Treasury Secretary Janet Yellen gives unbelievable response when asked if she goes grocery shopping and if she has felt ‘sticker shock’

Treasury Secretary Janet Yellen surprised an interviewer when she was asked whether she herself had felt a ‘sticker shock’ in the supermarket as a result of inflation.

A growing economy could inspire confidence in Biden’s leadership ahead of the election, but the issue of persistent inflation could ruin that.

Grocery prices have risen by double digits under Biden as Americans are routinely shocked by the cost of a normal trip to the store.

Yellen – which is worth approximately $20 million – says she goes to the supermarket ‘every week’ and is not shocked by the prices.

“It’s sticker shock, isn’t it? If you look at shipping costs, they have gone down. Global food commodity prices have also fallen, but food prices still remain high,” said Jennifer Schonberger.

Treasury Secretary Janet Yellen surprised an interviewer when she was asked if she herself had felt ‘sticker shock’ at the supermarket as a result of inflation

Without even letting her finish the question, Yellen replied bluntly, “No.”

“I think this is largely a reflection of the cost increases, including labor cost increases that supermarkets have experienced, although there may be some increase in margins,” Yellen added.

Yellen added that she expects inflation to decline, saying it will “return to the Fed’s two percent target” early next year.

The Biden administration has announced new steps to expand access to affordable housing, as still-high prices for groceries and other necessities and high interest rates have dramatically driven up the cost of living in the years since the pandemic.

Yellen promoted the new investments during a visit to Minneapolis on Monday.

The investments include providing $100 million through a new support fund affordable housing financing over the next three years, strengthening the financing of affordable housing and other measures by the Federal Finance Bank.

She blamed the continued slow decline in inflation on housing costs, rather than government policies.

The issue of inflation and the economy consistently remains one of the top issues for voters heading into the 2024 elections.

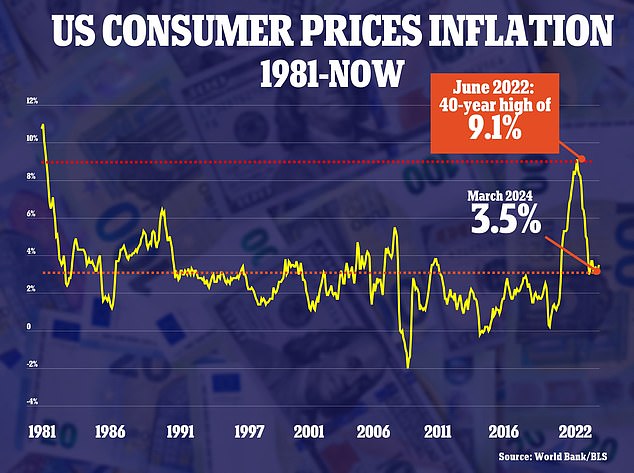

Inflation rose to 3.5 percent in March as prices were pushed up by high housing and gas costs

The annual inflation rate fell slightly to 3.3 percent in May. That is less than the month before.

This is down from a 40-year high of 9.1 percent in June 2022, but still above the Federal Reserve’s 2 percent target.

Trump constantly talks about inflation during his presidential campaign.

Biden claimed in an interview with CNN in May that the polls are wrong and that Americans struggling with inflation have more money in their pockets, saying, “They have the money to spend.”

He did admit that inflation, one of the biggest factors that dented Biden’s popularity in the first half of his term, was real.

“It’s real, but the fact is that if you look at what people have, they have money to spend,” he claimed.

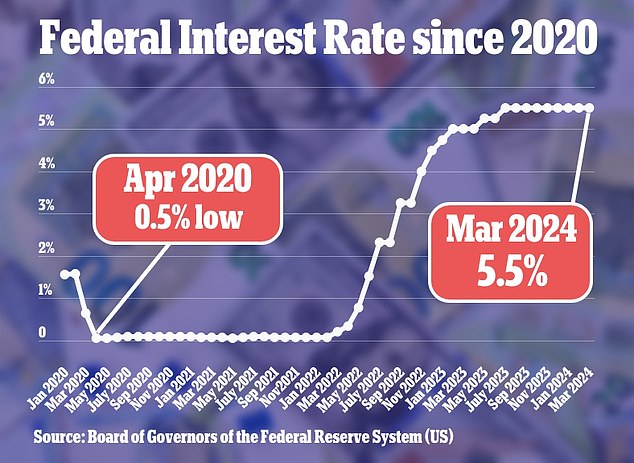

Investors had expected about four interest rate cuts earlier this year. However, at its last meeting in March, the Fed opted to keep interest rates at current levels

He blamed “greedy companies” for the lack of consumer confidence.

‘It makes them angry and it makes me angry that you have to spend more. For example, the whole idea of this idea that you have… shrinkflation… It’s like 20% less for the same price, that’s corporate greed. It is corporate greed and we have to deal with it.”

Many on social media were outraged by Biden’s comments as Americans continue to struggle.

Since prices spiked in 2022, the Biden administration has defended the economy.

The president is now eager to turn attention to former President Trump’s actual economic proposals, which are expected to be a major focus of the presidential debate later this week.

Trump’s main proposals include imposing a 10 percent tariff on all imports, a 60 percent tariff on Chinese imports, cutting corporate taxes and eliminating taxes on tips.

Biden, meanwhile, plans to raise taxes on corporations. He has also kept his promise not to increase levies on households earning less than $400,000, as families continue to feel the pressure of rising prices.

However, historical trends regarding the overall economy could prove to be a winner for Biden against Donald Trump in November.

Historically, the state of the U.S. economy leading up to elections has been highly correlated with how the country votes.

Investors often look for patterns in how markets have behaved in the past to predict what might happen in the future.

Inflation is eroding the purchasing power of most Americans, which potentially bodes well for Donald Trump. In the photo he leaves the White House with Melania in January 2021

An analysis of the returns of the S&P 500 over the past ninety years shows that in election years in which the incumbent president is re-elected, economic growth is strong in advance.

In contrast, when the incumbent loses, America’s largest companies appear to lose steam, casting doubt on the country’s economy and leadership.

The performance of the S&P 500 index this year may therefore shed some light on who will win the November election, when incumbent President Joe Biden will be challenged for a second term by Donald Trump.

Currently, it points to a Biden victory as it continues to rise consistently in the first half of the year.

Furthermore, a group of 16 Nobel Prize-winning economists issued a stark warning on Tuesday that inflation would be even worse under Donald Trump.

The former president would reignite inflation and cause lasting damage to the US economy, the Nobel laureates said in a letter first obtained by Axios.

“While each of us has different views on the specifics of different economic policies, we all agree that Joe Biden’s economic agenda is vastly superior to Donald Trump’s,” the letter said.

The warning was spearheaded by American economist Joseph Stiglitz, who won the prestigious economics award in 2001.

However, the polls remain unkind to Biden, with Trump leading him by five points heading into the first presidential debate on Thursday.

The winner of November’s presidential election faces a bleak budget outlook, with public debt on track to reach a record share of the economy under the next administration.

The debt surpassed $34 trillion early this year and is expected to surpass $56 trillion by 2034, according to forecasts earlier this month.

The Social Security trust fund is also on track for depletion by 2033, when only 79 percent of planned benefits would be payable.

If Congress does not ensure that these programs have the resources to continue paying full benefits, it would mean millions of Americans would see their monthly benefits reduced.