US consumer spending FELL 0.2% in December as prices rose 5% from a year earlier

>

US consumer spending FELL 0.2% in December as prices rose 5% from a year earlier, but down from 5.5% in November

- A new Commerce Department report shows spending fell in December

- Friday’s report includes data for retail, travel and healthcare spending.

- This follows a report on Thursday that showed strong growth in the economy.

The Commerce Department released a new report on Friday detailing that during the holiday season, spending fell 0.2 percent while prices rose 5 percent compared to December 2021.

However, the price increase was less than the 5.5 percent increase in November. Friday’s report marks a third straight decline in month-over-month prices.

Consumer spending fell 0.2 percent from November to December and was revised down to show a 0.1 percent drop from October to November.

Spending on health services and air transport increased slightly in the last month of the year.

The report contains a measure of inflation that is closely watched by the Federal Reserve, which has aggressively tried to rein in inflation by raising its key interest rate seven times in the past year.

The move showed that inflation has cooled to levels not seen since October 2021.

A new Commerce Department report shows spending fell in December

Holiday sales were sluggish in 2022 for most retailers and overall spending figures for the past two months were the weakest in two years.

Friday’s report showed that personal income in dollars increased in December thanks to increases in private sector wages.

Spending fell on gasoline, cars and auto parts, which is interesting as energy prices fell 5.1 percent.

“Core” prices, which exclude volatile food and energy costs, rose 0.3% from November to December and 4.4% from a year earlier.

The year-on-year figure was down from 4.7 percent in November, though still well above the Fed’s 2 percent target.

The weak carry-over to 2023 increases the risks of a recession for the second half of the year.

The Fed has been steadily raising interest rates on loans across the economy, trying to rein in the spending, growth and rising prices that have plagued the nation for nearly two years.

The Fed raised its benchmark rate seven times last year, and will do so again next week.

Friday’s report showed prices fell for the third month in a row for consumers.

In addition to retail spending, Friday’s report also factored in travel spending.

The central bank’s key rate, which affects many commercial and consumer loans, is now in a range of 4.25 percent to 4.5 percent, up from almost zero last March.

Although inflation has been slowing, most economists say they believe the Fed’s tough medicine will push the economy into recession sometime this year.

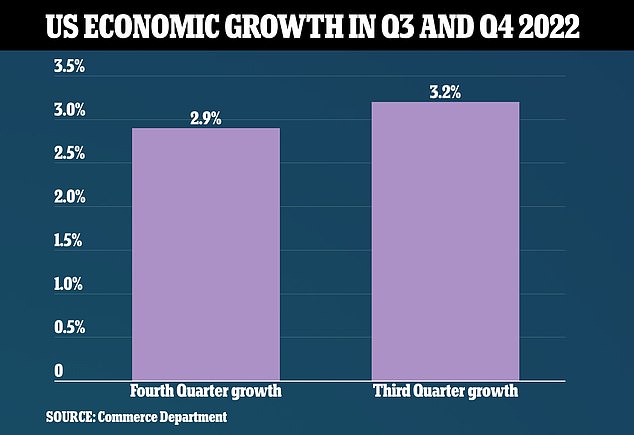

Yesterday, a separate report from the Department of Commerce detailed that the US economy maintained a strong pace of growth in the fourth quarter as consumers increased spending on goods, but the momentum appears to have slowed considerably towards the end of the year. , with higher interest rates eroding demand. .

Gross domestic product rose at an annualized rate of 2.9 percent last quarter, the Commerce Department said Thursday in its forward estimate of fourth-quarter GDP growth. The economy grew at a rate of 3.2 percent in the third quarter. Economists polled by Reuters had forecast GDP would rise at a rate of 2.6 percent.

That could be the last quarter of strong growth before the lag effects of the Fed’s fastest tightening cycle since the 1980s kick in. Most economists expect a recession in the second half. of the year, albeit slight compared to previous downturns.

Retail sales have weakened considerably in the past two months and manufacturing appears to have joined the housing market in recession. While the job market remains strong, business confidence continues to sour, which could eventually hurt hiring.

The mixed data comes as markets try to account for the political chaos ahead amid the upcoming showdown over raising the nation’s debt ceiling, with the Treasury already taking ‘extraordinary measures’ to keep the nation out of default. pending congressional action.