US jobs growth in the last year could be revised down by ONE MILLION – refueling concerns the economy is headed for a downturn

According to revised US employment figures released this week, as many as a million jobs could be lost.

Top bankers warn that job growth in the year to March was likely much lower than initially estimated.

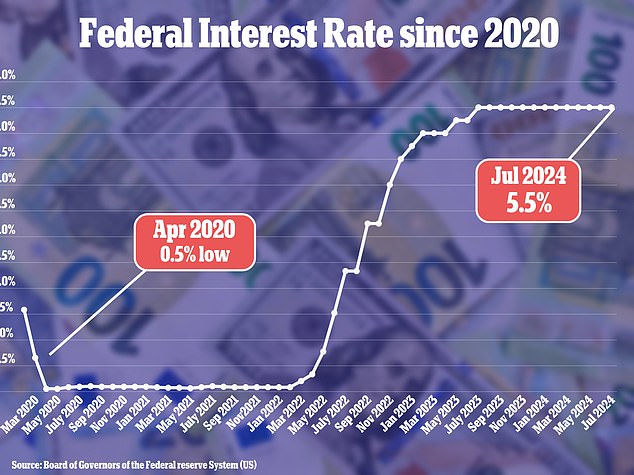

This could fuel concerns that the US economy is not as robust as it appears and that the Federal Reserve is lagging in its efforts to cut interest rates.

The government will publish the first revisions to job growth figures on Wednesday, with final figures expected early next year.

Goldman Sachs economists expect job growth this year to be at least 600,000 lower than current estimates, and could even be as low as a million.

A downward revision of more than 501,000 would be the largest in 15 years, Bloomberg reported, and would indicate that the labor market has been cooling for longer than originally thought.

Experts say revised US employment figures released this week could see as many as a million jobs lost

According to current figures from the Bureau of Labor Statistics, the US economy added 2.9 million jobs in the year through March 2024.

This is an average of 242,000 per month.

Once a year, the government revises the March figures based on a more accurate and detailed quarterly data source.

If the total revision rises to one million, the monthly job gain would be about 158,000, Bloomberg reported.

Wells Fargo economists also expect earnings to decline as a result of the revised numbers.

“A large negative revision would indicate that the strength of employment was already declining before April of last year,” Wells Fargo economists Sarah House and Aubrey Woessner wrote in a report last week.

They said this could lead to more concerns about the labour market situation given the ‘softening of other labour market data.’

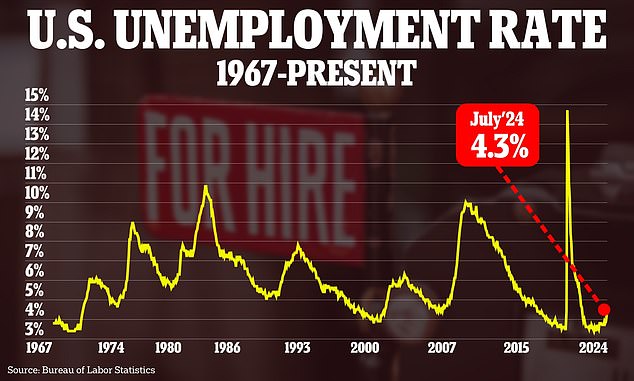

US job growth fell far short of expectations in July and the unemployment rate rose to its highest level in nearly three years.

This led to a sell-off in the market, amid fears of an impending recession.

Employers added 114,000 jobs last month, well below the Dow Jones estimate of 185,000.

The unemployment rate also rose slightly to 4.3 percent, the highest level since October 2021.

While the stock market has since recovered, a revision to the data showing a big drop could rekindle fears that the economy is heading for a recession.

“Markets, which have recently been hit by a growth scare that has led to concerns the Fed is lagging behind, will be closely watching Wednesday’s benchmark revision release to see if the market’s initial reaction was indeed correct,” Quincy Krosby, chief global strategist at LPL Financial, told Bloomberg.

Analysts Krishna Guha and Marco Casiraghi of Evercore ISI said in a note Monday that while the Fed expected the revision, it “will underscore that the picture on employment strength is not as strong as it actually appeared.”

Jerome Powell will take the revised numbers into account when he speaks Friday at the Federal Reserve’s annual symposium in Jackson Hole, Wyoming

Unemployment rose to 4.3 percent in July, the highest level in nearly three years

The Federal Reserve kept interest rates between 5.25 and 5.5 percent at its last meeting

Other economists predict the revision will be more likely on the small side of the estimate range.

According to Bloomberg, analysts at JPMorgan Chase predict a smaller decline of 360,000 jobs.

Some argue that even if monthly job growth falls to 158,000, that is still a healthy pace.

Fed Chairman Jerome Powell will include the revised figures in his speech at the annual symposium in Jackson Hole, Wyoming, on Friday.

At its last meeting, the central bank indicated it was focusing more on the labor aspect of its dual mandate, which also includes bringing annual inflation down to the 2 percent target.

Policymakers are expected to begin cutting interest rates in September, after keeping benchmark borrowing costs at a 23-year high since July 2023.