Warren Buffett suddenly buys $563m of stock in three companies after hoarding cash all year

Warren Buffett has bought shares in three companies after hoarding cash for most of 2024.

The 94-year-old investment firm Berkshire Hathaway had a cash pile of $325 billion at the end of the third quarter of 2024.

But recently, Berkshire and Buffett picked up $563 million worth of stock in Occidental Petroleum, Sirius XM and VeriSign. The motley fool.

Berkshire had to disclose these purchases because it already owns more than a 10 percent stake in each company.

The company bought about $405 million worth of stock in domestic oil company Occidental Petroleum, about $113 million in broadcaster Sirius XM, and about $45 million in VeriSign, a provider of domain name registration services.

None of these stocks had performed well this year, despite the broader market rising nearly 26 percent, but Occidental Petroleum and VeriSign jumped on the news of the Berkshire purchase.

It comes after Wall Street watchers wondered whether Buffett thought the market was overvalued as he sold billions in shares of Apple and Bank of America and grew his cash reserve to the highest percentage since 1990.

Some thought he might be wary of a stock market crash, while others thought he could wait to make a big acquisition at the right time and at the right value.

Warren Buffett has bought shares in three companies after hoarding cash for most of 2024

The three stocks are classic value stocks that Buffett and Berkshire like to own, often with great success, The Motley Fool reported.

Buffett and his late business partner Charlie Munger have always been focused on holding stocks over a long period of time, rather than trying to time the market.

Occidental Petroleum has been struggling due to falling oil prices and a bleak outlook for oil in 2025.

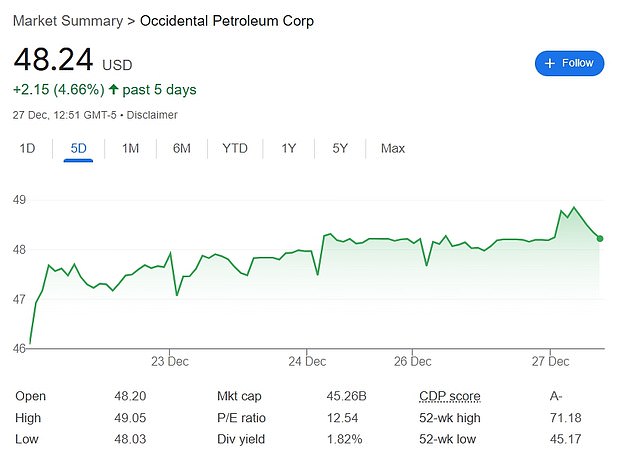

However, it’s clear the legendary investor thinks differently about the price of oil, at least in the long term, and shares are up nearly 5 percent in the past five days.

Sirius XM, which provides satellite radio and online radio services, has also struggled but is now investing heavily in its podcast platform.

VeriSign, meanwhile, also a global internet infrastructure provider, has underperformed due to regulatory concerns and questions about its market and future growth, the outlet said.

However, the stock has risen 3.89 percent in the past five days.

Shares of Occidental Petroleum are up nearly 5 percent in the past five days

Berkshire bought broadcaster Sirius XM, which hosts radio programs such as The Ramsey Show, for about $113 million

Warren Buffett stockpiled cash rather than dive into the record-breaking rally following Donald Trump’s presidential election victory

It’s possible that Buffett is starting to see buying opportunities, The Motley Fool reported, with all three stocks trading at fairly reasonable valuations.

After reaching an all-time high following Donald Trump’s victory in the presidential election last month, the stock market has been more volatile in recent weeks.

The Dow Jones Industrial Average recently fell for ten consecutive days, and the S&P 500 also fell more than 2 percent last week.

It comes after a veteran fund manager claimed America’s ‘addiction to government debt’ is a fatal flaw – and could lead to a stock market crash next year.

Ruchir Sharma, author and fund manager, said efforts to rein in debt – which now stands at a record $36 trillion – will ultimately weaken economic growth.

Sharma, chairman of Rockefeller International who worked at Morgan Stanley for 25 years, made the comments in a column for the Financial times.

He had previously said that the US financial market has become “the mother of all bubbles” that will soon burst.