Will the Bank of England halt punishing rate hikes on borrowers after a shock fall in inflation?

Will the Bank of England stop punishing borrowers with rate hikes after a shock drop in inflation?

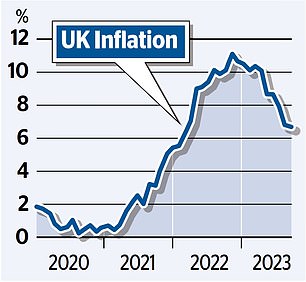

- Inflation fell from 6.8 percent to 6.7 percent, surprising economists

- Financial leaders are calling on the Bank of England to freeze interest rates during a downturn

The Bank of England was urged last night not to impose a further punishing rate hike on borrowers after a surprise fall in inflation.

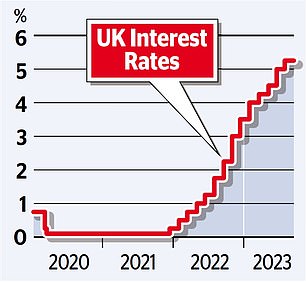

Economists and business groups said it would be a mistake if officials met today to raise rates for the 15th consecutive time from 5.25 percent to possibly 5.5 percent.

And the financial markets, which until yesterday were resolutely betting on a new interest rate increase, considered the decision to be on the cutting edge. Experts at Goldman Sachs and a number of other banks now expect the bank to keep interest rates unchanged.

This came after a surprise decline in consumer price index inflation from 6.8 percent in July to 6.7 percent in August, a new 18-month low. Economists had expected an increase of up to 7 percent.

Stripping out volatile factors such as energy and food prices, the numbers looked even better, with so-called core inflation falling sharply from 6.9 percent to 6.2 percent.

Bank of England Governor Andrew Bailey (pictured) recently suggested the rate hike cycle was nearing an end, but many now believe it should be over already.

The interest rate is currently 5.25 percent. Inflation, meanwhile, has fallen to 6.7 percent, prompting calls to keep interest rates stable

It added to evidence that the Bank of England’s aggressive series of rate hikes since late 2021 is starting to work in cooling price pressures that have put pressure on the cost of living.

However, the rate-hiking drug has left a bitter aftertaste, adding hundreds of pounds to monthly mortgage costs, increasing pressure on business borrowers and fueling fears of a recession.

Bank of England Governor Andrew Bailey recently suggested that the rate hike cycle was nearing an end, but many now believe it should be over already.

David Bharier of the British Chambers of Commerce said: ‘Businesses will now be concerned that further interest rate rises could reduce consumer demand and make investment even more difficult.’

Kitty Ussher, from the Institute of Directors, said the inflation news “supports our narrative that the interest rate rises we’ve seen so far are doing their job.”

Rate increases “must be given more time to work before the Bank of England considers whether the base rate should rise further,” she added.

Simon French, chief economist at Panmure Gordon, said: ‘Anything other than a pause in the UK walking cycle would have the hallmarks of a policy mistake.’

Economists at Goldman Sachs say they now expect the Bank to keep interest rates stable.

Mike Riddell of Allianz Global Investors said: ‘We think the BoE will rise this month, but it will be the last.’

Yesterday’s figures showed inflation fell despite a rise in fuel costs, which was expected to push up the headline rate.