ramsey explains the key to early retirement

Financial guru Dave Ramsey has claimed that the golden rule for retiring early is paying off your mortgage.

The controversial radio host, known for his ultra-frugal tips, advocates for households to live virtually debt-free lives.

And in his latest blog post, he doubles down on the advice and explains his ultimate plan to retire before age 65.

It’s vital to pay off all debt, especially a mortgage, he says. That’s because it’s the largest debt burden Americans will have in their lifetimes and can eat up hundreds or thousands of dollars a month in payments.

He says anyone who wants to retire early should come up with a fake retirement budget to cover their expenses. And without debt it is much more manageable, he says.

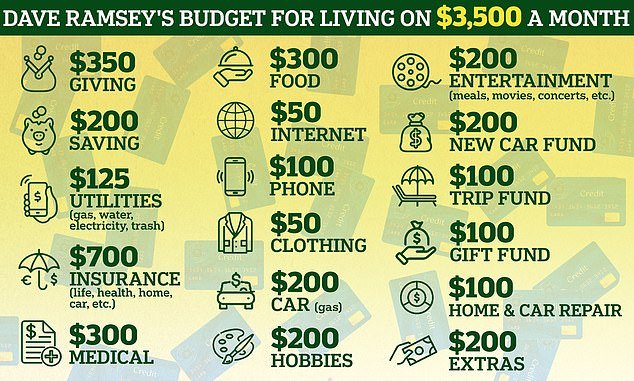

Below we discuss Ramsey’s budget. It will help you determine how much income you need each year. You can multiply this by the expected duration of your retirement to know how much savings you need.

Financial guru Dave Ramsey has claimed that the golden rule for retiring early is to pay off your mortgage

Ramsey insists that anyone hoping to do that should come up with a mock retirement budget to cover their expenses – with the exception of a home loan

To make his point, Ramsey points to a National Study of Millionaires showing that millionaires spend an average of about 10.2 years paying off their properties.

He writes: ‘Note that this budget does not include a mortgage payment. You want to pay off the mortgage (and any other debts) before you retire.

‘Debt will destroy your plans to retire early! It will eat up your monthly income and drain your retirement savings faster than you can say “foreclosure.”

The fake budget outlined gives an example of how you can live on $3,500 a month – or $42,000 a year.

The plan from Ramsey, an ardent Christian, includes a donation of $350 per month. In addition, his budget covers: $200 in savings, $125 for utilities, $700 for all insurance, $300 for medical expenses, $400 for food, $100 for a phone plan, $50 for internet, $50 for clothing, $200 for gas, $200 for entertainment.

The plan also allows $200 for a new car fund, $100 to add to a travel fund, $100 for a gift fund, $100 for home and car repairs, $200 for hobbies and $125 for extra expenses.

But Ramsey warns that your fake budget must also take inflation into account, which means maintaining your current budget will be different in the coming decades.

Ramsey is a fervent Christian who is famous for his ultra-frugal lifestyle tips. He is depicted with daughter Rachel

After determining how much money you need, the financial guru recommends evaluating your current financial situation and paying off your debts.

Ramsey promotes the “debt snowball” method, which encourages individuals to make a list of their outstanding debts and pay them off from smallest to largest balance, regardless of interest rates.

After debts are paid off, he recommends savers build up three to six months’ worth of expenses in an emergency fund.

As a rule of thumb, Ramsey says households should put 14 percent of their income into a tax-advantaged retirement account like a Roth IRA or 401(K).

However, he adds that anyone who wants to retire early should save every extra dollar they have for retirement.

To do this, he says, households should invest in an investment account that offers more flexibility than traditional retirement accounts because owners can withdraw from it at any time – without incurring a penalty.

But he warns that gains from investments in an investment account will be taxed as capital gains in the same tax year in which they are sold. If your account pays dividends, you’ll be taxed on those too, Ramsey notes.

His other key tips for early retirement include consulting a financial advisor regularly, making serious lifestyle changes, investing in real estate, and “doing it smart” once you retire.