Two months left for first-time home buyers to potentially save up to £15,000 in stamp duty, warns Zoopla

- More first time buyers to pay SDLT as nil rate threshold drops to £300,000

- Return to old thresholds will hit buyers hardest in the south for the first time

First-time homebuyers in England are being warned that they only have around two months to find a home, or their stamp duty payments could skyrocket.

Thousands of first-time home buyers have benefited from the temporary reduction in transfer tax rates under the 2022 mini-budget.

But from 1 April 2025, SDLT rates will revert to their old thresholds, assuming no further changes are announced in the Autumn Budget.

A first time buyer purchasing a property worth up to £425,000 currently pays no transfer tax.

Tax share: Currently a first home buyer pays no transfer tax on properties up to £425,000, but this will drop to £300,000 from April 2025

However, from April 1, there will be a tax of £6,205 for the same purchase as stamp duty returns to its previous level.

According to Zoopla, first-time buyers have around two months to find a home and get their offer accepted, by which time it may be too late to avoid the SDLT changes.

According to the real estate portal, it takes an average of 25 weeks for a home to be sold, from the market place to delivery.

How is the stamp duty changing?

Currently, first time home buyers pay no transfer tax if they purchase a home worth up to £425,000.

If their house is more expensive, they pay tax on the part above £425,000.

However, from April 2025 this limit will drop back to the old threshold of £300,000.

First-time buyers buying homes priced between £500,000 and £625,000 will also no longer be eligible for mortgage interest relief for first-time buyers.

According to Zoopla, the changes mean that a third of home buyers in England will pay more in transfer tax from April next year than they do now.

Who is hit hardest?

First-time home buyers can save up to £15,000 in transfer tax by purchasing a home before April 1, according to Zoopla.

In reality, only a minority of first-time home buyers will come close to such savings.

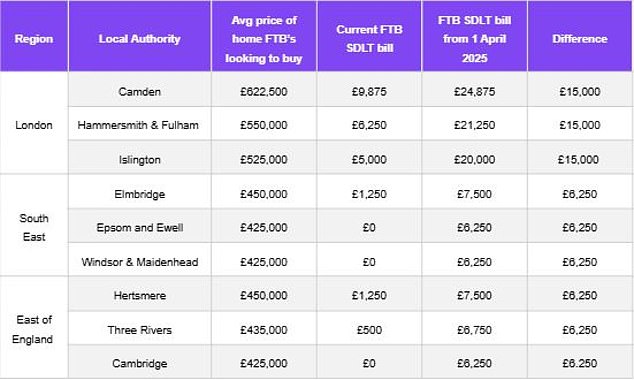

According to Zoopla’s analysis, people moving to the South of England, 81% of total SDLT income, are most affected by stamp duty.

From April 1, the average buyer in London will pay £5,600 in stamp duty on their first home.

People in the South East of England pay an average of £1,390, while in the East of England they pay an average of £1,040. Nowadays that is nothing at all.

However, in some parts of London, first-time buyers have to pay an extra £15,000 in transfer tax. No change has been announced in the Budget.

For example, in the London boroughs of Camden, Hammersmith and Fulham, and Islington (where house prices average over £500,000), SDLT will rise by an average of £15,000.

Local authorities worst hit in South of England: More than four in five total SDLT income comes from South of England, Zoopla says

Due to lower house prices, the vast majority of buyers in Northern England and the East and West Midlands will not be affected by the changes in April next year.

According to Zoopla, around 95 per cent of first-time home buyers in these areas are looking for a home priced under £300,000 and so won’t be affected.

Izabella Lubowiecka, senior property researcher at Zoopla, said: ‘Thousands of first-time buyers have taken advantage of the transfer tax exemption introduced in 2022.

‘With just two months to go, people looking to buy their first home this autumn need to take action to avoid paying more in transfer tax. This is particularly true if they are buying a home in the South of England. First-time buyers in this area are likely to see a significant increase in SDLT when the changes come into effect next April.

‘Anyone who wants to buy a house after April 1 must ensure that he or she includes the additional transfer tax in his or her planning and takes it into account in his or her total budget.’