Trump’s net worth plummets by staggering $1.9 billion as DJT media stock suddenly tanks

Donald Trump’s net worth has fallen by nearly $2 billion as his publicly traded media company has floundered in the stock market over the past two days.

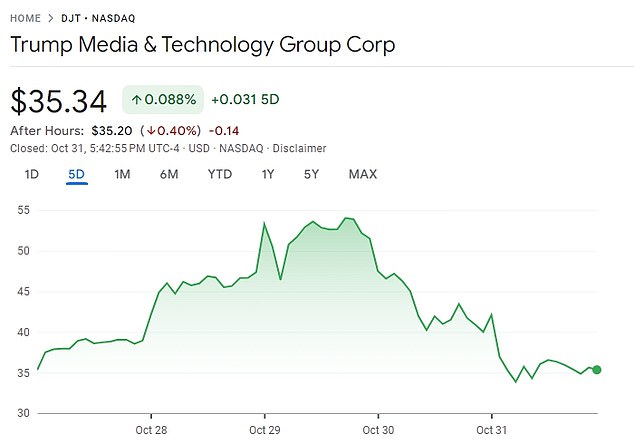

Trump Media & Technology Group, which owns Truth Social and trades under ticker symbol DJT, fell 11.7 percent to $35.34 on Thursday.

And that’s on top of the 22 percent decline that DJT shares saw on Wednesday.

The stock, which had previously surged more than 24 percent in the days following Trump’s raucous rally at Madison Square Garden on Sunday, essentially traded away all of its gains and more.

If The New York Times has reported that a decline in this often volatile stock will hurt its 600,000 shareholders, many of whom are regular people who support Trump’s candidacy and use Truth Social.

But it’s Trump himself who routinely experiences the biggest swings in his wealth, as he owns a whopping 115 million shares of Trump Media.

Former President Donald Trump looks on at a rally he held Thursday at the Albuquerque International Sunport in New Mexico

The stock, which rose more than 24 percent in the days after Trump’s raucous rally at Madison Square Garden on Sunday, essentially traded away all its gains and more.

At DJT’s intraday peak of $54.68 on Tuesday, the former president’s stake was worth nearly $6.3 billion.

After the crazy two-day sell-off, that dropped to just over $4 billion.

It’s not entirely clear what caused this, but DJT has attracted a lot of short sellers – in other words, those who believe the stock will fall.

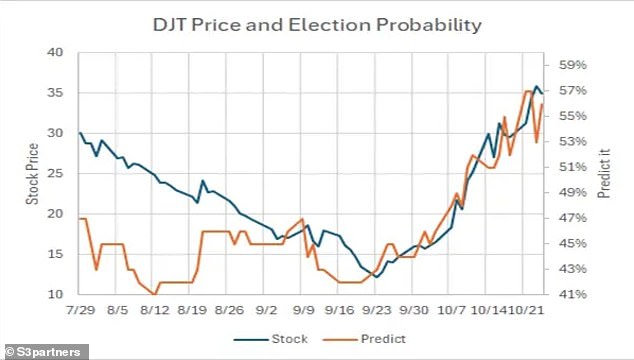

According to research group S3 Partners, part of what fueled the stock’s 200 percent growth through most of October is the fact that short sellers had to buy more shares to cover their losing bets.

S3 Partners also pointed out that DJT’s stock price somewhat reflects the trajectory of Trump’s chances of becoming president in the gambling markets.

Since Trump owns nearly 60 percent of the company, selling even a small portion of his stake would devastate the stock price and, more importantly, the portfolios of his most ardent followers.

So when a provision banning him from selling his shares expired on September 19, he tried to reassure his fans by promising he wouldn’t do so.

‘A lot of people think about the reason [DJT is] The problem is a lot of people think I’m going to sell, and if I sell, it won’t be the same,” Trump said days before his lockdown was set to end. “But I have absolutely no intention of selling.”

This chart from S3 Partners shows how DJT’s stock price compares to Trump’s odds of winning the election

Trump Media was founded weeks after he left the White House in January 2021, but waited more than three years before going public on the NASDAQ.

The stock often closely follows the positive and negative outcomes of Trump’s business and political efforts.

For example, it dropped 9 percent immediately after he was found guilty in his hush money trial.

The stock plunged 21 percent in one trading day in April after financial filings showed the company lost $58 million in 2023.

Trump only invested a few million dollars when he founded the company, meaning he has done extremely well for himself anyway.

A Trump supporter named Greg Bowden, 66, who owns shares of Trump Media, told The New York Times that Trump has “no reason to sell.”

Trump’s recent financial setback comes as millions of Americans turn out to the polls ahead of Election Day to return him to the Oval Office or elect his opponent, Vice President Kamala Harris, to the top job.

Bowden expressed this view in early September, when DJT stock was trading much lower than it is today.

On September 23, four days after Trump was technically allowed to sell DJT, the price reached $12.15.

At that point, Trump’s stake would have been worth nearly $1.4 billion.

Trump’s recent financial setback comes as millions of Americans turn out to the polls before Election Day to return him to the Oval Office or elect his opponent, Vice President Kamala Harris, to the top job.

The latest DailyMail.com/JL Partners national poll before Election Day showed Trump overtaking Harris by three percentage points.

The poll of 1,000 likely voters, which has a margin of error of plus or minus 3.1 percent, shows Trump trending upward, with support at 49 percent to Harris’ 46 percent.