Where will house prices rise and fall in 2023? Winners and losers announced

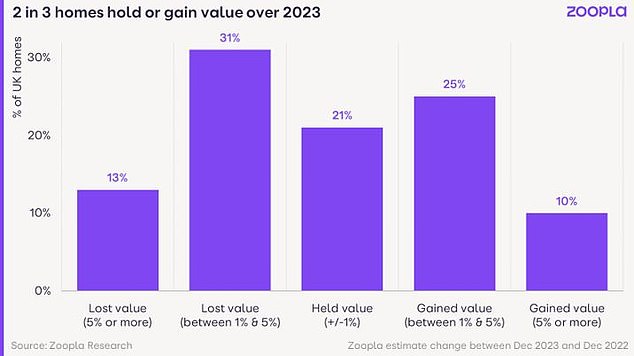

More than two in five homeowners saw the value of their home fall last year, according to the latest analysis from Zoopla.

The property website says 44 per cent of UK properties suffered a fall in house prices last year.

Of these, 13 percent of homes fell by 5 percent or more in 2023, while another 31 percent fell in value by between 1 and 5 percent.

In contrast, there were some areas in the country where almost a fifth of homeowners saw their home prices rise by more than 5 percent.

We look at the house price winners and losers of 2023.

South coast declines: half of homeowners in the seaside resorts of Dover and Hastings register a 5% drop in house values by 2023

Where are house prices falling – or growing more slowly?

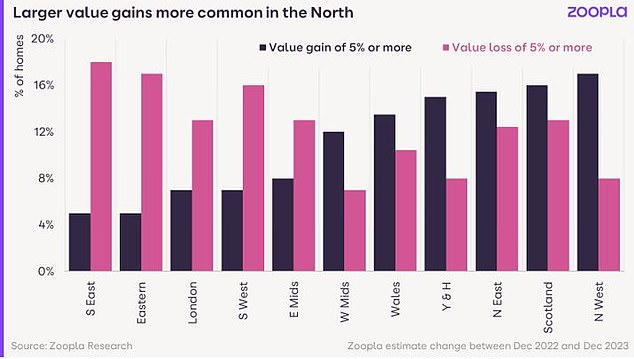

The falls have been more acute in the south of England, where 18 per cent of homeowners in the south east saw their homes fall in value by 5 per cent or more.

Zoopla says it has noticed that housing markets near rural and coastal areas in the South East have cooled since the pandemic.

For example, more than half of homeowners in the seaside resorts of Dover and Hastings will have seen a 5 percent drop in home values by 2023.

Although the average house price in the UK fell in 2023, the country’s 30 million homes are spread across thousands of housing markets, each with its own characteristics and drivers.

More than a third of homeowners saw their home increase in value, Zoopla’s analysis shows.

In fact, one in ten homeowners would have seen their house price rise by 5 percent or more in 2023. That amounts to three million households.

However, the total profits of households that did increase in value last year were considerably less than in the previous year.

It says the average annual profit of homeowners whose properties increased in value was £7,800 last year – a big drop from the £19,700 recorded in 2022.

Where are house prices rising?

Zoopla found a clear north-south divide in the fortunes of homeowners in 2023, as lower prices softened the impact of higher mortgage rates in more affordable parts of the country.

As a result, the report says more homes in the north of Britain actually registered a higher value.

Exceeds expectations: more than half of homeowners saw the value of their home remain static or increase by at least 1%

Last year, the Northwest had the highest percentage of homes that increased in value by 5 percent or more.

Zoopla says half a million homes (17 percent of homes) in the region saw gains of more than 5 percent or more.

The North West was closely followed by Scotland, where 16 percent of homes increased in value by 5 percent or more by 2023.

Izabella Lubowiecka, senior property researcher at Zoopla, said: ‘While national house price indices pointed to a modest decline in house prices in 2023, our tracking of home values at a property level shows that the value of most homes is unchanged or slightly over the year has become higher.

‘Depreciation was concentrated in southern England, while modest gains were recorded in the lower priced, more affordable housing markets.’

Homeowners in southern England were most likely to experience a fall in the value of their home; 18% of homeowners recorded a decrease in home value of 5% or more

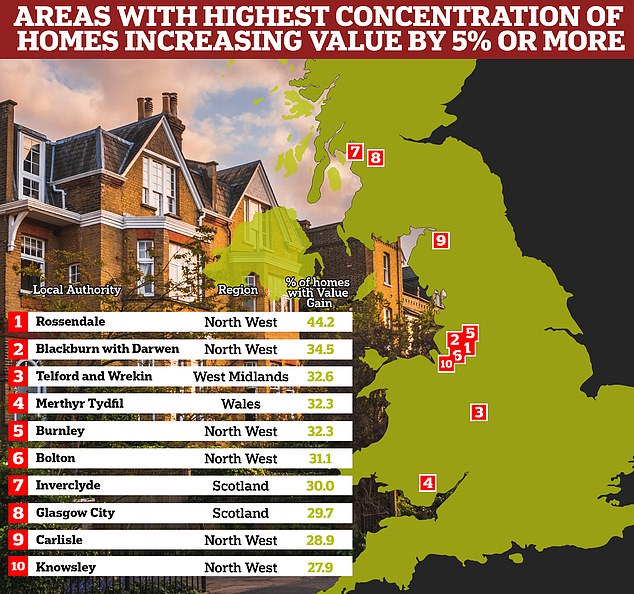

Rossendale is the hottest property market

One local area in particular has bucked the typical housing market trend in 2023 – a trend in which prices have predominantly fallen or stagnated.

The Rossendale area in the northwest of England was rated by Zoopla as the hottest property market of 2023, with the highest concentration of homes increasing in value by 5 percent or more of any local authority.

According to data from Zoopla, 44.2 percent of homes in that area have increased in value by 5 percent or more.

Rossendale is located in East Lancashire, bordering Bury, Hyndburn, Burnley, Todmorden and Rochdale.

On the bright side, by 2023 the North West had the highest proportion of homes with greater value increases of 5% or more – according to Zoopla, an average gain of £13,200

Graham Shuttleworth, manager at Ryder & Dutton estate agents in the town of Rawtenstall, based in the Rossendale borough, says the area is benefiting from the ripple effect on house prices coming from Manchester and millions of pounds of investment coming into the region. area from the government’s leveling plan.

‘There are three really exciting market towns driving growth in Rossendale. Rawtenstall, Haslingden and Bacup. They are all great places to live and within easy traveling distance of Manchester city centre.

It is a perfect destination for all ages who want to get out of the city center but still stay close

Rossendale estate agent, Graham Shuttleworth

‘We’re based in Rawtenstall and the place just keeps getting better with more trendy bars, shops, craft breweries and restaurants opening up.

‘If you miss the traffic it takes 20 minutes to get into Manchester and otherwise it’s 45 minutes at rush hour, via the handy M66 link.

‘So it’s a perfect destination for all ages who want to move outside the city centre, but still want to stay close. The area has become very popular for families.

‘There is also a huge amount of regeneration taking place in some of the city center redevelopments in the area, coupled with increasing government funding.

“Haslingden Market town center is being redesigned, while similar multi-million pound projects are underway in Bacup and Rawtenstall.”

Other local areas where around a third of homes rose in value by 5 per cent or more include Blackburn with Darwen in the north west of England and Telford and Wrekin in the West Midlands.

What next for house prices?

Zoopla predicts a modest 2 percent fall in house prices across Britain by 2024.

However, as you can see, the precise impact of this on individual homeowners depends on their location.

Zoopla expects those who saw a rise in home values in 2023 will see a similar increase in 2024.

According to the report, high mortgage interest rates will continue to limit purchasing power and will be most felt in high-value regions in southern England, contributing to further falls in house values.

This is particularly true for those who own a flat or detached house in the South, who Zoopla says should continue to price realistically to complete a sale.

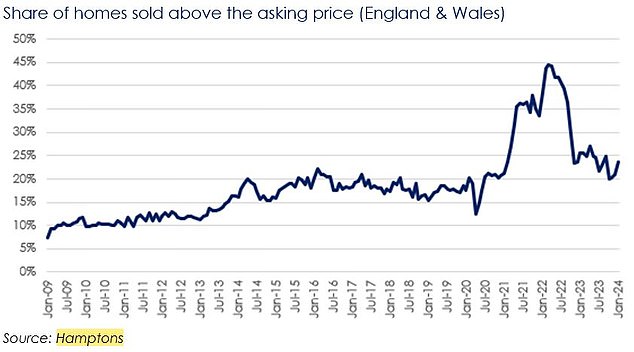

But while Zoopla predicts more of the same in 2024, property agent Hamptons reports that the housing market has turned around.

According to Hamptons, sellers were less likely to lower their asking price in January than at any time in the past eight months.

It showed that 48 percent of homes sold in England and Wales in January were subject to a price reduction, compared to a peak of 55 percent in October 2023.

More than a quarter of these homes were sold above the final asking price, the highest share since October 2022.

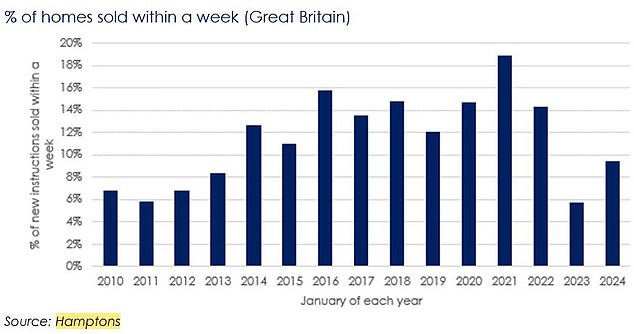

Hamptons also reported that with more buyers, new homes coming onto the market are selling faster than last year.

According to the report, 9 percent of homes that came on the market in January sold within a week, up from 6 percent in January 2023.

But with many buyers and sellers still trying to adapt to the market, this figure remains significantly lower than in January 2021, when 19 percent of homes sold within a week.

Aneisha Beveridge, head of research at Hamptons, believes early signs in 2024 indicate the market has definitely turned the page.

“Falling mortgage rates have been the main catalyst for last year’s missing movers to restart their home search,” Beveridge says.

“As a result, more households wanted to buy last month than in any January in the past decade, including the start of both 2021 and 2022.

‘First-time buyers and second-time buyers, who are usually the most dependent on mortgage financing, are leading the recovery.

‘This injection of demand is starting to stabilize the decline in house prices, especially for mid- to lower-end properties, which should also improve sales conditions further down the chain as the year progresses.

“That said, the affordability picture is still more challenging than it was a few years ago, which will keep price growth firmly in check.”

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.