Why DO Americans feel so blue about the economy despite low unemployment and falling inflation? Fears over ‘incompetent government’, war and the end of social security spooks millions of workers

Americans remain extremely gloomy about the state of the economy and their financial prospects, despite all indicators improving rapidly.

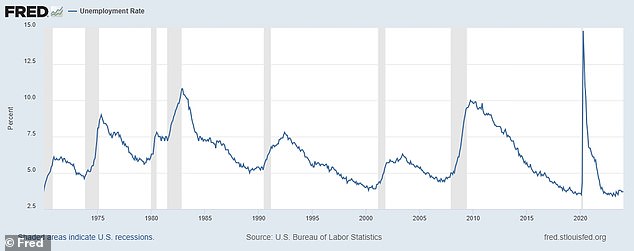

Unemployment has fallen to just 3.7 percent and has been below 4 percent for two years in a row, while GDP grew by 3.1 percent last year despite fears of a recession.

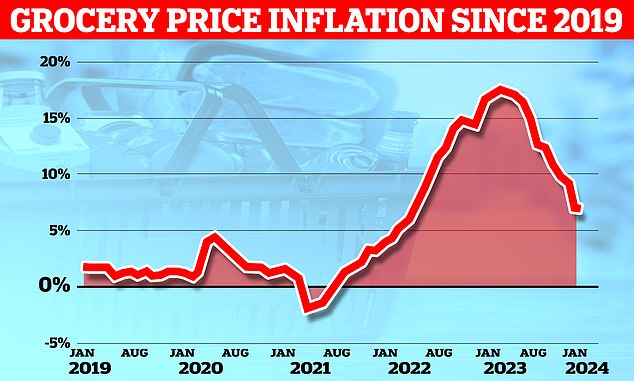

Even inflation, which peaked above 10 percent and sent prices of everyday goods soaring, is now just over 3 percent last year, and is expected to fall to 2.2 percent this year.

Prices rose just 2.6 percent and Americans are spending again, with retail sales up 5.6 percent from a year ago — a good indication of improved economic health.

But every poll shows that Americans are pessimistic about the economy and expect things to get worse, not better, as all the numbers predict.

Americans remain extremely gloomy about the state of the economy and their financial prospects, despite all indicators improving rapidly

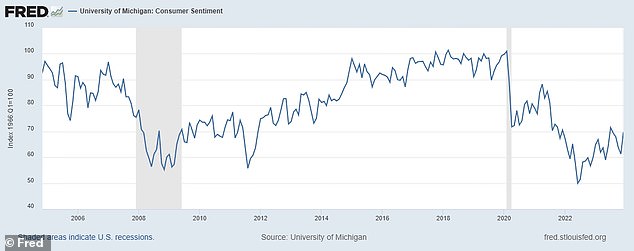

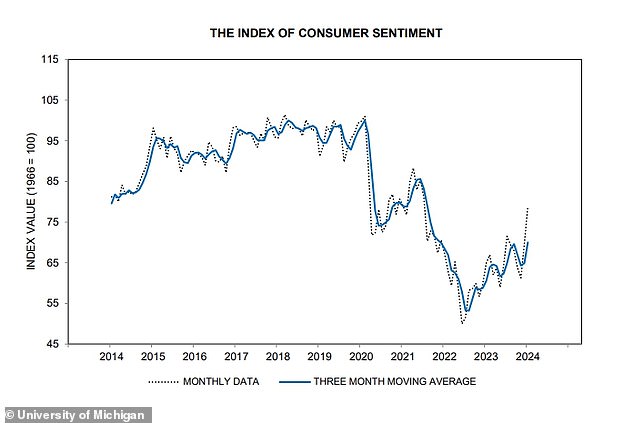

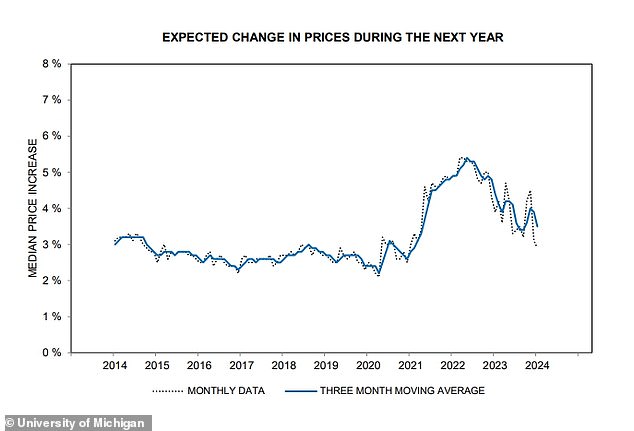

Consumer confidence, as measured by the University of Michigan, rose 13 percent last month and 29 percent since November, but is still 20 percent lower than weeks before the pandemic

Unemployment has fallen to just 3.7 percent and has been below 4 percent for two years in a row

A National Opinion Research Center survey found that 78 percent of Americans were unsure that their children’s lives would be better than theirs — a record low.

About 71 percent think the economy is heading in the wrong direction, and only five percent of Republicans and 58 percent of Democrats rated the economy as excellent or good.

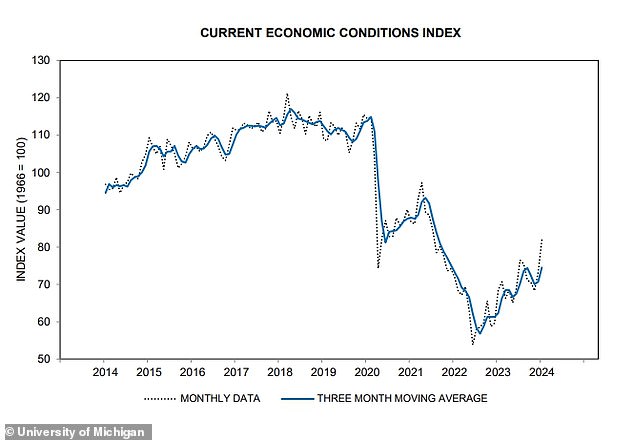

Several other key indicators are finally on the rise, but are still well below where economists think they should be.

Consumer confidence, as measured by the University of Michigan, rose 13 percent last month and 29 percent since November, but is still 20 percent lower than weeks before the pandemic.

Views of economic conditions in an SSRS survey also improved, with 26 percent of Americans believing the economy is starting to recover – up from 20 percent six months ago.

But half of those surveyed believed that the economy is “still in recession and conditions continue to deteriorate,” despite all signs to the contrary.

The number increased only slightly from 53 percent in December 2022, when the situation was still somewhat dire, to 48 percent last month.

Broad economic indicators have risen, but individual Americans are still recovering from 2022’s massive cost-of-living increase

Consumer confidence may finally be rising after a sharp decline in recent years

Economic conditions are improving rapidly and are expected to do even better this year

Those who felt worse off than a year ago fell to 42 percent, compared to 49 percent in December 2022, and only 20 percent said they were doing better.

“Everything important in life is getting more and more expensive, no matter what the inflation index says,” wrote one Georgia Republican who responded to the poll, according to CNN.

‘Everything is still expensive and many people have difficulty with that. Consumer debts have risen sharply. Wall Street is doing well, but that doesn’t help the average worker,” wrote another from Louisiana.

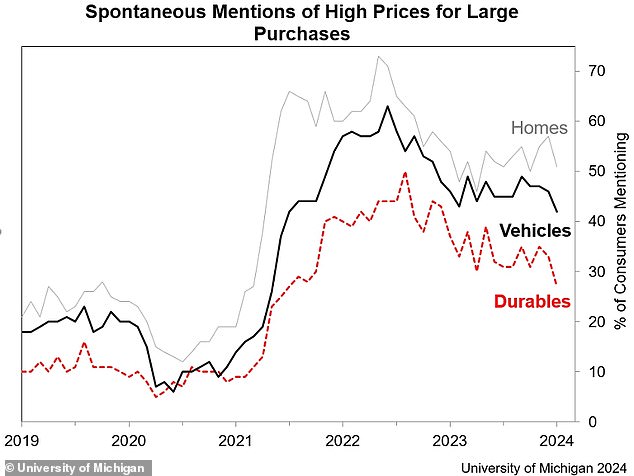

Therein lies the problem: Overall economic indicators are up, but individual Americans are still recovering from the huge cost of living increase in 2022.

Even as their wages and wealth rise, they fear that everything could collapse again in an instant.

Several Americans whose financial situations were objectively improving told a Wall Street Journal research that general uncertainty with the world scared them.

“Even though I’m fine now, there’s a feeling that it could all go away in a second,” said Kristine Funck, a nurse in Ohio.

This is largely fueled by how hard and fast the crash was, and how much inflation skyrocketed over the space of months.

Prices rose only 2.6 percent in 2023 and inflation is expected to reach just 2.2 percent this year

The monthly inflation rate over the first nine months of last year

The Russian invasion of Ukraine, which was responsible for huge spikes in energy costs that helped drive up inflation, and the recent conflict in the Middle East only reinforce the idea that everything is on a razor’s edge.

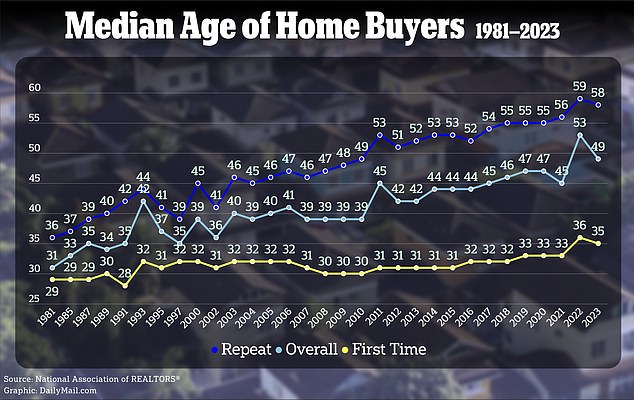

There are also more structural problems at play, including growing inequality between rich and poor, and huge increases in rents and house prices, and the costs of education and health care.

Americans are increasingly leaving college with hundreds of thousands of dollars in debt, only to find that the high-paying jobs they expected don’t exist.

Others are alarmed by the scarcity of employer pension plans and the difficulty of funding their own retirement, and fear that Social Security will be bankrupt and gone by the time they retire.

All this against the backdrop of a long-term decline in American confidence in government to find solutions to such problems, or even to govern the country well.

Theresa Foster, who lives with her husband in Albany, New York, is still shocked by supermarket prices, despite making $200,000 a year.

“I feel like we’re on very thin ice, that it’s very fragile, that neither political party has a theoretical basis for what they want to do with the economy.” she told the WSJ.

Americans are increasingly leaving college with hundreds of thousands of dollars in debt, only to find that the high-paying jobs they expected don’t exist

Pessimism about the economy is bad news for President Joe Biden as he seeks re-election, as the economy has historically been the most important issue.

Even with multiple wars abroad and thousands of migrants flooding the border, the economy has swung almost every election for decades.

Former President Donald Trump has a handy lead on this issue, 59 to 37 percent, according to a New York Times poll of five crucial swing states.

Another poll, conducted by NBC, gives Trump a 55 to 33 percent lead on the question of who could better manage the economy.

Some of this is explained by a phenomenon where people view the state of the economy through a partisan lens.

Weeks before the 2016 election, only 11 percent of Republicans rated the economy as excellent or good, but this rose to 26 percent after Trump was elected – despite no change in the economy itself.

Within a year it was 73 percent, despite little change in the economy, and Democrats’ optimism collapsed.

A study by Neale Mahoney, an economics professor at Stanford University, in November on the “asymmetric strengthening” of consumer confidence depending on politics, found that the effect was much larger for Republicans.

“We find that Republicans cheer louder when their party is in control, and boo louder when their party is out of control,” he wrote.

“Adjusting the decibel level so that Republicans and Democrats cheer at equal volume explains 30 percent of the current gap between perceived consumer confidence and what you would predict based on economic fundamentals.”

Biden is eager to talk about how well the economy is doing, hoping voters will eventually listen, blaming price increases on corporate greed.

“But despite everything we’ve done to bring prices down, there are still too many companies in America ripping people off. Price gouging, junk feeds, greed inflation, shrink inflation,” he said last week.

“America – we’re tired of being played as fools!”