When do you retire? The dream age is 62 – but the reality is bleak for many savers

The most popular age for people to retire is 62. However, the majority of adults believe they will continue working longer. In some cases, they even believe they will never be able to retire.

People who expect to work longer think it will take an average of another seven years before they can afford to retire, while about a quarter say it will never happen, a new survey has found.

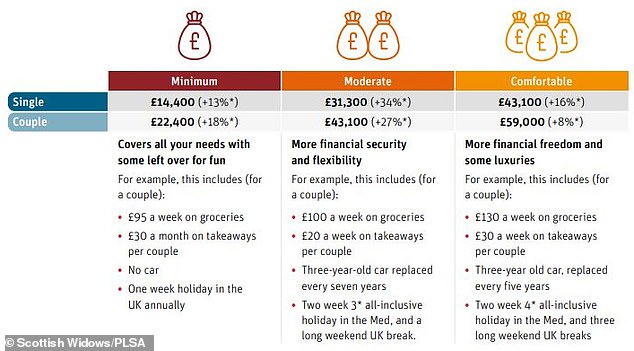

The report also found that more adults will be left below the minimum income standard in retirement – £14,400 for a single person and £22,400 for a couple – than this time last year.

Retirement plan: The most popular age to retire is 62, but 54% of adults think they will have to work longer than they would like

According to the Scottish Widows survey, there are now a further 1.2 million people who cannot provide for even the most basic pension needs.

Influential industry standards were used that look at what individuals and couples need for a minimum, average or comfortable retirement. More information about each level can be found below.

The Study by the Pension and Lifelong Savings Association assumes you are eligible for a full state pension, which rose to £11,500 a year in April. However, the figures exclude income tax, housing costs (if you rent or have a mortgage to pay) or healthcare costs.

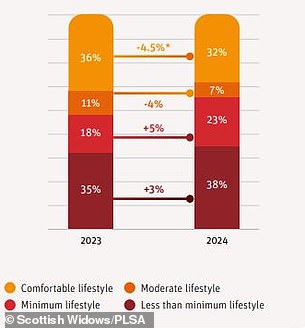

The report attributes the increase in the percentage of people expected to reach the worst retirement age, from 35 percent to 38 percent in the past year, to the rising cost of living.

The agency points out that rents rose by 15 percent between 2022 and 2023, while wages rose by 6.2 percent and the state pension increased by 8.5 percent.

According to Scottish Widows, 54 percent of people think they will have to work longer than they would like, with the preferred age limit typically being 62.

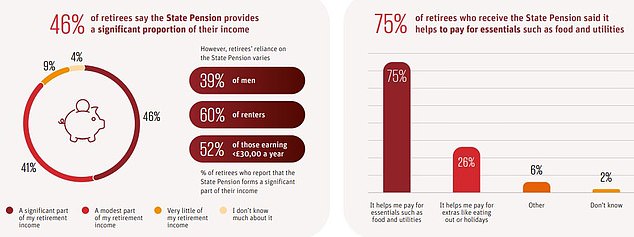

The survey also found that 25 percent of future retirees expect the state pension to provide a significant portion of their retirement income.

Rising costs mean fewer people are on track for a better retirement life

Of those who are already retired, 75 percent say the state pension helps them pay essential bills.

The AOW retirement age is currently 66 years and will rise to 67 years between 2026 and 2028.

It provides a guaranteed income for life, which many people no longer receive through their work arrangements as private sector employers abolish final salary pensions.

Outside the public sector, employers have switched to more meager defined contribution pension schemes, with citizens also bearing the investment risk on the savings they will have to live on in their old age.

Scottish Widows surveyed over 5,000 adults in the spring, weighted to be representative of the British population.

“People are starting to think about how their private pension pot can interact with their state pension entitlement to plan for their retirement,” said Pete Glancy, head of pensions policy at the firm.

‘But there is still a real dependency on the state pension system. Some people are able to use their own pension pot to get the flexibility they want in terms of retirement age. Others are only just beginning to realise that they will ultimately have to work much longer.’

He added: ‘It is the right time for the new government to take a holistic view of people’s financial resilience across their lives, with a particular focus on those whose retirement age is expected to be much lower.

The state pension, currently £11,500 at full rate, helps many retirees cover basic needs (Source: Scottish Widows)

Are you concerned about whether you have saved enough money for your retirement?

Pete Glancy of Scottish Widows gives the following tips.

Imagine your future: It is very important to think about how you want to live and what your financial priorities are, as this will help you determine how much you need to save.

Our retirement report shows that 57 percent of people want to spend more time on activities, while 37 percent plan to care for their children and grandchildren in retirement.

Think about the money: Half of people in their fifties and early sixties have done little to no research into how much they should save for retirement.

This includes all costs, from healthcare and bills to food and housing.

If you don’t know where to start, PLSA has published a set of standards for subsistence living for retirees which show what life after retirement might look like at different income levels.

Now it’s time to calculate how your current savings compare to the lifestyle you want to lead.

PLSA Living Standards for Retirees: What Lifestyle Do You Have at Different Income Levels?

Not on schedule? Don’t panic. There are things you can do to boost your retirement savings, no matter where you are on your savings journey.

If you have a company pension, discuss your contributions and increasing your savings level with your employer or see if they offer salary swaps.

If you are self-employed and are able to save for a personal pension, look at your options. It is also a good idea to take advantage of opportunities such as salary increases or bonuses to increase your contributions.

> How to get the most out of your work pensionN – plus see the tips below

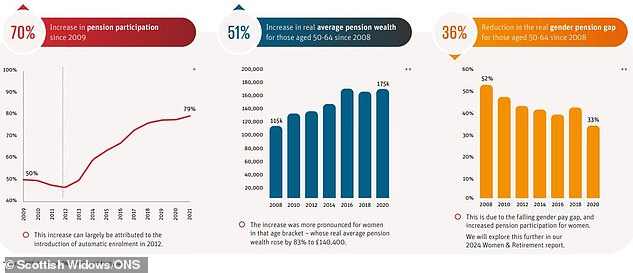

How have pensions changed since Scottish Widows began its annual survey twenty years ago?

Are you thinking about working longer? More than half of people expect to work seven years longer than they thought, and only 26 percent expect to retire at or before the current retirement age of 66.

By postponing your retirement, you have more time to make contributions. You can leave the money invested and give it a chance to grow until you decide to withdraw some of it.

This could mean retiring gradually or finding work that you can continue to do well into old age.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free. We do not write articles to promote products. We do not allow commercial relationships to influence our editorial independence.