Young workers and low paid to get auto enrolment pension savings boost

Young workers aged 18-21 and lower incomes will benefit from an extension of automatic pension registration, although the timing is not yet final.

The age limit to be automatically enrolled in a pension will be lowered from 22, meaning young people who stand to gain the most from compound investment growth will start saving sooner.

Meanwhile, the income margin, currently £6,240 to £50,270, at which workers, employers and the government contribute at least 8 per cent to pensions will be widened.

The lower limit of that band will be abolished, allowing people to save from the first pound of income.

Savings incentive: young and low-paid workers will benefit from an extension of automatic pension registration

The government has backed a Private Members Bill pushing through the changes made by Jonathan Gullis, the Tory MP for Stoke-on-Trent North.

It first proposed these steps itself in late 2017, but warned at the time that they would not be introduced until the mid-2020s.

Now the government says Gullis’s bill “will not result in an immediate change” but will give the Minister for Work and Pensions the power to change the age limit and lower the qualifying income limit for automatic enrollment.

“There will be a legal obligation to consult and report on the results to inform the implementation approach and timing, before using these powers. This will help maintain the strong consensus that underpins the success of auto-enrollment,” it says.

But the announcement has raised hopes that the changes could take effect sometime in the next year and be phased in April 2024, before the likely date of the next election.

Gullis says auto-enrollment for pensions will benefit “dozens of young people in all four corners of the country.”

He adds: “With all the evidence of the huge positive impact it can have, it’s a good idea that we should now extend auto-enrollment to those aged 18 and over.”

Pensions Minister Laura Trott says: ‘We know that these broadly supported measures will make a real difference to people’s pension savings in the coming years.

“In doing so, the government will fulfill our commitment to grow the economy and support the hard-working people of this country, especially groups such as women, youth and lower income earners who have historically found it more difficult to save for their pension.’

Gary Smith, director of financial planning at Evelyn Partners, says: “If implemented, these proposed auto-enrollment reforms would dramatically increase the number of younger workers saving for workplace retirement and the amounts saved by lower earners – by making sure they save from the first pound earned.

STEVE WEBB ANSWERS YOUR PENSION QUESTIONS

“Given the powerful effects of compound returns, early retirement savings are hugely beneficial and may prevent savers from having to make up for lost time later in life by depositing a large percentage of their monthly earnings into their retirement.

‘The DWP support for this bill can somewhat remedy the low savings rate among lower incomes and that is to be welcomed.

“The self-employed are now the cohort that could fall behind when it comes to private pension provision, unless the authorities come up with some imaginative nudges to get it right.”

Kate Smith, Aegon’s head of pensions, said: “The next step is to agree on a timetable for implementing these improvements. With the next general election due in January 2025 at the latest, we are urging the government to phase this in from April 2024.

“Basing contributions on the first pound of earnings rather than a band over £6,240 will increase contributions from both individuals and employers.

‘Employees pay 5 per cent, so this works out to £312 a year, but after tax it’s just over £20 a month. But with employer contributions, this increases to an additional £499 per year.

“To avoid overnight change, it is important to introduce this gradually over a number of years, especially as we emerge from the current cost-of-living crisis. Otherwise someone earning £12,480 would see their contributions double overnight.”

Michael Ambery, partner at Hymans Robertson, says government’s move is a step in the right direction, but a turnaround is needed

“We would like to see no restrictions on income for contributions (from the first pound with no upper limit), that automatic enrollment be open to all, whether employed or self-employed (including ‘gig’ economies) and that all top age limit.

“A review of the 8 per cent minimum contribution levels, supported by the work of the Pensions and Lifetime Savings Association, is key to this and we look forward to hearing from the Minister for Pensions and the Government in due course.”

Nigel Peaple of industry association the PLSA supported the changes, but added: “We have also long maintained that for savers to earn an adequate income in retirement, further increases will need to be made over the next decade, so that automatic enrollment rises from a 8 per year. cent pension contribution today to about 12 percent in the early 2030s – split 50/50 between employers and employees.”

Need for retirement income for single people (Source PLSA)

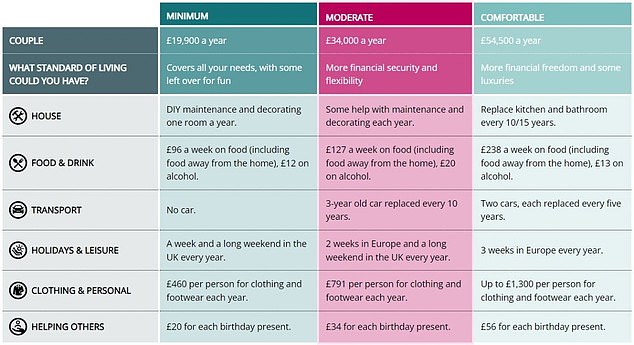

Retirement Income Needs for Couples (Source PLSA)

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and use it for free. We do not write articles to promote products. We do not allow any commercial relationship to compromise our editorial independence.