WeWork plans to file for bankruptcy as early as next week after struggling with massive losses – despite once being valued at $47billion

WeWork plans to file for bankruptcy as soon as next week, a source familiar with the matter said on Tuesday, as the company faces a huge debt pile and significant losses.

Rumors of the company’s bankruptcy filing have dogged them for some time, after they told regulators there was “substantial doubt” about its ability to remain in business in the coming year.

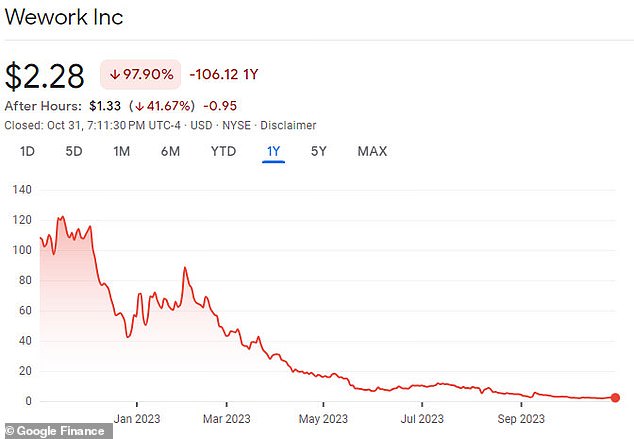

Shares of the flexible workspace provider fell 32 percent in extended trading after the Wall Street Journal first reported the news. This year they are down about 96 percent.

New York-based WeWork is considering filing a Chapter 11 petition in New Jersey, the WSJ reported, citing people familiar with the matter. WeWork declined to comment.

Earlier on Tuesday, WeWork said it had reached an agreement with creditors for a temporary deferral of payments on some of its debt, with the deferment period nearing an end.

WeWork plans to file for bankruptcy as soon as next week, a source familiar with the matter said on Tuesday, as the company struggles with a huge debt pile and steep losses.

The company had net long-term debt of $2.9 billion and more than $13 billion in long-term leases as of the end of June, at a time when rising financing costs are hurting the commercial real estate industry.

WeWork’s bankruptcy filing would mark a stunning turnaround for the company that was privately valued at $47 billion in 2019, and a black mark for billion-dollar investor SoftBank.

The company has been in turmoil since plans to go public in 2019 imploded due to investor skepticism over its business model of taking long-term leases and renting them out for the short term, and concerns about large losses .

WeWork’s problems did not abate in subsequent years. It ultimately managed to go public in 2021 at a much lower valuation. Its main backer, Japanese conglomerate SoftBank, has invested tens of billions to back the startup, but the company has continued to lose money.

WeWork in August expressed “substantial doubt” about its ability to continue as a going concern, with numerous top executives, including CEO Sandeep Mathrani, leaving this year.

Rumors that the company has filed for bankruptcy have dogged them for some time, after they told regulators there were “substantial doubts” about its ability to remain in business for the next year.

When did WeWork’s problems start?

The troubles first started for the New York-based company, which was founded in 2010, when it looked to go public in 2019.

In August that year, the company, which rents out co-working spaces to freelancers, start-ups and established companies, published its full financials, showing a loss of $900 million in six months.

The IPO failed after investors raised concerns about the business model and governance under founder and then-CEO Adam Neumann. The company collapsed in spectacular fashion and saw its valuation plummet to less than $10 billion.

Neumann fell from grace and was eventually ousted over claims of a toxic environment at WeWork.

Despite the company’s utopian image, employees later characterized it as a “cult-like” environment, calling Neumann the “party in chief” while describing his “tequila-fueled leadership style,” which included smoking marijuana on private jets.

In one alleged excessive incident, Neumann threw a three-day party for 8,000 employees to celebrate the company’s $37 billion valuation.

In his book Billion Dollar Loser: The Epic Rise and Fall of WeWork, Reeves Wiedeman wrote that Neumann demanded that there were cases of Don Julio 1942 tequila in every office and that he would ‘lose his s*** if they weren’t there.

Despite poor wages at WeWork that angered staff, Neumann bragged about how little he paid his staff and insisted they should use a “sense of purpose” and free beer to pay their bills, the book said.

In 2020, it was reported that the company paid a female whistleblower more than $2 million in cash to keep quiet after she threatened to expose an alleged culture of drug use, sleeping with coworkers and discrimination within the company, claiming that she was the victim of a sexual assault.

The company eventually went public in October 2021, via a merger with a special purpose acquisition company, but the turbulence continued.

WeWork was hit hard by the Covid-19 pandemic as social distancing led to people increasingly working from home, and has yet to make any gains since restrictions were eased.

Founder Adam Neumann was forced to step down as CEO after a failed IPO in 2019

The New York-based workspace sharing company rents out co-working spaces to freelancers, startups and established companies

What happened to WeWork in 2023?

The company told regulators on August 8 that macroeconomic conditions have further weakened demand for shared office space, and it is suffering from high membership turnover.

WeWork’s interim CEO David Tolley took over in May 2023

WeWork has 512,000 members at its workplaces in 33 countries – and there are currently 32 co-working locations in the US, according to the company’s website.

But according to real estate services provider JLL, office vacancy in the United States exceeded 20 percent at the beginning of this year.

Researchers at Columbia University also found a 45 percent decline in office values in 2020, with little recovery expected in the coming years.

In May, CEO Sandeep Mathrani stepped down and board member David Tolley took over as interim CEO.

Three members of the board of directors resigned in the first week of August due to “a material disagreement over the board’s governance and the strategic and tactical direction of the company.”

The company struck deals in March to reduce its debt by about $1.5 billion and extend the dates of some maturities to preserve cash.

Tolley acknowledged some bright spots in the company on Aug. 9, pointing to revenue growth, but he also listed the headwinds the company faces, including a glut of office space and increased competition from other co-working companies.

To remain viable, WeWork said it would have to reduce the cost of its leases and “seek additional capital through bond or equity issuance or asset sales.”