What was it like buying your first home in 1974 versus 2024: how much harder is it to get on the ladder now?

An analysis of house prices, salaries and deposits made every year since 1974 shows just how difficult it can be for couples to buy their first home these days.

House prices have risen by 2,534 percent over the past fifty years, while salary growth has not been able to keep pace, according to figures from real estate agent Mojo Mortgages.

In 1974 the average cost of a house was £10,027. Fast forward to 2024 and the figure is £254,985 higher at £265,012 – based on figures from the Nationwide index.

Average individual salaries have risen by 1,791 per cent to £33,644 since 1974, according to data from the Office for National Statistics.

However, according to Mojo’s analysis, current salaries are £13,676 lower than house prices.

Put another way, if average house prices had only risen in line with wages, they would have been £76,000 or 29 per cent cheaper than they are now.

In 1974, the amount needed for a deposit on a house, records show, was £537. Since 1974 this has risen by 10,575 per cent to £58,303.

Climbing the ladder: The research shows how house prices, deposits and the age of first-time buyers have changed

The average deposit as a percentage of two people’s income was 15.05 percent in 1974, compared to 86.65 percent this year.

However, how much deposit couples need depends on factors such as the location in question and the type and size of property being purchased.

According to the data, it takes a few years to save for a down payment, compared to six months in 1974.

The average down payment saved, expressed as a percentage of the property price, was 5.36 percent in 1974 and 22 percent in 2024.

The age of a couple buying their first home together has increased from 26 years in 1974 to 33 years this year.

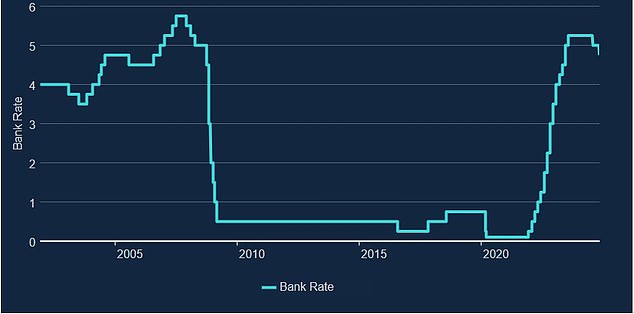

Inflation was about 16 percent in 1974, compared to 2.3 percent today, meaning mortgage rates were also higher then than they are today.

House prices and salaries

The data shows that if salaries had risen at the same rate as the average house price, the current average salary would have been £47,320, which is significantly higher than £33,644.

Conversely, if property prices had risen in line with slow salary growth, the average house would cost £189,100 this year. This is £75,912 less than the current figure.

In the 1980s house prices tripled to £30,833, while the average combined salary rose to £13,095. The ratio of house prices to income improved slightly to 2.2 times, meaning the decade was generally considered more affordable than the previous one.

In 1994, average house prices were £51,362, while combined incomes rose to £13,095, the research shows.

Many are still finding ways to make their homeownership dreams come true, even as costs rise

Fast forward to 2004 and average property prices rose to £147,462. However, a couple’s combined salaries rose to £43,711. This caused the house price to income ratio to rise to 3.4 times, making it harder to get on the property ladder.

Average property prices continued to rise and stood at approximately £186,544 in 2014. Collective salaries were approximately £54,122, bringing the affordability ratio to 2.45 times.

Mojo Mortgages added: ‘Fast forward to today, and the average house costs £265,012 compared to salaries of £33,644.

‘The result is a record-high house price-to-income ratio of 3.94 times – the steepest of the years analyzed.’

John Fraser-Tucker, head of mortgages at Mojo Mortgages, told This is Money: ‘Our analysis has made it clear that today’s first-time buyers are navigating a much more difficult landscape than those who entered the market in 1974.’

He added: “However, despite these discouraging statistics, there is a silver lining. New buyer activity will increase by 21 percent in 2024 compared to the previous year. This increase suggests that many are still finding ways to achieve their home ownership dreams, even as costs rise.”

Fall and rise: Interest rates have been at record lows for most of the past fifteen years before surging recently – but they remain at record lows

Tips for buying your first home

For most people, buying their first home will be the biggest financial decision of their lives, which means it shouldn’t be taken lightly.

The first step is to figure out how much you should spend on a home.

This is determined by a combination of your deposit and the mortgage you can get based on your income, age, other debts and monthly expenses.

Keep in mind that having a larger down payment relative to the purchase price means you own more of your home and have to pay back less overall. In theory, the larger your deposit, the lower your mortgage interest rate should be, although this may not apply to all borrowers as factors such as income and creditworthiness are also taken into account.

As a rough rule of thumb, most lenders typically limit people to borrowing no more than 4.5 times their annual income.

However, it could be lower depending on any other loans and debts you need to consider, or possibly higher if your income and expenses are robust.

Before you start viewing properties, it’s worth putting together a spreadsheet, either with pen and paper or online, showing how much you’re likely to spend in total for a property, taking into account all the different fees and costs.

Stamp duty, survey costs, legal fees, removal and any renovation costs must all be taken into account.

It’s also worth speaking to an independent mortgage adviser to get an idea of how much you can borrow and what rates are available to you.

Fraser-Tucker of Mojo Mortgages said: ‘First, take a good look at your finances. Understanding your savings potential and credit score can help you set realistic goals and determine what you can afford. A higher credit score means better mortgage rates, making your monthly payments more manageable.

‘Next, carefully consider which government schemes, such as Help to Buy or shared ownership, can help you if you’re struggling to save for a deposit. These programs can make homeownership more attainable.

‘I would also recommend setting a clear savings target. Instead of simply saving what you can, create a structured plan that outlines how much you need to save each month to reach your deposit goal in a reasonable time frame. Automating your savings can simplify this process.

‘Be open-minded in your search. Consider different areas or types of properties that may be more affordable than you originally thought. Sometimes expanding your criteria can reveal unexpected opportunities.’

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.