Vodafone offloads its Italian branch for £6.8 billion

- Telecom giant agrees to sell Vodafone Italia to Swisscom

- Move is part of broader plans to reshape sprawling businesses

- It follows weeks of speculation about the fate of Italian unity

Refurbishment: Margherita Della Valle wants to simplify the telecom giant

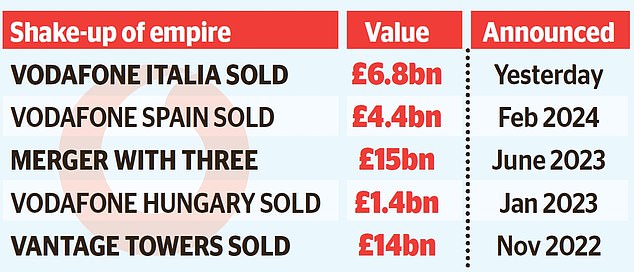

Vodafone is selling its Italian operations to a Swiss rival for £6.8 billion in the ‘third and final step’ of its European makeover.

The telecoms giant has agreed to sell Vodafone Italia to Swisscom as part of wider plans to reshape its sprawling business.

It follows weeks of speculation about the fate of the Italian unit, where Vodafone rejected a bid from French telecom operator Iliad in January.

Vodafone said yesterday that the deal with Swisscom, majority owned by the Swiss government, would allow the company to exit Italy, where it was “not possible” to earn sufficient returns.

Announcing the deal, the FTSE 100 company also said it would return up to £3.4bn to shareholders through buybacks and cut the dividend to 4.5p per share (3.8p) from next year. at 9 cents (7p) in 2024.

Vodafone shares rose 5.7 percent.

The sale of the Italian company is the third major step by CEO Margherita Della Valle, who wants to simplify the company’s activities under pressure from shareholders.

Since taking over in January last year, the Italian-born boss has dumped Vodafone’s Spanish operations in a £4.4bn deal with Zegona and overseen a planned £15bn mega-merger between Vodafone and Three UK, which owned by Hong Kong. conglomerate CK Hutchison.

Della Valle said: ‘I announce the third and final step in the reform of our European activities. Going forward, our businesses will operate in growing telecom markets – where we have strong positions – enabling us to achieve predictable, stronger growth in Europe.”

The planned buyback will consist of £1.7 billion from the sale of Vodafone Spain and up to £1.7 billion from the sale of its Italian business, which is subject to regulatory and other approvals, the company said.

Sophie Lund-Yates, chief analyst at Hargreaves Lansdown, said: ‘Vodafone’s Italian operations have struggled, so removing this weight should help the group refocus.’

She added that the announcement of a buyback would also be seen by shareholders as a “welcome sign for their patience during a difficult period.”

However, some analysts have warned that cutting the dividend would hurt investors in the long term. Russ Mold of AJ Bell said: ‘A lower dividend over the long term reduces Vodafone’s ongoing financial commitment to shareholders. This can help put capital allocation on a more sustainable footing, but it dilutes one of the main reasons why people hold the shares.”

And the company is still struggling with its weak German business, which remains its largest market. Karen Egan of research group Enders Analysis said: ‘The company highlights how well it is now positioned to grow without Italy and Spain, and with the prospect of a better position in Britain.

“Germany is more important than ever, and the jury is still out on that turnaround.”

Voda’s German unit posted sales of £2.5 billion in the three months to the end of December, up just 0.3 percent on the same period the year before.

And the planned merger with Three is far from guaranteed.

The partnership – which could create Britain’s largest telecoms operator – is under scrutiny by competition authorities, who have until next Friday to decide whether to launch a further investigation into the deal.