Typical pension pot worth £190k ‘could be drained by age 81’

Pension shortfall: Many people who strive for a ‘moderate’ income could go broke

Many people who strive for decent lifestyles in old age could see their retirements dry up unless they save more, lower income expectations or invest successfully, a new retirement survey shows.

Workers who invest an average pension fund of £190,000 – the typical amount people aged 65 to 74 have saved according to official data – could empty their pot by the age of 81.

This is based on a gross investment return of 8 percent per annum, excluding an annual fee of 1.8 percent.

But your fund could be gone by age 75 if you earn an average return of 2 percent before fees, according to a withdrawal calculator from financial advisor Money Minder.

A gross investment return of 12.2 percent per year would be necessary to maintain the starting value of your pension fund, it appears.

Investing your retirement after retirement involves taking financial market risks and trying to estimate how long you will live.

The Money Minder survey aims to identify the challenge that people retiring in their mid-60s face in generating a modest annual income in old age, based on an industry standard measure.

This says individual incomes of £12,800, £23,300 and £37,300 per annum are required for a basic life and a decent and comfortable lifestyle in retirement, respectively.

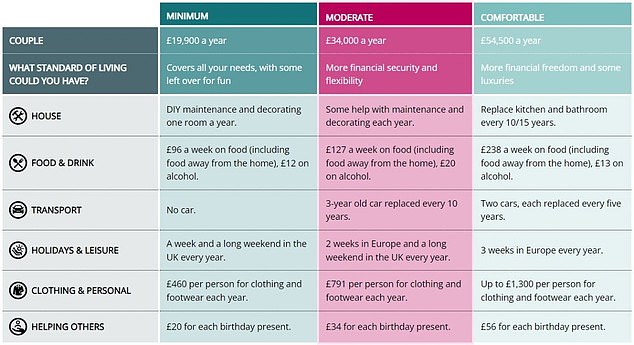

For a couple, the figures are £19,900, £34,000 and £54,000.

That’s based on several baskets of goods and services such as food and drink, transportation, vacations, clothing, and social outings, compiled in the Pensions and Lifetime Savings Association’s annual Retirement Living Standards report.

However, rent or mortgage costs, social security charges and income tax do not count in the PLSA measure.

Current life expectancy for 65-year-olds in the UK averages 85 years – or 18.5 years for men and 21 years for women.

How long will YOUR pension pot last?

Money Minder looks at what it takes to make an annual income of £23,300, if you qualify for the full state pension which is currently worth £10,600 a year but need to top up the £12,700 balance with private savings.

It assumes people have that saved £190,000, based on what the Office of National Statistics says 65 to 74 year olds typically have into their personal pension pot, and that they withdraw 25 per cent tax-free money from the start, leaving a residual fund of £142,500.

It also based calculations on a gross taxable income of £14,846, taking into account an income tax rate of 20 per cent and a personal tax deduction of £12,570. The full AOW amount takes up about £10,600 of the personal allowance. See below for what the company is finishing calculator found it.

Source: Money Minder’s withdrawal calculator

Meanwhile, annuity rates have improved recently, but Money Minder calculates you’d need a pot of £367,848 to buy an income of £12,700 a year, on top of a full state pension, and to live a ‘moderate’ lifestyle reach.

Ray Black, CEO of Money Minder, says he wants to highlight the sobering reality of life without enough retirement savings.

‘Although everyone will have access to the AOW, you cannot blindly trust that you will have enough money to maintain the same standard of living as during your work.

A retirement withdrawal option allows you to access your retirement funds while keeping them invested — possibly with the opportunity to earn more over time.

“For people who are content with keeping their pension fund fully invested, it has the potential to grow substantially in real terms.”

Black added: “The bright side of this story is that it highlights that having a retirement plan will help make retirement more comfortable by giving people extra income to spend, especially in the early years of retirement, when life likely will be. more expensive with traveling and making memories with family while having the energy and motivation to do so. ‘

Need for retirement income for single people (Source PLSA)

Retirement Income Needs for Couples (Source PLSA)

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and use it for free. We do not write articles to promote products. We do not allow any commercial relationship to compromise our editorial independence.