Will a drop in mortgage rates increase house prices if lenders continue to make cuts?

Mortgage lenders are cutting interest rates daily, leading some to suggest the sluggish real estate market could see a rebound this year.

NatWest, First Direct, TSB and MPowered Mortgages all announced mortgage rate cuts today.

This followed HSBC's announcement yesterday and cuts at Halifax and Gen H at the start of the year.

So far this year there have also been rate cuts at Lloyds Bank, Leeds Building Society, Blusetone Mortgages, Hodge and LendInvest Mortgages.

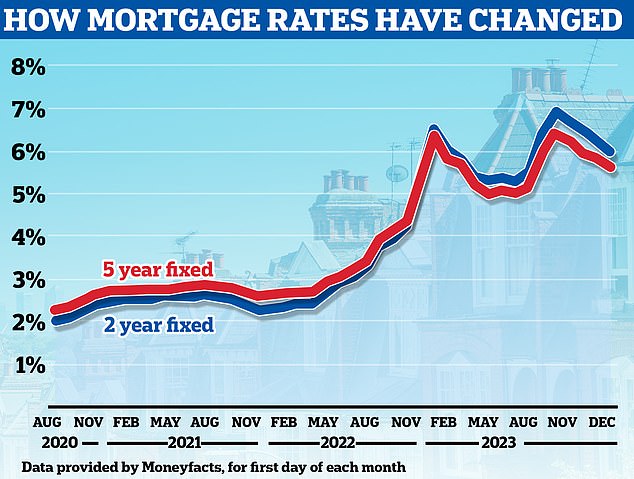

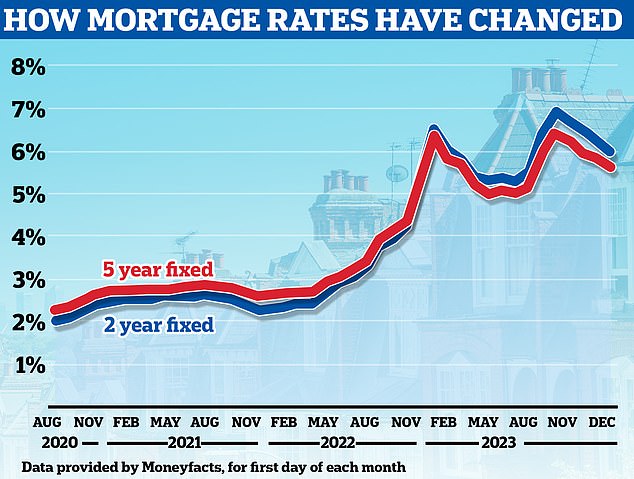

According to Moneyfacts, the average five-year fixed mortgage rate across the market has fallen from 5.53 percent to 5.46 percent in the past day alone.

New Year's Cuts: NatWest, First Direct, TSB and MPowered Mortgages all announced rate cuts today. This followed HSBC's announcement yesterday

Meanwhile, the average two-year interest rate has fallen from 5.92 percent to 5.87 percent.

Starting tomorrow, there will be a total of ten fixed rate deals on the market offering rates below 4 percent.

The cheapest deals are for people who have at least 40 percent equity in their home, or a 40 percent down payment to put down when they buy (60 percent loan-to-value).

HSBC is offering existing customers a five-year fixed deal of 3.87 per cent at a loan-to-value of 60 per cent, with a fee of £999. New HSBC customers can also take advantage of a rate of 3.94 per cent.

From tomorrow, NatWest will cut rates by up to 0.42 percentage points on most of its fixed rate products, with discounts for first-time buyers, movers and people refinancing.

First Direct has also announced a raft of rate cuts, including two sub-4 per cent deals, one for ten years and the other for five years – both with a loan-to-value ratio of 60 per cent.

TSB has focused on cutting two-year fixed rates, which are currently more expensive than five-year ones but are preferred by some buyers as they expect rates to have fallen by the time they refinance.

Two-year mortgages for first-time buyers have been cut by up to 0.55 percentage points, with rates now starting at 4.54 percent for those with the largest deposits.

Falling: Interest rates have already fallen noticeably and, barring any unforeseen developments, this trend is likely to continue next year, according to analysts

TSB has also reduced the two-year interest rate for customers who refinance their mortgage by up to 0.4 percentage points. Rates now start at 4.44 percent for people with at least 40 percent equity in their home.

Meanwhile, the new mortgage provider MPowered has continued to push the major lenders. The five-year fixed interest rate now starts at 4.13 percent.

For those with smaller deposits or less equity in their homes, rates are also improving.

Gen H offers a mortgage that covers 95 percent of a property's value at a rate of 4.95 percent with a fee of £999. This is aimed at both buyers and those refinancing.

First Direct has also announced significant cuts, aimed at those buying or remortgaging with lower deposits or equity.

Those who need a mortgage covering 90 per cent of a property's value can get interest rates from 4.69 per cent through the standard five-year fixed mortgage.

Mortgage brokers are confident that interest rates will fall further from here, with some claiming we could see interest rates of 3.5 percent in June.

This is because the Bank of England's base rate, which influences mortgage prices, is expected to be cut in 2024 as inflation falls.

Mark Harris, CEO of mortgage broker SPF Private Clients, said: 'The pricing of fixed rate mortgages is heavily influenced by future interest rate expectations.

'As long as markets believe this trend will continue, in line with lenders' increased willingness to lend, we expect interest rates to continue to decline across the board.

“While crystal balls are notoriously inaccurate, it is not inconceivable that with an early cut in base rates we could see markets react further and lenders releasing products closer to 3.5 percent by June.”

Will lower mortgage rates affect house prices?

The volatile and higher mortgage interest rates will weigh heavily on the housing market in 2023.

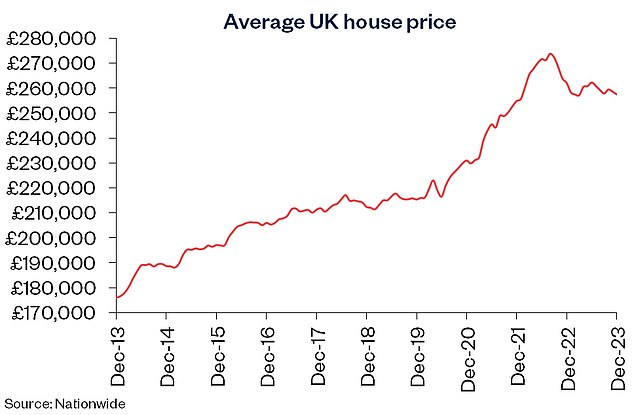

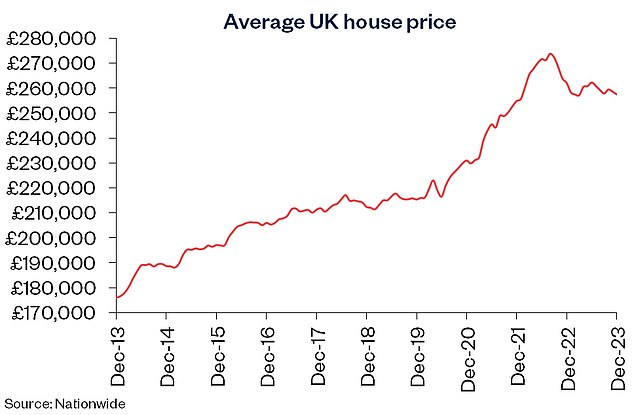

House prices at the end of 2023 will be 1.8 percent lower than a year ago, according to the latest figures from Nationwide Building Society.

Meanwhile, the number of property transactions fell by 22 per cent in the year to November 2023, according to the latest HMRC figures.

Late 2023 saw unusually high activity during the usual seasonal slowdown, which will set things up nicely for a stronger housing market in 2024

Sam Mitchell, Purplebricks

It is expected that falling mortgage rates can stimulate the housing market.

Sam Mitchell, CEO of online estate agent Purplebricks, said: 'The reductions in mortgage rates we have seen so far this year are good news for the property sector, and other lenders are sure to follow suit.

“There was unusually high activity late last year during the traditional seasonal slowdown, which will set things up nicely for a stronger housing market in 2024, and hopefully beyond.

'Reducing mortgage rates will stimulate affordability and demand. This will benefit not only those already on the property ladder, who can benefit from better remortgage rates, but also first-time buyers who have previously found it difficult to access the market.”

Lower: House prices will be 1.8% lower at the end of 2023 than a year ago, according to the latest figures from Nationwide Building Society

Adrian MacDiarmid, head of mortgage lender relations at housebuilder Barratt Developments, added: 'We have already seen some mortgage rate cuts at the start of this year and expect more lenders to follow suit in the coming days.

'There are many lenders competing for market share and this creates more opportunities to buy a home.

'Aspiring buyers who feared that buying their own home was beyond them – due to barriers such as saving for a down payment – could find that mortgages are cheaper than they expected.'

However, while mortgage rates have fallen to their lowest level since May last year, they remain much higher than the 1 to 2 percent interest rate that many had become accustomed to before rates started rising in 2022.

According to Moneyfacts, the average five-year mortgage rate is currently still 5.46 percent. Two years ago the average rate was 2.66 percent.

For a mortgage of €200,000 that is repaid over 25 years, this is the difference between €1,223 per month and €913 per month.

Unsurprisingly, some market commentators argue that it is too early to tell whether the recent interest rate cuts will have any effect on house prices.

The forecasts for house prices in 2024 are not overly positive. Some predict prices will remain relatively flat, while others expect an average decline of 5 percent by the end of the year.

> Will house prices rise or fall in 2024? Read all predictions here

Jeremy Leaf, North London estate agent and former chairman of Rics Residential, said: 'The timing of the rates cuts is great for the market and will have an effect on marketability and activity, but not necessarily on prices as people are still being nervous about pushing the boat. go too far until they have a longer-term indication that the market will not decline.

“Many people have said to us that the March Budget should also help, which will be partly offset by the impact of a general election later this year.

“But overall this is a bull's eye for the market and acts as a delayed Christmas gift.

“We haven't seen any New Year's fireworks yet, but there is undeniably more confidence among buyers and sellers.”

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.