Why NOW might be a good time to buy a home: Almost 1 in 4 sellers are slashing asking prices by a typical $15k – here’s where property values are rising (and falling) fastest

Home sellers have no choice but to lower asking prices to attract buyers who are deterred due to high interest rates, a new report shows.

According to real estate site Zillow, about 23 percent of homes on the market in November have had their prices reduced since they were first listed. Researchers said the number was 'abnormally high' for the time of year.

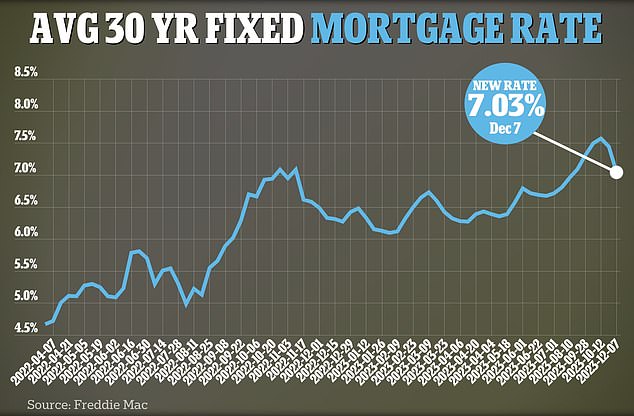

The trend was attributed to higher mortgage rates, which have fallen slightly in recent weeks but still remain above 7 percent, making payments for an average home about $1,000 a month more expensive than they were two years ago.

The number of new home sales fell 15.9 percent between October and November, according to Zillow's report, which was released this week. Turnover was also 4.6 percent lower than in November last year.

But the picture varies widely across the country, with some metro areas faring much better than others. Zillow's report shows where home prices have risen or fallen the fastest over the past year

Separate figures from Redfin show the extent of the price cuts. Houses in New Orleans are, for example now on sale for about 5 percent below the asking price. Meanwhile, sellers in Naples, Florida, Memphis and Chicago are cutting prices by 5 percent, 4 percent and 2 percent, respectively.

With the average home in New Orleans at $310,000, a 5 percent discount would equate to a savings of $15,500.

The Zillow report noted, “Home buyers and sellers who brave the wind and rain late in the year are in for some early holiday surprises.

“Monthly costs for a new mortgage are falling, inventories are getting closer to normal levels and price cuts are unusually common.”

But the picture varies widely across the country, with some metro areas faring much better than others.

Zillow's data shows that Hartford, Connecticut, had the strongest price growth over the past year. House prices in the region have risen by 11.3 percent.

This was followed by Milwaukee, Wisconsin, San Diego, California, and Providence, Rhode Island, where home prices rose 8.5 percent, 7.6 percent, and 7.4 percent, respectively.

The top five was completed by Boston, Massachusetts, where homes increased in value 7.2 percent.

By comparison, New Orleans, Louisiana, had experienced the worst drop in home values. Properties there fell by 8.9 percent in value.

This was followed by Austin and San Antonio, both in Texas, where prices fell 8.2 percent and 3 percent, respectively.

Jacksonville, Florida and Memphis, Tennessee also saw home prices drop 1.5 percent and 0.9 percent each.

The findings come after it was reported that average monthly mortgage payments are now nearly double what they were when Biden took office.

The analysis is based on the cost of a $430,000 home with a 30-year mortgage and assumes a 10 percent down payment. It also does not take into account a slight decline in home loans in recent weeks.

Mortgages have been boosted by the Federal Reserve's aggressive campaign to raise interest rates from near zero in April 2020 to a 22-year high of between 5.25 and 5.5 percent

Higher interest rates and rising home prices mean buyers are facing one of the least affordable markets in recent memory

Mortgages have been pushed up by the Federal Reserve's aggressive campaign to raise interest rates from near zero in April 2020 to a 22-year high of between 5.25 and 5.5 percent.

Higher interest rates are used to tame blazing inflation, in the hope that they will curb consumer spending and bring prices back under control.

But cooling inflation – currently hovering around 3.2 percent annually – has allowed the Fed to hold rates steady twice in a row since July.

As a result, mortgages have finally started to fall. The latest data from government-backed lender Freddie Mac shows that the average interest rate on a 30-year fixed-rate mortgage has fallen to 7.03 percent – the lowest level since early August.

But homeowners who bought a home in recent years still have to pay about $1,000 extra per month for a new home.

At the current rate, a buyer purchasing a $400,000 home would face mortgage payments of $2,536 on a 30-year mortgage. This analysis assumes a five percent down payment.

But just two years ago – when interest rates were 3.10 percent – the same buyer would have paid just $1,623 per month.