Why another interest rate rise will make it harder for an average Australian to buy a house

>

Australians on the average full-time salary have seen their borrowing capacity drop by $133,000 in just nine months and another rate hike will make matters worse.

In April 2022, someone earning $92,030 could borrow $568,000. With a 20 percent deposit, that was enough to buy a $710,000 home.

But eight interest rate hikes since May have slashed what an Australian can borrow due to strict bank lending rules.

Another interest rate hike on February 7, which all of the Big Four banks are forecasting, would see this lending capacity drop by another $10,000 to $425,000.

That would mean the average single worker could only borrow enough to buy a $531,250 home with a 20 percent down payment.

Borrowing capacity has plummeted by $133,000 since May, but another rate hike next week would push the deficit to $143,000.

Australians on the average full-time salary have seen their borrowing capacity drop by $133,000 in just nine months and another rate hike will make matters worse (a Melbourne auction in April 2022 pictured)

A dual-income couple, with a combined income of $184,060 – based on two full-time average salaries – would have seen their borrowing capacity reduced by $329,000 from $1,309,000 to $980,000, with another rate increase in February.

With a 20 percent down payment, this has taken them from being able to buy a $1,636,250 home to only being able to afford a $1,225,000 home.

The Reserve Bank of Australia’s ninth consecutive monthly hike would take the cash rate to a new 10-year high of 3.35 percent.

Canstar finance expert Steve Mickenbecker said a series of interest rate hikes have made things more difficult for first-time homebuyers, even if they had saved for a deposit.

“For years, first-time homebuyers have been struggling to get enough deposit to buy on the housing market,” he said.

“Just when declining property prices have eased this burden somewhat, higher interest rates and repayments have become the main impediment.”

Lenders and banks must model a potential borrower’s ability to cope with a three percentage point increase in variable mortgage rates, based on Australian Prudential Regulation Authority rules.

The era of the record 0.1 percent cash rate ended in May, and since then the RBA cash rate has risen three percentage points.

This has marked the most severe pace of monetary policy tightening since the Reserve Bank began publishing a target cash rate in 1990.

Fee increases have been tougher on single Australians than on couples.

Sydney’s median home price last year fell 13.2% to $1,221,367, meaning it’s still affordable for a married or de facto couple, both earning $92,000 a year, data shows from Core Logic.

But a single Australian with a 20 per cent down payment has fewer options, with a home buying budget of $531,250.

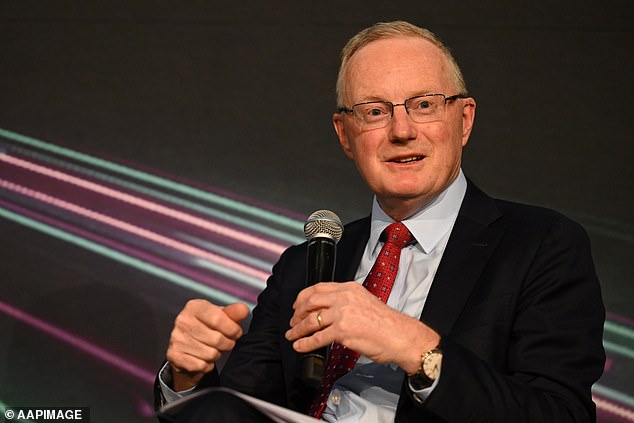

Eight interest rate hikes since May have slashed what an Australian can borrow due to strict banking rules (Pictured Reserve Bank of Australia Governor Philip Lowe)

They would have to settle for a cheaper house in Perth, where $586,721 is the median price for a house with a backyard.

Individual borrowers have more apartment options with Melbourne having a midpoint unit price of $589,752, compared to Brisbane’s $492,059 and Hobart’s $528,256.

The Commonwealth Bank and AMP expect the RBA to raise the cash rate by a quarter of a percentage point to 3.35 percent, making the February hike the last in this tightening cycle.

Westpac and ANZ expect the Reserve Bank to raise rates a further three times to 3.85 percent by May.

Deutsche Bank is even more bearish, expecting four more rate hikes that would take the cash rate to 4.1 percent for August.

Headline inflation last year soared to 7.8 percent, the highest pace in 32 years, which is also well above the RBA’s target of 2 to 3 percent.

Another 25 basis point rate increase on February 7 would see a borrower with an average $600,000 mortgage see their monthly mortgage payments rise another $93 to $3,303, up from $3,210 now.

That’s based on a Commonwealth Bank variable loan rising to 5.22 percent from 4.97 percent.

Since May, the typical borrower would have seen their monthly payments increase by $997 or 43.2 percent from $2,306 when the CBA offered a variable rate of 2.29 percent.