This data point shows global investors are again looking towards India

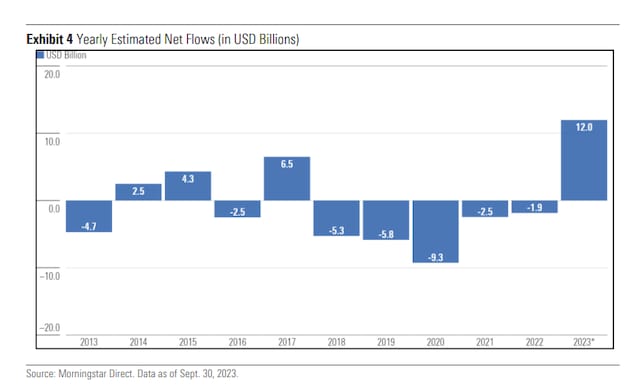

After seventeen consecutive quarters of net outflows, India-focused offshore funds and ETFs witnessed net inflows during the quarter ended September 2022. This trend has continued since then, with the category now witnessing five consecutive quarters of net inflow, according to a Morningstar survey.

An offshore India fund is a fund that is not domiciled in India but invests primarily in the Indian stock market.

According to the Morningstar India report, India-focused offshore funds and exchange-traded funds (ETFs) recorded the highest-ever quarterly inflows of $7.97 billion in the September quarter. In the June quarter, the category saw net inflows of $3.19 billion.

Morningstar has included asset flows from mutual funds and exchange-traded funds (ETFs) with an allocation to Indian equities as of September 2023.

“Robust net inflows and a strong rally in the Indian equity market saw the asset base of the India-focused offshore fund and ETF category grow by 18.2% to $59.8 billion, compared to $50.6 billion in the previous quarter,” said Melvyn Santarita of Morningstar.

The asset base of the India-focused offshore fund and ETF category rose 18.9 percent to $59.8 billion in the quarter, compared to $50.6 billion in the previous year.

The number of funds witnessing outflows and the amount of outflows have also fallen sharply, the report said. This indicates a strong positive trend and sentiment among foreign investors towards the Indian stock markets, after a long gap.

In the quarter ended September 2023, the S&P BSE Sensex Index gained 1.71% during the quarter. However, the mid and small cap segments were the biggest beneficiaries. While the S&P BSE Midcap Index rose 12.39%, the S&P BSE Small Cap Index rose 15.21%.

The India-focused offshore funds and ETF category and the MSCI India USD Index delivered similar returns of 2.9% in the quarter ended September 2023.

Of the universe of 285 India-focused funds we examine, 107 managed to outperform both the category average and the MSCI India USD Index in the quarter ended September 2023.