What Biden’s taxes on billionaires and big corporations could mean for YOU: Experts tell Daily Mail how the president’s hikes on the mega-rich could impact all Americans

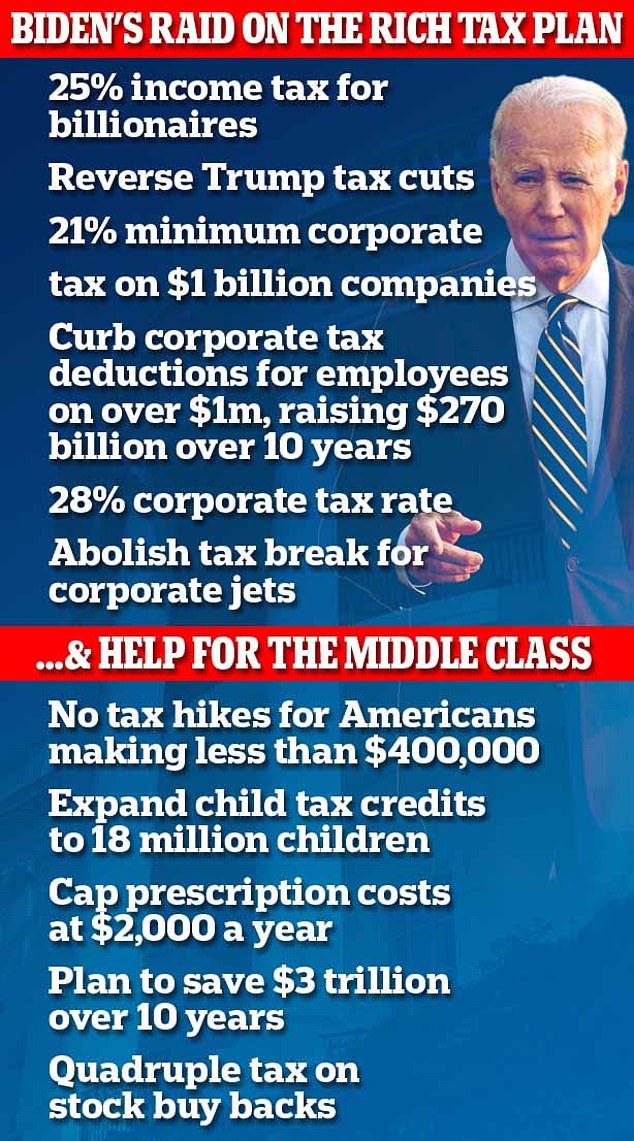

President Joe Biden will urge Congress on Thursday evening to pass sweeping tax hikes on billionaires and corporations to ensure they “pay their fair share.”

The proposals include raising the minimum tax on companies valued at more than $1 billion to 21 percent, up from the 15 percent that took effect last year.

The president will also call for a 25 percent tax on those with wealth over $100 million and the elimination of tax deductions on corporate jets.

Biden has insisted that his plans will not raise taxes on Americans earning less than $400,000.

But those who aren’t in the top one percent of American earners may still feel squeezed.

DailyMail.com spoke to experts about Biden’s bold tax plan and whether they think it will impact the middle class.

White House officials said Biden would preview steps that will be part of a proposed 2025 budget to be released next week that aims to reduce the federal budget deficit by $3 trillion while also raising taxes on Americans with a low income.

David Williams, chairman of the conservative Taxpayers Protection Alliance, warned that when Biden brags about the economy, he will call for increases that will hurt taxpayers, consumers and businesses.

“Biden’s Robin Hood approach of taxing the rich to give to the poor will backfire if companies raise prices to accommodate the tax increases, because we all know that companies will pass those increases on to consumers,” he said.

According to White House officials, the steps are part of his proposed 2025 budget, which will be released next week, and are aimed at cutting federal deficits by $3 trillion over the next decade.

At the same time, the president continues to call for reversing parts of the 2017 Republican tax law passed under President Donald Trump.

Biden wants to raise the corporate tax rate to 28 percent, up from the current 21 percent but still below the 35 percent it was before the Republican law was passed.

“Raising corporate rates will also encourage companies to leave the country, putting thousands of American jobs at risk,” Williams said.

Garrett Watson of the Tax Foundation, a center-right nonprofit, said the president’s likely proposals are in line with approaches they’ve seen in recent years, which have largely failed to gain political support.

The Tax Foundation concluded that raising corporate taxes to 28 percent would ultimately reduce growth by 0.7 percent.

Both the Tax Foundation and the Institute on Taxation and Economic Policy (ITEP) estimate that this would reduce revenues by $1.3 trillion.

But the ITEP, a more liberal-leaning non-partisan organization, has argued that the claims in favor of a lower rate are weak and based on a misunderstanding of how companies respond to tax changes.

They argue that corporate tax cuts largely benefit shareholders and have been used for share buybacks rather than investment and job creation.

ITEP previously found that Fortune 500 companies and S&P 500 companies that were consistently profitable during that period actually paid much less in the first five years after the corporate tax rate was set at 21 percent.

Due to tax breaks and loopholes, they actually paid a rate of 14.1 percent.

They have been hit by Biden’s 15 percent minimum business tax, which would increase under the president’s latest proposal.

Biden will also extend his “billionaire tax” proposal, which is actually significantly below that level.

It imposes a minimum tax of 25 percent on income for Americans with wealth over $100 million.

According to Howard Gleckman, senior fellow at the Urban-Brookings Tax Policy Center, the proposal to further tax the wealthiest Americans would not have much impact on ordinary Americans.

“There could be some kind of indirect effect in that those very, very wealthy people would be able to make fewer investments at the margin,” he said.

“And as they invest less, there would be less demand for shares and share prices would fall.

“But I can’t imagine this would have much effect on the average American stock investment,” he added.

The average American worker paid about 25 percent in taxes in 2022, the OECD reports.

White House research found that the wealthiest individuals paid about 8 percent between 2010 and 2018.

At the same time, Biden will also call on Congress to pass much stricter limits on the corporate income deduction for executive compensation, capping it at $1 million for a given employee.

Current law already prohibits deductions from compensation for CEOs, Chief Financial Officers and other key positions.

White House officials said the new proposal would apply to all workers paid more than $1 million and would generate more than $250 billion in new corporate tax revenue over 10 years.

ITEP estimates the measure would have an impact of $270 billion over 10 years, but warned that more details are needed to understand exactly what the president is proposing.

Biden will also pursue business income deductions for use of corporate jets, an area already the target of audits by the Internal Revenue Service.

This includes extending the depreciation period for business jets from the current five years to seven years, as for commercial aircraft.

That will reduce annual discounts on aircraft, an administration official said.

What would have the biggest immediate impact for average Americans is whether Biden and Republicans can reach a deal, since many of the tax cuts passed in 2017 are set to expire at the end of 2025.

Biden will pledge to extend Trump-era tax cuts to those making less than $400,000, will call for restoring a COVID-era expansion of the child tax credit, giving eligible families up to $3,600 a year per child are paid, and will increase a tax credit for low wages. employees.

Republicans, on the other hand, want to expand all provisions in the Trump law, including tax cuts for people above the $400,000 threshold.

Whatever new corporate tax proposals or billionaire taxes the president proposes will not pass in Congress.

“What Biden is clearly trying to do is differentiate his tax agenda from Trump’s,” Gleckman said.

However, Trump has not yet outlined his future tax agenda.

What he has been talking about as he campaigns to return to the White House is tariffs.

He has talked about raising these prices by as much as 60 percent on Chinese goods.

Such a move would have a substantial impact on the purchasing power of Americans.