Warren Buffett’s company says a billionaire family – including governor of Tennessee and Cleveland Browns owner – offered bribes to inflate earnings at a truck stop chain

Warren Buffett's Berkshire Hathaway says the billionaire Haslam family has tried to bribe at least 15 executives at one of his companies to inflate the value of their remaining stake in it.

A lawyer for the billionaire Haslam family on Thursday called bribery allegations by Pilot, the truck stop chain, a “wild invention.”

But a judge did not immediately decide whether those allegations will be resolved at a January trial that should help determine the multibillion-dollar price Berkshire Hathaway would have to pay the Haslams for the rest of the chain.

The Haslams' company and Buffett accuse each other of manipulating Pilot's earnings this year to influence the price Berkshire would have to pay for the Haslams' remaining 20 percent stake in the company if the family decides to sell.

The Haslam family — which also includes Cleveland Browns and Columbus Crew owner Jimmy Haslam and former Tennessee Governor Bill Haslam — accused Berkshire last month of understating Pilot's revenue this year by changing its accounting practices.

Warren Buffett's Berkshire Hathaway says the billionaire Haslam family has tried to bribe at least 15 executives at one of his companies to boost the value of their remaining stake in it.

Berkshire responded this week with its own lawsuit accusing Jimmy Haslam of trying to bribe key Pilot executives with payments several times their annual salaries to inflate the company's profits.

“We called Berkshire's allegations wild inventions in our opposition letter,” said attorney Anitha Reddy, who represents the Haslams.

“I don't think we could have been clearer that we dispute them. And if there is any doubt in the mind of Berkshire, we believe them to be false and intend to defeat them regardless of the schedule the court orders.”

The judge promised to decide by the end of the week whether Berkshire's lawsuit can be heard when a trial on Pilot's original lawsuit is scheduled for January.

Berkshire wants the court to prevent the Haslams from exercising their option to sell the rest of the company to Berkshire next year because, according to the court, there are so many doubts about the accuracy of Pilot's 2023 earnings.

Even if the judge agrees, the Haslams would still have the option to sell in future years under the agreement they signed in 2017.

Berkshire's attorney Craig Lavoie argued that it is critical to block a sale next year because it will be difficult to determine how much Pilot's earnings have been affected by the alleged bribes.

He said Berkshire believes at least 28 executives — many of whom are involved in buying and selling fuel for the nation's largest truck stop chain — received bribes.

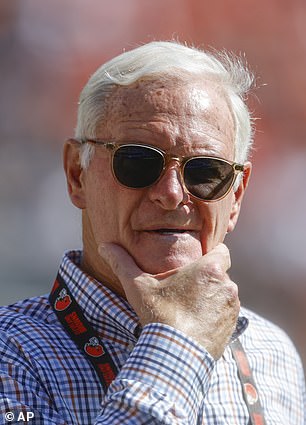

The Haslam family – including Cleveland Browns owner Jimmy Haslam (pictured left) and former Tennessee Governor Bill Haslam (pictured right) – last month accused Berkshire of understating Pilot's earnings this year by changing its accounting practices

A lawyer for the billionaire Haslam family on Thursday called bribery allegations by Pilot, the truck stop chain, a “wild invention”

Berkshire said in its lawsuit that it only learned a few weeks ago about the Haslams' attempts to bribe executives who worked for the family at the company that Jim Haslam — the father of Jimmy and Bill Haslam — founded before Berkshire became the majority shareholder became part of the company. the beginning of this year.

A senior executive who had been promised a bonus disclosed it to Pilot's current CEO, according to Berkshire.

Lavoie said it's difficult for Berkshire to figure out what short-term decisions these executives may have made because of the bonuses.

'Mr. Haslam's side promises have forced the company to investigate many of the key employees it relies on to run the business today,” Lavoie said.

When Berkshire bought its initial 38.6 percent stake in Pilot in 2017, it paid $2.758 billion.

This year it paid another $8.2 billion to give it control of 80 percent of the company, then installed a new CEO and chief financial officer.

Buffett said Berkshire shareholders this spring that he wished he could have bought the entire company at once because the price was better in 2017, but the Haslams didn't want to sell it all at the time.

Pilot's chain of more than 850 locations and approximately 30,000 employees in the United States and Canada has already created a meaningful impulse to Berkshire's revenue and profit this year.

Buffett told Berkshire shareholders this spring that he wished he could have bought the entire company at once because the price was better in 2017, but the Haslams wouldn't want to sell it all then.

Berkshire said in its lawsuit that it only learned a few weeks ago about the Haslams' attempts to bribe executives who worked for the family at the company that Jim Haslam — the father of Jimmy and Bill Haslam — founded before Berkshire became the majority shareholder became part of the company. the beginning of this year

The Haslams said Berkshire's decision this year to switch to something called “pushdown accounting” forced Pilot to take on higher depreciation expenses, resulting in lower net income.

The Haslams were voted out of this change at Pilot Board meetings.

In addition to Pilot, Berkshire owns an eclectic range of other companies, including Geico Insurance, BNSF Railway and several major utilities, along with a number of smaller manufacturing and retail companies.

It also includes a extensive share portfolio with major interests in Apple, Coca-Cola, American Express and Bank of America, among others.