Urgent warning is issued to every Australian with a mortgage: How monthly repayments have soared by 59 per cent – and it could be about to get even worse

Australian borrowers are now paying 59 per cent more on their mortgage than three years ago – with financial markets now expecting even more interest rate rises in 2024.

In April 2021, the Commonwealth Bank, Australia’s largest housing provider, offered a variable mortgage rate of 2.69 percent.

But three years later, variable-rate borrowers are now paying 6.69 percent.

For a borrower with an average mortgage of €600,000, monthly repayments have increased from €2,431 to €3,868, or €17,244 per year.

Someone with an $800,000 mortgage – who would buy a $1 million home with a 20 percent down payment – would see their monthly repayments rise from $3,241 to $5,157.

That would amount to an increase in annual mortgage costs of $22,992.

And despite interest rate rises, house prices in Australia’s capitals have soared as immigration hit record highs – creating another hurdle for those struggling to buy a home.

The average house price in Sydney has risen by 10.7 per cent in the past year, but by 15.9 per cent in Brisbane and 20 per cent in Perth.

Australian borrowers are now paying 59 per cent more on their mortgage than three years ago – with financial markets now expecting even more interest rate rises in 2024

AMP chief economist Shane Oliver said Australian borrowers were far more likely to have variable rates, leading to much larger increases in repayments compared to the rest of the world.

AMP Capital chief economist Shane Oliver said with more than 98 percent of Australian borrowers on variable interest rates, mortgage costs were rising much more dramatically than in the rest of the developed world, where fixed rates are more common.

The 3.5 percentage point increase in Australian variable mortgage rates, even including discounts on bank loans, is more than double the levels in Britain and Germany, and seven times more severe than the rise in US mortgage costs.

“Australian homeowners with a mortgage are paying more than three per cent more on average,” he told Daily Mail Australia.

“In Canada it’s only about 2.5 percent more, in Germany it’s about 1.25 percent, in Britain it’s 1.5 percent more.”

By comparison, average American borrowers paying off the same house would have seen their borrowing costs increase by only 0.5 percentage points, because almost all of them have a 30-year fixed rate in a country where a government company finances mortgages.

“Fannie Mae and Freddie Mac, we don’t have them, but we don’t have those long-term contracts either,” Dr. Oliver said.

“Whether you’ve transacted or not, you’re paying the higher rate in Australia, even those who were on a fixed rate two years ago, most of them have seen their rate roll to a much higher level.”

Three years ago, in April 2021, Sydney was weeks away from a prolonged lockdown, when the Reserve Bank of Australia’s cash rate was still at a record low 0.1 per cent.

With Sydney and Melbourne in lockdown for much of 2021, the Commonwealth Bank cut its variable rate mortgages to 2.29 per cent in October that year.

This is despite inflation rising to 3.8 per cent in the June quarter of 2021, at the time the highest annual benchmark since 2008, and further above the RBA’s target of 2 to 3 per cent.

Three years later, economists are now talking about the prospect of more rate hikes, even though borrowers have endured 13 rate hikes between May 2022 and November 2023.

The RBA cash rate rose to a 12-year high of 4.35 per cent after inflation hit a 32-year high of 7.8 per cent at the end of 2022.

Headline inflation in the March quarter fell to 3.6 percent, down from 4.1 percent in the December quarter.

But the underlying inflation measures – which ignore large price rises and falls – were worrying.

In April 2021, the Commonwealth Bank, Australia’s largest housing provider, offered a variable mortgage rate of 2.69 percent (pictured is Michelle Bullock with her predecessor at Reserve Bank Governor Philip Lowe)

For a borrower with an average mortgage of $600,000, monthly repayments have increased from $2,431 to $3,868 – or by $17,244 per year (pictured is a house in Clontarf near Redcliffe selling for $750,000)

The weighted median, based on prices in the middle of the range, showed an increase of 4.4 percent.

The truncated average measure, the RBA’s preferred barometer that rules out extreme price movements for an average increase, showed underlying inflation rose 4 percent.

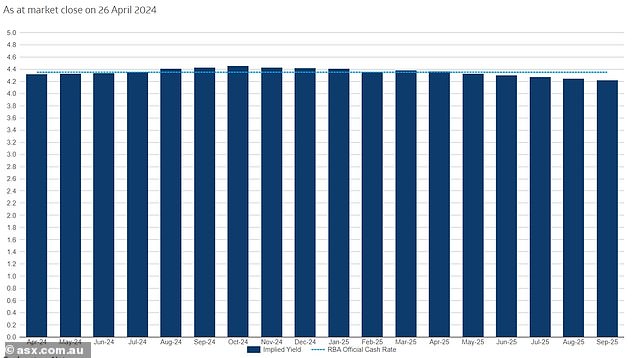

Judo Bank is now predicting three more rate hikes in 2024, but its chief economic advisor Warren Hogan is certainly not alone as the bond and futures markets are now also betting on more rate hikes.

Predicted increases in August, September and November would take the RBA cash rate to 5.1 percent – a level last seen in 2008 during the global financial crisis.

Until Wednesday, the Commonwealth Bank was forecasting three rate cuts by Christmas, but ANZ has since ruled out any rate cuts in 2024.

AMP is now predicting a rate cut in December, after previously expecting a rate cut in June.

“I had thought the prospect of another rate hike was very low – about a week ago, maybe around 10 percent, but now you’d have to say it’s around 20 or 25 percent,” Dr Oliver said.

‘It appears that interest rate cuts will be postponed.

“Many may have been looking for interest rate cuts sometime in the next six months, but that relief may not come until the end of the year or early next year.”

Financial markets are volatile and until recently the 30-day interbank futures market predicted three rate cuts in 2024.

But if interest rates were to rise three more times, the average borrower with a €600,000 mortgage would see their monthly repayments rise by another €303 to €4,171.

The borrower with an $800,000 mortgage would see his payments increase by another $404 to $5,561.

In two and a half years, borrowers would have endured 16 rate hikes, contributing to the most aggressive rate hikes since 1989.

Mortgage rates have not risen at such an aggressive pace since they rose to 18.5 per cent in November 1989 – up from 10.63 per cent in April 1988 in the era before the RBA had a target rate and houses were much cheaper compared to incomes.

But in Sydney’s western suburbs, in a place like Blacktown, the increase would be even greater

Judo Bank is now predicting three more rate hikes in 2024. Its chief economic advisor Warren Hogan is hardly alone as the bond and futures markets are now also betting on more rate hikes

In December the contrast with the end of 2021 would be even greater than now.

A variable mortgage interest rate of 7.44 percent, compared to 2.29 percent three years earlier, would mean an increase in monthly repayments of 80.9 percent.

For a $600,000 mortgage, that would mean repayments would rise to $4,171, up from $2,306 three years earlier, representing a $22,380 increase in annual maintenance costs.

For an $800,000 mortgage, that would mean payments would increase from $2,486 to $5,561, which amounts to a $29,832 increase in annual loan costs.

A net 548,800 migrants moved to Australia in the year to September, but only 168,690 homes were built last year, leading to a surge in housing demand.

“There is a huge shortage in the supply of new homes, which has led to a very tight rental market, which has also led to a very tight homebuyer market,” Dr Oliver said.

“That has drowned out the negative impact on home prices of higher interest rates.”