US home insurance bills to hit $2,500-a-year in 2024 due to climate change but as much as $12,000 in worst-hit areas – how much will it be in YOUR state?

U.S. home insurance rates will hit a record high this year, according to dire new forecasts.

According to the insurance comparison platform, the typical annual premium will rise to $2,522 by the end of 2024 To ensure – an increase of 6 percent compared to a year earlier.

This expected increase for 2024 follows a 20 percent increase in the past two years. This is largely due to escalating natural disasters, insurers pulling out of certain areas – reducing competition – and higher home repair costs.

Rising costs are making home insurance increasingly unaffordable for many Americans, resulting in many choosing to forego coverage entirely.

But some states are much worse off than others. In states prone to natural disasters, average annual premiums are forecast to rise to as much as $12,000 this year. Scroll down for the interactive map below – hover your cursor or finger over your state.

According to predictions from insurance comparison platform Insurify, the typical annual premium will rise to $2,522 by the end of 2024

Florida homeowners are already paying the highest premiums for coverage in the U.S., averaging $10,996 per year by 2023.

But according to Insurify’s projections, that will rise another 7 percent this year, pushing the typical premium in the state to a whopping $11,759.

Meanwhile, those living in Louisiana currently face the second-highest home insurance rates in the country – $6,354 per year – nearly three times the national average.

Insurify predicts the state will see the largest premium increase in 2024, with a 23 percent increase to an average of $7,809.

Severe weather risks have long affected interest rates in Louisiana, but the effects of climate change are now also overtaking states with historically lower-than-average interest rates, such as Maine.

Rising sea levels and coastal storms in the state mean Insurify predicts premiums will rise 19 percent in the state this year.

Climate change is increasing the severity and frequency of extreme weather events across the country.

According to the National Oceanic and Atmospheric Administration (NOAA), approximately thirteen natural disasters occurred per year in the 2010s.

Last year, the US saw a record 28 climate disasters, each causing at least $1 billion in damage. Bloomberg reported.

Jewell Baggett, 51, sits on a bathtub amid the wreckage of her home in Horseshoe Beach, Florida, which Hurricane Idalia reduced to rubble in August 2023

Florida’s home insurance crisis has especially intensified in recent years as costly natural disasters have made it difficult for insurers to maintain profitability in the state.

More than a dozen home insurance companies have declared bankruptcy since 2019, major insurers have said they will not renew thousands of policies, and Farmers Insurance withdrew from the state entirely last year.

Hurricane Ian caused $109.5 billion in damage in 2022. This was the third costliest disaster to hit the US and the most destructive in Florida’s history, according to NOAA.

“Insurers rely on reinsurance coverage to cede some of the exposure to losses,” said Betsy Stella, vice president of carrier management and operations at Insurify

When insurers cannot cover the costs of natural disasters, reinsurance steps in.

Reinsurance, essentially insurance for insurers, is a major factor in Florida’s home insurance crisis, according to Insurify.

“Insurers rely on reinsurance coverage to cede some of the exposure to losses,” says Betsy Stella, vice president of carrier management and operations at Insurify.

“Reinsurance coverage is difficult to obtain in Florida and reinsurance rates have skyrocketed.

“Reinsurers are subject to the same factors that impact underlying coverages: increasing number and severity of natural disasters, inflationary pressures, and labor and materials shortages.”

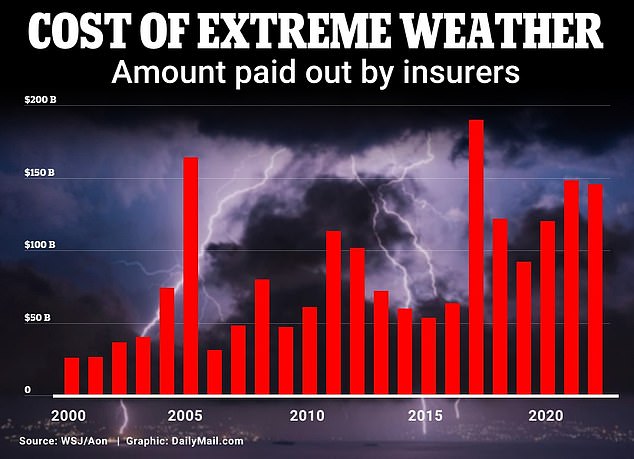

The amount paid out by insurance companies to cover damage caused by extreme weather, such as wildfires and hurricanes, has increased steadily since 2000

A view shows a house burning as the Fairview Fire near Hemet, California, US, September 5, 2022. Wildfires have driven up costs for insurers – who have increased premiums

Florida isn’t the only state where insurers are dropping coverage for the riskiest properties.

State Farm announced last month that it would no longer provide coverage for 72,000 homes across California due to the increased risk of natural disasters and the effects of inflation.

To fill this gap, state insurers are increasingly becoming the only choice as a last resort.

In Florida, for example, the state-owned Citizens Property Insurance Corporation is now the largest in the state.

“It is possible that the highest risk areas could become uninsurable,” Stella added. ‘But if there is demand, a supplier usually appears. The question will be: at what price?’