Will base rate peak this week? BoE set to hike to 4% on Super Thursday

>

When does the base rate peak? Bank of England moves to 4% on ‘Super Thursday’ as rate hikes to fight inflation near end

- Markets forecast a 50 basis point increase from 3.5% to 4% on Thursday

- The BoE has to juggle mixed messages from recent economic data

- Analysts suggest base rate will peak at 4.25% next month

The Bank of England is expected to add 0.5 percent to base rates on Thursday in what some analysts say will be the penultimate increase in the bank’s hiking cycle.

The BoE’s latest move on Wednesday follows the US Federal Reserve and coincides with the European Central Bank on what has been dubbed “Super Thursday” as policymakers cautiously approach the conclusion of their battle against inflation.

An increase of 50 basis points would bring the base rate from 3.5 percent to 4 percent. The widely held market view is that there will be a final jump from 25 basis points to 4.25 percent in March.

Analysts suggest base rate will peak at 4.25% next month

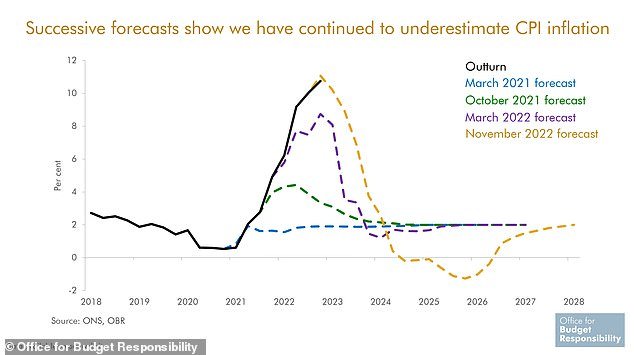

OBR forecasts have consistently underestimated inflation, but there is confidence that November marked the peak

The BoE’s Monetary Policy Committee will be forced to weigh mixed signals from UK economic data when making a decision on interest rates this week.

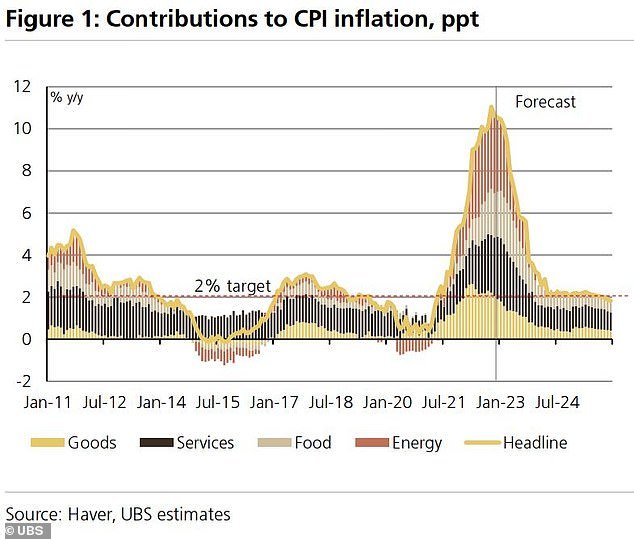

On the one hand, the consensus suggests that inflation peaked in November and then falls, while a sharp fall in gas prices – a major driver of inflation over the past year – should feed through to retail prices this year.

However, the MPC could be forced into a more aggressive stance by better than expected economic activity in the last quarter of 2022, a stubbornly tight labor market and concerns that core inflation in the UK could prove ‘stickier’ than elsewhere in the world.

His decision will be accompanied by the most recent monetary policy report, which should provide further insight into how the MPC evaluates recent data and how that may affect the course of the walking cycle.

Analysts at UBS said: “Following a 50 basis point hike on February 2, we continue to expect the BoE to hike another 25 basis points on March 23, bringing bank rates to 4.25 percent.

“We view the risk to our call as balanced and dependent on incoming inflation and labor market data and inflation expectations.”

The main drivers of inflation are starting to wane

UBS added that the “tone” of the MPC report will be central to gauging the outlook for the BoE’s hiking cycle.

It read, “While we expect the MPC to adhere to guidance that “further increases in bank rates may be necessary,” we will be watching closely for signs that the committee is closing in on the end of the walking cycle.”

Markets suggest that the BoE is not alone in approaching the end of its walking cycle.

The US Federal Reserve is widely expected to rise 25 basis points to an interest rate range of 4.5 to 4.75 percent, while the ECB is expected to increase by 50 basis points.

Collectively, this means that global interest rates will hit a 15-year high.

ING analysts said: “The BoE seems to be following the ECB rather than the Fed… and we expect a rate hike of 50 basis points for the second consecutive meeting.

While the minutes of the December meeting seemed to open the door to a possible downgrade to a 25 bps step in February – and this meeting seems closer than the markets are pricing – the reality is that recent data has looked relatively aggressive.

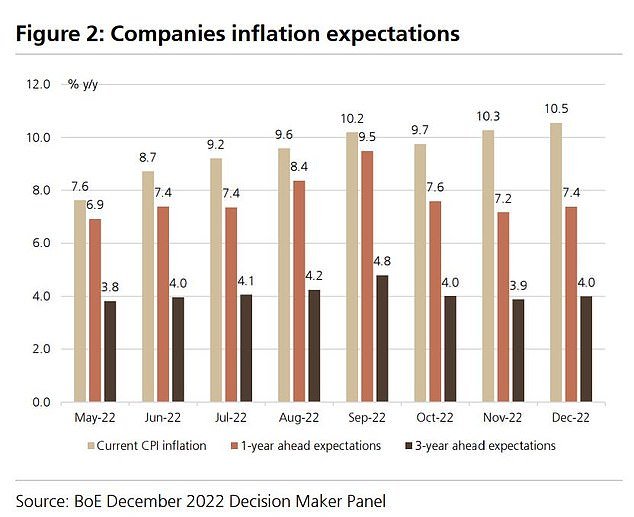

“Wage growth is persistently high, according to both the official figures and the BoE’s own corporate surveys. Headline inflation came in slightly lower than the Bank had forecast in November, but service sector CPI – seen as a better indicator of domestic inflation – has come in ahead of expectations.

“Still, if we get a 50 bps increase on Thursday, it’s probably the last one.”

ING expects ‘a final’ rate hike of 25 basis points in March, with interest rates in the UK peaking at 4.25 percent.

Peder Beck-Friis, portfolio manager at PIMCO, also expects the BoE to rise 50 basis points on Thursday.

He said: Headline inflation is falling and probably peaked in November. But core inflation remains high and wages are rising.

“The labor market remains tight, with low unemployment. The demand for labor is starting to fall, albeit gradually. Unlike most other developed market countries, labor supply remains stubbornly weak.

As policy rates continue to rise in restrictive territory, we think the Bank of England will pause its tightening in the first half of the year. We expect policy rates to peak somewhere between the ECB and the Fed.’

British companies’ inflation expectations one and three years from now show inflation will fall, but not as far as the 2% target