UK consumer confidence drops to near-historic lows

>

Consumer confidence in the UK is falling to near historic lows on double-digit inflation and rising energy prices

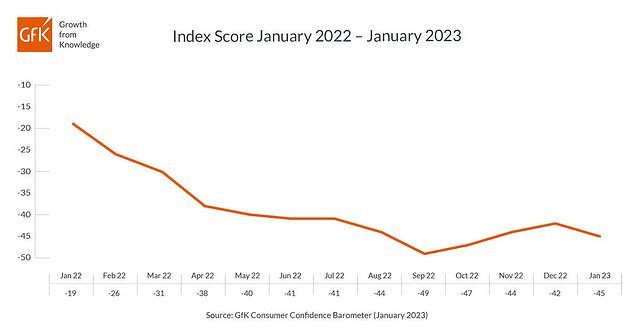

- GfK’s monthly Consumer Confidence Index fell 4 points to -45 in January

- This was just four points above September’s record low of -49

- Consumer incomes have been hit by record energy bills and rising food prices

Consumer confidence has fallen close to its all-time low as steep inflation and skyrocketing utility bills continued to fuel rampant pessimism in the UK.

GfK’s monthly Consumer Confidence Index, a long-running measure of how Brits view their personal finances and the overall economy, dropped to -45 in Januarya drop of three points from the previous month.

This was just four points above the record low of -49 recorded in September just before a controversial ‘mini budget’ that caused widespread panic in the markets, but 19 points below the same month last year.

Downturn: Figures from the ONS showed UK retail sales fell again last month as shoppers become increasingly aware of buying festive items

Confidence in the general economy has remained under serious pressure over the past 12 months, contracting another 5 points from December to -71, while the outlook for individual finances fell to -31 over the same period.

Meanwhile, the Big Buys Index, a measure of confidence in acquiring big items, shrank six points to -40, representing a 30-point slump in January 2022.

Joe Staton, GfK’s director of customer strategy, commented: ‘Consumers have a New Year’s hangover – but of the economic type – with a high level of pessimism about the state of the economy in general. And unlike a conventional hangover, it won’t go away anytime soon.”

Figures released by the Office for National Statistics on Friday showed retail sales in the UK fell again last month as price increases made shoppers increasingly aware of buying festive items.

In December, food prices rose at their fastest rate since 1977, with the cost of staples such as milk, cheese and eggs rising the most.

Consumer incomes are under further pressure from record energy bills, which have skyrocketed in response to Russia’s full-scale invasion of Ukraine and the easing of Covid-19 restrictions.

Pessimism: GfK’s monthly Consumer Confidence Index, a long-running measure of how Britons view their personal finances and the overall economy, fell to -45 in January

As part of the UK Government’s Energy Price Guarantee, a household consuming a ‘typical’ amount of gas and electricity is taxed at a maximum of £2,500 annually. However, from April this amount will grow by a further £500 to £3,000.

Staton added, “With inflation continuing to eat up wage increases and the prospect of shocking utility bills coming in soon, the outlook for consumer confidence this year doesn’t look good.

“One thing we know for sure: 2023 promises to be a bumpy ride.”

The Bank of England has made nine consecutive rate hikes but is likely to make another rate hike next month as UK inflation remains at 10.5 percent, well above the central bank’s target rate of 2 percent.

The governor, Andrew Bailey, told Media Wales yesterday that inflation was likely to come ‘fall pretty fast’ in 2023 due to falling energy prices.

His comments were echoed by consultancy group Cornwall Insight, which now estimates that annual energy bills will fall about £2,200 from Julyabout £300 lower than previously predicted.