You may soon have to pay fewer surrender charges for terminating your insurance

The insurance regulator has proposed rules to protect policyholders by increasing the payout they receive if they decide to cancel their insurance policy before its maturity date.

Irdai has published a draft insurance guidelines, which, among other things, proposes to reduce surrender charges for life insurance products, especially for non-par savings plans. The surrender value represents the cash value a policyholder receives if he decides to surrender his policy before the due date for payment of the policy premiums. The regulator has proposed a premium threshold above which insurers cannot levy surrender charges, thereby refunding the premium to policyholders.

Interested parties are invited to submit comments or suggestions on the proposed regulations by January 3.

Under the new methodology, a threshold premium is defined for each product and surrender charges are only levied up to the accumulated premium balance; based on that threshold value and not on the total accrued premiums.

“Currently, the surrender value is calculated as a percentage of the total premium paid. Let's say the surrender value of a policy is 50 percent in the fourth year of a ten-year policy. So if a policyholder surrenders their policy after paying Rs 1 lakh premium per annum for four years, they would get only Rs 2,00,000 (100,000*4*50%) as surrender value against her total premium paid of Rs 4 lakh. Moreover, surrender charges may also be levied,” said Anuj Parekh, co-founder and CEO of Bharatsure, an insurance company.

But under the new proposal, if the threshold limit (a concept introduced under this proposal) for such a product is Rs 25,000, then the surrendered value for the threshold premium is Rs 50,000 (25,000*4*50%). The premium return above the threshold premium is 3,00,000 (1,00,000 – 25,000) x 4. Based on the above, the actual guaranteed surrender value will then be Rs 3,00,000 + 50,000 i.e. Rs 3,50,000.

“This would be generally positive for policyholders as it would mean they could collect on their policies without incurring major losses. However, it could also mean increasing premiums to take into account the losses that insurance companies may incur. This could also impact the distribution commission for intermediaries,” Parekh said.

“If this step is implemented, it will significantly reduce financial losses for policyholders who terminate their policies midway. This is an extremely customer-friendly move by the regulator as a significant portion of such policies expire or are surrendered before completion of the policy. Moreover, the majority of these types of lapses or surrenders occur during the first two years of a policy, where the financial loss to the policyholder is usually the highest,” said Sabyasachi Sarkar, appointed actuary at Go Digit Life Insurance.

Sarkar mentions two examples:

example 1

A person has taken a traditional non-single premium policy with an annual premium of Rs 1 lakh and a policy term of 10 years.

Annual premium: Rs 1,00,000 | Premium above the threshold limit: Rs 80,000

Premium Threshold*: Rs 20,000 | Regular premium policy (term: 10 years)

*Note: The threshold limit has been adopted at Rs 20,000. No premium threshold is defined in the current exposure design. The exposure design states that a premium threshold must be defined for each product.

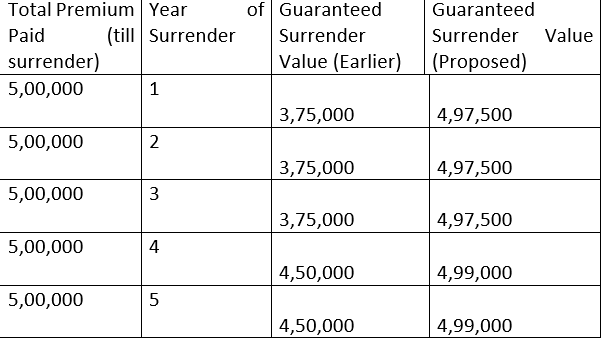

Example 2

Let us assume that someone has taken a traditional single premium policy with a single premium of Rs 5 lakh and a policy term of 10 years.

Single premium: Rs 5,00,000 | Premium above the threshold limit: Rs 4,90,000

Premium Threshold*: Rs 10,000 | Single premium policy (term: 10 years)

*Note: The threshold limit has been adopted at Rs 10,000. No premium threshold is defined in the current exposure design. The exposure design states that a premium threshold must be defined for each product

Analysts at IIFL Securities believe that while the proposal has the potential to improve the attractiveness of traditional products, it is likely to hurt VNB margins due to higher redemption benefit payouts.

Under the previous regulations, a guaranteed surrender value was given only on payment of premium for at least two consecutive years, which caused a loss to the policyholder if the policy had to be canceled due to emergencies. However, the draft proposes a guaranteed surrender value even if the policy is surrendered in the first year, with the payout equal to the balance premium above the threshold limit.

“The exposure draft suggests that the threshold limit should be fair and equitable but does not define a methodology to calculate the threshold premium nor does it make it clear who would determine the limit between the insurers or the IRDAI. If insurers were to lower the threshold limit, it could give them the power to control their loss of surrender charges due to the new guidance, but at the same time allow them to differentiate in terms of their product strategy,” said IIFL analysts.

First print: December 18, 2023 | 8:36 am IST