Wondering WHY you overspend? Financial therapist reveals how sadness and anger cause us to splurge on new purchases

- Hunger, loneliness, fatigue, stress and sadness all influence our financial decisions

- Research has shown that being sad makes people vulnerable to overspending

- As the holidays approach, consumers are advised to ‘pause’ and ‘reflect’

Financial decision-making is sometimes associated with sobriety and calculation. But psychologists emphasize that emotions like sadness, anger and fear have a powerful effect on our wallets.

Years of academic research has shown that people who are sad are likely to spend more, while anxious people tend to avoid risks.

“Never make a financial decision when you are hungry, angry, lonely or tired,” says Heather Pulier, financial therapist and founder of Start financiallytold DailyMail.com.

Although there are no general rules, negative emotions are commonly associated with bad choices. This may involve overspending, but also the opposite, what Pulier calls ‘financial hunger’.

Financial therapist Heather Pulier (pictured) said people should avoid making financial decisions when they are ‘hungry, angry, lonely or tired’ and urged consumers to ‘pause’ before spending money

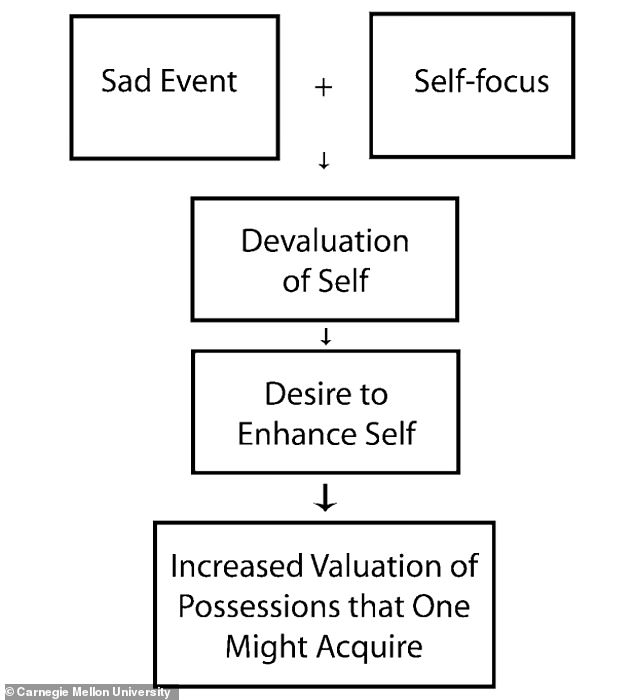

An article in Psychological Science shows that sadness leads to low self-esteem, which in turn can lead to spending. Pictured is a figure in the newspaper explaining the process that can lead a sad person to overspend

a Study from 2008 in the journal Psychological Science titled ‘Misery Is Not Miserly’ it was found that sadness ‘increases the amount of money decision makers give up to acquire a good’.

The authors said that sad events can cause people to feel that their sense of self has been diminished. This in turn causes a desire to purchase valuable possessions in an attempt to improve their ‘self’.

This is the kind of behavior Pulier sees in her own clients.

“People use money to cope with depression, to elevate themselves or to boost low self-esteem,” she said. “Money is an addiction for many people – we have an overwhelming and chronic belief that more money will make us feel better.”

This study is one of many in the growing field of behavioral economics, which applies psychological methods – as opposed to mathematical models – to understand the economy.

A seminal moment for the field came in 2002 when psychologist Daniel Kahneman was awarded the Nobel Prize in Economics for his work with Amos Tversky on how biases can influence decision-making.

“That changed the way we looked at behavioral economics,” Pulier said of the 2002 prize. She pointed out that a range of generally negative emotions can prevent people from making financial decisions that are in their best interests.

‘A father of behavioral economics’: Daniel Kahneman (photo) won the 2002 Nobel Peace Prize for economics and laid the foundation for the increasingly mainstream field of behavioral economics

Other studies have found that angry people are more optimistic when it comes to analyzing risk, which can result in uncontrolled overspending. Pictured is the cover of the journal Psychological Science

“When you’re anxious, you don’t make good choices – anxious decision-making is fear-based decision-making and you’re usually looking for the quickest and quickest way out of your anxiety,” she said.

Pulier also noted that fatigue can cause poor decisions.

“When you’re tired it’s a terrible time to spend money, your defenses are down,” she said. ‘Just like you’re more likely to scold someone.’

Other studies have found that angry people are more optimistic when it comes to analyzing risks and can act erratically, which in turn can result in uncontrolled overspending.

Although the therapeutic approach to thinking about financial decisions championed by Pulier is relatively new, retailers and marketing professionals have been thinking about it for decades.

“The greatest minds in the world spend all their time advertising and promoting our emotions to arouse them,” she said.

“We’re entering a season where the addictive quality of consumer culture is going to focus on those things, especially during the holidays.” Her advice to consumers approaching this stressful time of year is to ‘pause’ and ‘reflect’.

“Every financial decision someone makes is emotional,” she said. “But the quickest way to change that behavior is self-awareness and self-acceptance — you have to truly believe that money doesn’t meet unmet emotional needs.”