Where UK house prices officially fell the most in 2023 – and areas that bucked the trend

According to the latest figures from the Office of National Statistics, house prices officially fell last year.

The ONS revealed that the average UK house price fell by 1.4 per cent in the year to December as the mortgage crisis took its toll on property sales.

It means that a typical house lost £4,000 in 2023, while the average sales price was £285,000.

But some locations saw a much bigger drop, with house prices falling by 10 percent or more in six English boroughs.

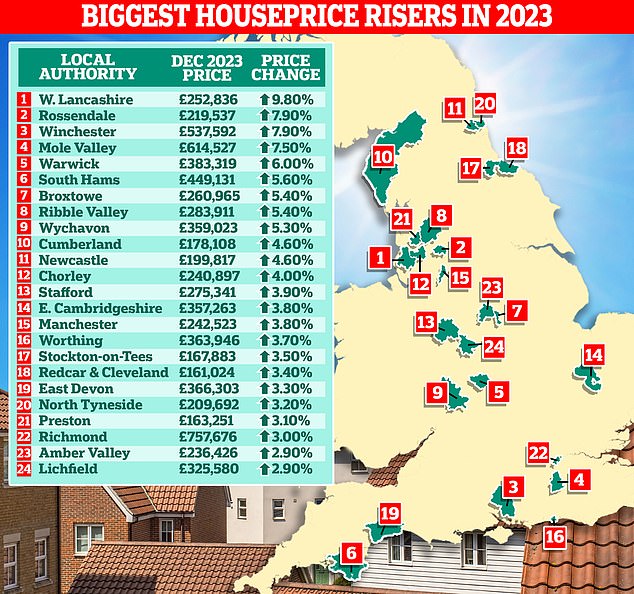

Meanwhile, others bucked the trend, with nine seeing property prices rise by 5 percent or more.

It’s officially fallen: the ONS revealed the average UK house price fell by 1.4 per cent in the year to December

The ONS figures are widely regarded as the most comprehensive and accurate house price index. This is because this report from Britain’s official statisticians uses land registry data and is based on average sales prices. However, this also means that the data lags behind other indexes.

Last year there was a geographical divide in Britain when it came to property prices.

England and Wales saw average sales prices fall by 2.1 percent and 2.5 percent respectively in the 12 months to December.

However, in Scotland and Northern Ireland, average prices rose by 3.3 percent and 1.4 percent.

Across regions of the country, changes in house prices ranged from a fall of 4.8 per cent in London and a fall of 4.6 per cent in the South East, to a rise of 1.2 per cent in the North West and a slight increase in 0.3 percent in the West Midlands. .

But there were much greater differences between local authorities.

This emphasizes the most important point: the real estate market does not move as a single entity, but consists of thousands of localized markets, all of which behave differently.

For example, average prices in West Lancashire rose by a whopping 9.8 per cent last year, with the average house rising from £230,000 to £253,000.

In the City of London, average house prices fell by 17.8 per cent from £975,289 to £802,000.

Where house prices fell the most in 2023

| Local authorities | 23 December | December 22 | Difference |

|---|---|---|---|

| City of London | £802,168 | £975,289 | -17.8% |

| City of Westminster | £877,733 | £1,046,255 | -16.1% |

| Kensington and Chelsea | £1,125,353 | £1,304,255 | -13.7% |

| Go exercise | £229,869 | £259,878 | -11.5% |

| Tunbridge Wells | £423,528 | £477,396 | -11.3% |

| Hammersmith and Fulham | £664,767 | £743,420 | -10.6% |

| Welwyn Hatfield | £399,510 | £441,496 | -9.5% |

| Runnymede | £437,283 | £481,693 | -9.2% |

| Surrey Heath | £424,318 | £466,601 | -9.1% |

| Fenland | £224,704 | £246,976 | -9% |

| Reading | £301,827 | £331,544 | -9% |

| Walthambos | £468,598 | £514,854 | -9% |

| Torridge | £302,716 | £332,194 | -8.9% |

| Tonbridge and Malling | £412,308 | £451,674 | -8.7% |

| Stevenage | £318,143 | £347,098 | -8.3% |

| Southampton | £231,895 | £252,397 | -8.1% |

| Hartlepool | £123,829 | £134,277 | -7.8% |

| Hyndburn | £120,181 | £130,321 | -7.8% |

| Lincoln | £173,939 | £188,530 | -7.7% |

| South-Holland | £225,338 | £243,857 | -7.6% |

| Watford | £371,851 | £402,609 | -7.6% |

Some of the worst performing housing markets are in London. Prices in the capital fell by an average of 4.8 percent in the twelve months to December.

According to the ONS, average house prices in the City of London (the capital’s historic financial district) have fallen by a whopping 17.8 percent, while the City of Westminster has fallen by 16.1 percent. Prices have also fallen by 13.7 percent in Kensington and Chelsea.

The ONS warns against reading too much into figures for very small transaction areas, such as the City of London, as these can be distorted by a few sales.

Outside the capital, Gosport on the south coast saw an 11.5 percent drop in house prices. Some popular commuter hotspots also suffered, with house prices falling by 11.3 per cent in Tunbridge Wells, 9.5 per cent in Welwyn and Hatfield, 9.2 per cent in Runnymede and 9.1 per cent in Surrey Heath.

Where house prices will rise the most in 2023

Locations in the North West performed strongly last year, with the key local government area of West Lancashire recording a 9.8 per cent increase in house prices.

Prices in the Rossendale area of northwest England also rose by 7.9 percent last year, according to the ONS.

Interestingly, Rossendale was also rated as the hottest property market of 2023 by Zoopla earlier this week.

The property website showed that around 44.2 per cent of homes there increased in value by 5 per cent or more last year – which is more than any other local authority.

At the other end of the country, Winchester and the Mole Valley, in the south, saw house price rises of 7.9 percent and 7.5 percent.

Will house prices rise or fall in 2024?

The ONS says average house prices rose by 0.1 percent between November and December last year.

This looks quite positive considering average prices fell by 0.8 percent in the same period 12 months ago.

Last week we heard from two separate reports that the housing market may be heating up and more people are looking to buy or sell.

The reset is quickly moving towards recovery

Jonathan Hopper, Garrington property finders

The latest property market research from the Royal Institution of Chartered Surveyors (Rics) shows that estate agents and surveyors are seeing more and more inquiries from buyers and more and more sellers are entering the market.

Meanwhile, Rightmove revealed that a record number of homeowners had contacted an estate agent to have their home valued in January.

Jonathan Hopper, CEO of Garrington Property Finders, said: ‘The reset is moving quickly towards recovery.

‘Crucially, we are starting to see more shares coming into the market as people who postponed their moving plans last year decide now is the time to act before prices rise again.

‘The recovery remains tentative, but there is a growing sense that the 2023 price reset is over, and that last year’s widespread price falls in England and Wales have given many areas more value.’

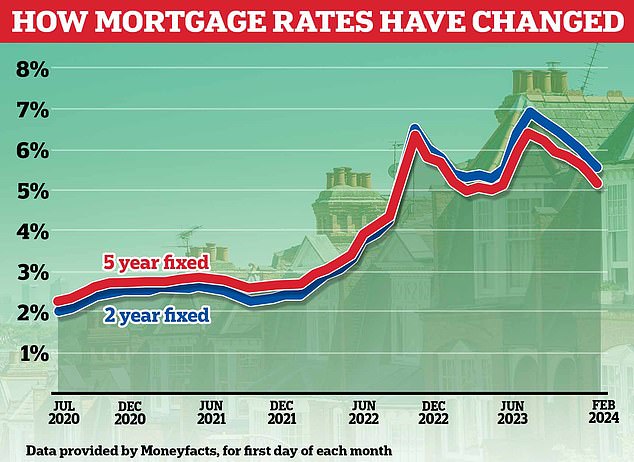

Buyer confidence has been accompanied by a drop in mortgage rates from their peak late last summer, with major cuts on the way in the new year.

Nicky Stevenson, chief executive of national estates group Fine & Country, added: ‘House prices ended the year lower than in 2022 as the gap between what sellers would accept and what buyers would pay for a home narrowed.

‘However, the small increase in prices in December lends credence to the suggestion that the property market is in a much healthier position overall than at the start of last year.’

Many within the real estate industry believe that mortgage rates have now reached levels that will encourage buyers and home movers to get back into the market.

Although the average fixed mortgage interest rate is still just above 5 percent, the cheapest deals are now below 4 percent, according to Moneyfacts.

It is now also generally expected that mortgage interest rates will fall further during the course of the year.

Jonathan Hopper says: ‘As the cost of borrowing falls, homes become more affordable.

“With consumer inflation stuck at double the Bank of England’s target, interest rates may be falling slower than many had hoped, but last year’s trickle of buyers has already turned into a flood.”

Stevenson added: “The expectation is that rates could fall at some point this year, which will increase affordability and boost demand.

“Today’s news that inflation will be kept at 4 percent will increase hopes that interest rates will be cut faster than expected.

‘The Bank of England has also reported three consecutive monthly increases in mortgage applications as momentum increases in the housing market.

‘This pent-up demand from buyers who have halted or postponed their property search means there is increasing activity in the market.’

Mortgage lenders have been cutting rates since August, when the two-year average rate peaked at 6.85 percent and the five-year average rate reached 6.37%.

Another factor that could support house prices is the fact that the number of new-build homes planned by house builders fell by almost half last year.

It is striking that the average price of a new home sold will have increased by 9.4 percent in 2023, according to the ONS figures.

A lack of supply of new homes is likely to further support prices, said Anthony Codling, head of investment bank RBC Capital Markets’ European housing and building materials division.

He added: ‘Today’s ONS data confirms that 2023 was not the year of the house price crash and with falling inflation, falling mortgage rates and rising wages we doubt there will be a crash in 2024, and the recent words that have been spoken and the actions taken by house builders confirm our view that the housing market is more likely to go up than down so far this year.

“The stage is set for a recovery, and we have our fingers crossed that any steps politicians take this election year will help, rather than hinder, the housing market recovery.”

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.