Why has orange juice become so expensive in recent years?

While market observers worry about rising oil prices amid an escalating conflict in the Middle East, the rising price of another commodity starting with O has largely escaped the headlines.

But consumers are unlikely to have missed the astronomical rise in the price of orange juice in recent years. Experts warn that box office prices could continue to rise.

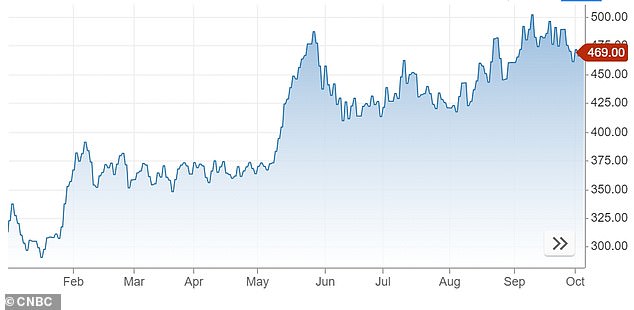

New York orange juice futures were at $4.69 a pound on Oct. 4, up about 45 percent this year and more than quadrupling since 2022.

Rise: The average volume price of orange juice at major British supermarkets rose 8.4 percent in the year ending September 7, according to market research firm Circana

According to market research company Circana, the average volume price of orange juice at major British supermarkets rose by 8.4 percent in the year ended September 7.

Alex Lawrence, senior strategic insight director, noted that price growth was slowing.

But Brits are drinking less orange juice than before, with overall volumes down 5.2 percent on last year, suggesting price rises have taken their toll on demand.

And British shoppers aren’t the only ones; research by Rabobank published in April showed that consumption fell by 15 to 25 percent in all prominent markets last year.

Luxury brands were particularly affected, with volumes down around 8 percent in the US in 2023.

Jump: New York orange juice futures were at $4.69 a pound on Oct. 4, up about 45 percent this year and more than quadrupling since 2022

Rabobank predicts that demand will shrink by another 20 percent this year, which “should limit the possibility of another significant price increase.”

However, this depends on the harvest in Brazil, the world’s largest orange juice grower and exporter, which reaches around 260 million boxes for the 2024/2025 season “with reasonable juice yields”.

If this figure is met, it would still be around 15 percent less than the 305 million boxes from the previous year’s harvest.

Yields in Brazil, home to three-quarters of all orange juice exports, have been hit by a double blow of severe drought and crop diseases.

The country is experiencing a second year of extreme drought, with the Amazon basin at historic lows, devastating the so-called ‘citrus belt’ – a region that includes São Paulo and the Triângulo Mineiro regions.

Extreme heat stress puts orange orchards at greater risk of citrus greening, a bacterial disease in which psyllid insects infect and eventually kill citrus trees by turning oranges bitter and sour.

Fundecitrus, a trade association for citrus growers and juice makers, estimates that 38 percent of orange trees showed symptoms of the disease in 2023, an increase of more than half from the previous year.

Diseases have similarly affected production in Florida, also known as the “Orange State,” where production has plummeted 92 percent over the past two decades.

Environmental threat: Extreme heat stress puts orange groves at greater risk of citrus greening, a bacterial disease in which psyllid insects infect and eventually kill citrus trees

But instead of heat, the greening is being exacerbated by severe cyclones, including hurricanes Charley, Ian and Michael.

Many growers have responded by drastically reducing acreage or leaving the orange industry altogether, with many selling their land to real estate developers eager to cash in on the state’s growing population.

While other countries, such as Mexico and South Africa, are increasing orange juice production, this is not enough to offset the long-term decline in Florida and weaker harvests in Brazil.

Global orange juice production is expected to be 3 percent lower according to the United States Department of Agriculture (USDA) at 1.5 million tons in 2023/24.

To avoid shortages, orange juice manufacturers traditionally freeze their inventory, allowing their product to be stored for up to two years.

However, three consecutive years of supply-demand imbalances have severely depleted supplies, leading to higher consumer prices.

The USDA forecast that global stocks of frozen concentrated orange juice will close the 23/24 harvest at just 150,000 tons.

This would be a decline of 25 percent from the previous year and almost two-thirds below the ten-year average of 400,000 tons.

Although Rabobank’s Padilla predicts a more balanced market in the short term due to weak demand, he warned that this depended on the amount of oranges produced in Brazil.

He wrote: ‘If crop expectations for Brazil turn out to be worse than expected and below our estimated range… due to weather instability and greening, prices would have to rise again to find a new equilibrium.’

Starting production in other regions could help alleviate shortages, but orange trees take three to seven years to bear fruit, depending on whether they are grafted or grown from seed.

Many farmers instead harvest much earlier in the season, but this can have a negative impact on crop supply and quality.

If you’ve noticed changes in the taste of your favorite orange juice drink, it could be due to changes in Brix levels: the sugar concentration of a liquid, which affects its sweetness and nutrient content.

Florida citrus growers are currently lobbying the U.S. Food and Drug Administration (FDA) to lower the required Brix level of not-from-concentrate pasteurized orange juice by 0.5 percentage points to 10 percent.

Rising prices: Orange juice will become more expensive this year due to the orange shortage – which could also mean mandarins are used as an alternative

The FDA is investigating whether this change would dramatically affect American consumers’ appetite for orange juice.

Drinkers can react quite badly if their favorite brand changes the composition and taste of their products and at the same time increases prices.

Circana said the price of an average juice bottle in the supermarket rose 10.8 percent in the year to May, something grocers are reluctant to comment on.

Sainsbury’s, Tesco, Morrisons and Marks & Spencer did not respond to questions about their orange juice prices.

Meanwhile, a Waitrose spokesperson said: ‘All retailers have seen external factors impacting the price of orange juice, but we are working with our suppliers to keep prices low.’

Whether the major British supermarkets have increased prices or not, figures from Circana show that sales of orange juice fell by 5.8 percent in the 52 weeks ending September 7.

“Commodity prices appeared to have peaked only in the past month and remain very high compared to previous levels.”

Alex Lawrence, senior strategic insight director at market researcher Circana

The cost of food and drink in Britain – and elsewhere – has risen sharply over the past three years, partly as energy prices skyrocketed following the easing of Covid-related restrictions and Russia’s invasion of Ukraine.

However, UK food and drink inflation has normalized and is at 2 percent in the second quarter of 2024, compared to 19.1 percent in March last year.

Orange juice futures have also shrunk from the record high of $5.89 per pound reached in early September.

“Commodity prices appeared to have peaked only in the past month and remain very high compared to previous levels,” said Alex Lawrence of Circana.

He expects price inflation to continue to slow in the coming year as juice makers prioritize boosting volume sales.

At the same time, Rabobank predicts that global demand for orange juice will shrink further, to 1.1 million tons in 2024/2025.

Not only do higher prices discourage purchases, but the bank says trade is being hurt by concerns about high sugar content, competition in the drinks sector and the ‘lack of engagement’ from younger consumers.

That could keep price increases in check, but consumers will need to see better crop yields and take action to combat greening if prices are to fall to more affordable levels.

DIY INVESTMENT PLATFORMS

A.J. Bell

A.J. Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund trading and investment ideas

interactive investor

interactive investor

Invest for a fixed amount from € 4.99 per month

Sax

Sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account fees

Affiliate links: If you purchase a product, This is Money may earn a commission. These deals have been chosen by our editors because we believe they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.