The true cost of influencer culture: Americans spent $71 BILLION on social media impulse buys last year – with over half regretting their purchases

The true cost of influencer culture: Americans spent $71 BILLION on impulse purchases on social media last year – with more than half regretting their purchases

- About 39 percent of adults have purchased an item on social media in the past year

- Of those who made a purchase, 57 percent said they had regretted at least one

- Those who do make impulse purchases spent an average of $754 in the year

Americans spent $71 billion on impulse purchases last year, inspired by what they saw on social media, a new study shows.

About 39 percent of Americans said they made such impulse purchases in the past year.

Of those, 57 percent said they regretted at least one of their purchases Bank rate.

The urge to make hasty online purchases was much more common among millennials and Gen Zers, with about 60 percent of both groups saying they choose what to buy based on what they see on social media.

Millennials spent more money, however, spending an average of $1,016 each as of August 2022, while Gen Zers typically spent about $844.

Americans spent $71 billion on impulse purchases last year, inspired by what they saw on social media, according to a Bankrate survey of more than 3,600 American adults

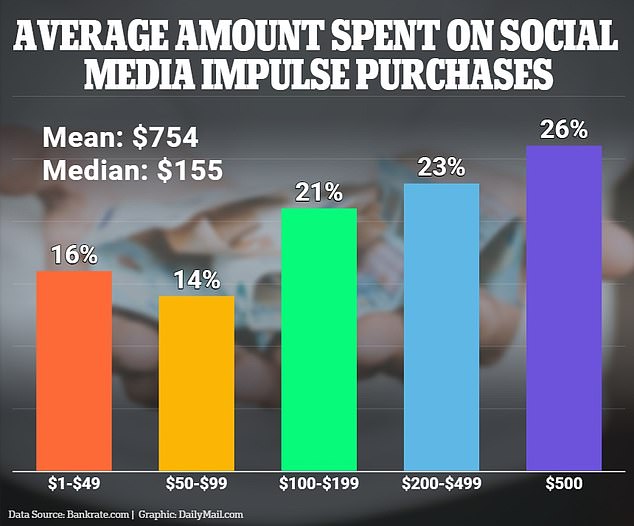

More than a quarter of respondents who said they make impulse purchases inspired by what they see on social media said they spent more than $500 between August

The survey, conducted in August, surveyed more than 3,600 American adults, 3,300 of whom said they were active on at least one social media platform.

The average amount spent by those who do make purchases based on what they see on social media was $754, but the median was $155, implying that big spenders are spending disproportionately.

And men who made impulse purchases via social media spent an average of $999, while women spent an average of $518.

Bankrate analyst Ted Rossman suggested that people struggling to save due to impromptu spending should consider taking their time before finalizing a purchase.

A common rule is that it takes 24 hours of seeing a product before you decide to buy it.

“For larger amounts, you may even want to wait a week or more,” Rossman said. ‘Make sure you include your partner in the discussion (if you have one). We found that secret spending is the most common example of financial infidelity.”

Rossman also warned how social media scammers are increasingly taking advantage of consumers’ propensity for unplanned and spontaneous shopping online.

“Be aware of ads on social media claiming to be ‘bankruptcy’ or ‘flash’ sales,” he told DailyMail.com.

“These could be phishing scams that trick shoppers into entering their personal payment details.”

The Bankrate survey also found that social media influences many users’ feelings about their own finances, due to the prevalence of influencers who boast luxury lifestyles.

About 20 percent of users felt negatively about their own finances after seeing posts on social media, while 9 percent said social media has a negative effect on the way they manage their own money.

Gen Zers and millennials not only admitted that they post on social media to convey a sense of wealth, but also said that social media has a negative effect on the way they manage their money.

‘Keep in mind that what you see on social media is not always realistic. That refers to your friends’ posts and may be even more true for influencers,” says Rossman.

According to the survey, 57 percent believe that people sometimes post things on social media to appear more successful, but only 12 percent admit to doing so themselves.