Wire Transfers Unveiled: 10 Tips You Absolutely Need to Know

In the ever-evolving landscape of financial transactions, wire transfers continue to be a fundamental method for moving money securely and swiftly. Whether you’re a seasoned professional or a newcomer to the world of wire transfers, understanding the nuances of this process is vital for ensuring seamless transactions. Here, we present 10 tips that are absolutely essential for mastering wire transfers.

Wire transfers serve as a linchpin in the financial system, enabling the swift movement of funds between individuals, businesses, and financial institutions. In an era where financial transactions are becoming increasingly digital, mastering wire transfers is essential for secure and efficient financial dealings.

Choose the Right Type of Wire Transfer

Not all wire transfers are created equal. Understand the differences between bank wire transfers, online money transfer services, and peer-to-peer transfers. Consider factors such as speed, cost, and convenience to choose the most suitable option for your specific needs.

Understand and Compare Fees

Knowledge is power when it comes to wire transfer fees. Familiarize yourself with the common fees associated with wire transfers, including transaction fees, intermediary fees, and currency conversion fees. Compare fee structures across different platforms to make cost-effective choices.

Time Management in Wire Transfers

Timing is crucial in the world of wire transfers. Gain insights into the processing times for wire transfers and plan accordingly. Implement strategies to ensure timely transactions and avoid unnecessary delays.

Essential Information of International Wire Transfers

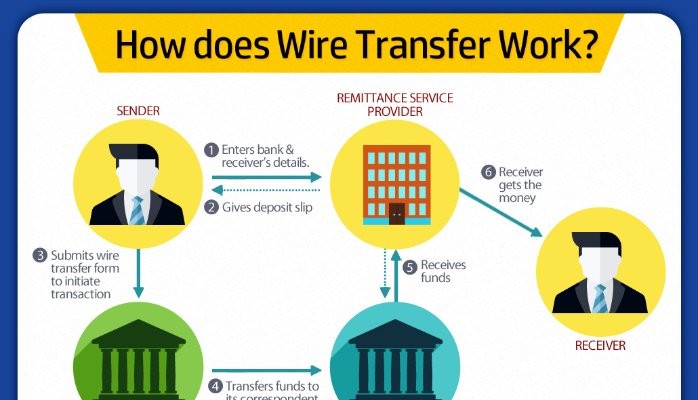

Ensure a smooth wire transfer process by providing accurate and complete information. Understand the details required for successful wire transfers, including sender and recipient information, bank details, and specifying the purpose of the transaction.

Security Measures

The digital nature of wire transfers introduces security concerns. Recognize potential risks associated with wire transfers and implement measures to enhance security. Stay vigilant against fraud by using secure channels and adopting best practices.

Exchange Rates and Currency Considerations

For international wire transfers, exchange rates play a pivotal role. Understand how exchange rates impact your transactions and explore strategies for obtaining favorable rates. Manage currency risks effectively to maximize the value of your transfers.

Set Realistic Limits

Every financial transaction comes with its limits. Understand the maximum and minimum limits for wire transfers and set realistic boundaries aligned with your financial goals and needs.

Regulatory Compliance

Navigate the regulatory landscape associated with wire transfers. Understand the restrictions and compliance requirements to ensure your transactions align with legal frameworks. Compliance is key to avoiding complications in the wire transfer process.

Explore Alternatives

While wire transfers are powerful, it’s essential to be aware of alternatives. Compare wire transfers with other payment methods, such as checks and credit cards. Stay informed about emerging technologies and innovations in the financial industry.

Learn from Common Mistakes

Mistakes happen, but learning from them is crucial. Identify common errors in wire transfers and equip yourself with tips to avoid and rectify these mistakes. A proactive approach can save time and prevent potential financial setbacks.

Conclusion

In conclusion, mastering wire transfers is a valuable skill for anyone engaged in financial transactions. By applying the 10 essential tips outlined above, you can navigate the world of wire transfers with confidence, ensuring that your transactions are secure, timely, and cost-effective. Stay informed, stay secure, and make the most of this powerful financial tool.