The SEC launches an investigation into the failure of the New York Stock Exchange that caused wild swings in prices

>

Federal regulators are investigating a failure on the New York Stock Exchange that caused wild swings in blue-chip stock prices and resulted in the cancellation of trades in more than 250 stocks, including shares of Nike, Verizon and McDonald’s.

The NYSE, owned by the Intercontinental Exchange, said a “system glitch” prevented auctions on a subset of its listed shares from opening Tuesday morning.

Those shares began trading without an opening impression, or the price used as a benchmark at the opening bell, resulting in an erroneous price that the exchange said will be declared null and void, with resulting trades cancelled. .

The US Securities and Exchange Commission said it was reviewing the issue, which experts believe could have cost brokers and small traders tens of millions of dollars.

“Such events are extremely rare and we are closely examining the day’s activity to ensure the highest level of resiliency in our systems,” NYSE chief operating officer Michael Blaugrund said in a statement to DailyMail.com.

Traders watch screens for information about a trading malfunction on the floor of the New York Stock Exchange on Tuesday. Federal regulators are investigating a glitch on the exchange that caused wild swings in blue-chip stock prices.

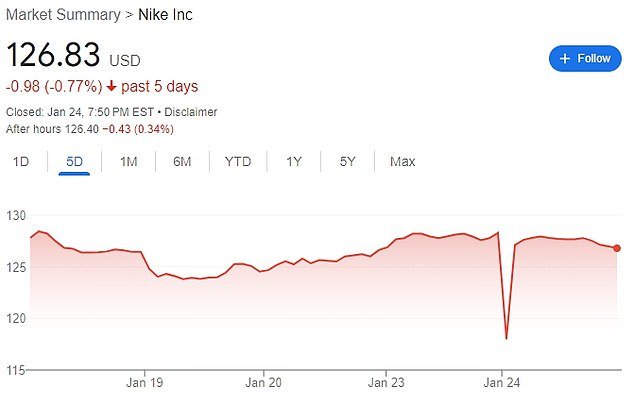

Shares of Nike plunged 12% at the opening bell after a technical problem at the New York Stock Exchange prevented auctions of more than 250 listed stocks from opening.

Blaugrund added: “We ended the day with a normal market close and expect a regular open on Wednesday.”

A spreadsheet released by the exchange showed 251 affected stocks, including shares of Nike, ExxonMobil, 3M, Verizon, McDonald’s, Wells Fargo and Walmart.

The glitch is the latest in a series since the 2010 flash crash, and it angered traders who were unable to execute trades at the opening bell or saw their trades canceled after they were executed at the wrong prices.

“What appears to have happened is a technical glitch where all my open orders on the New York Stock Exchange were automatically cancelled, even though some of them should have been filled,” said Dennis Dick, a trader at Triple D Trading.

“They’ve fixed it now, but this is going to be a big mess to clean up.”

The exact cost of the fallout from the failure is unclear, but the cost to brokers and retail traders is likely to be in the eight-figure range, according to a person from a major brokerage who spoke on condition of anonymity because the matter is delicate. .

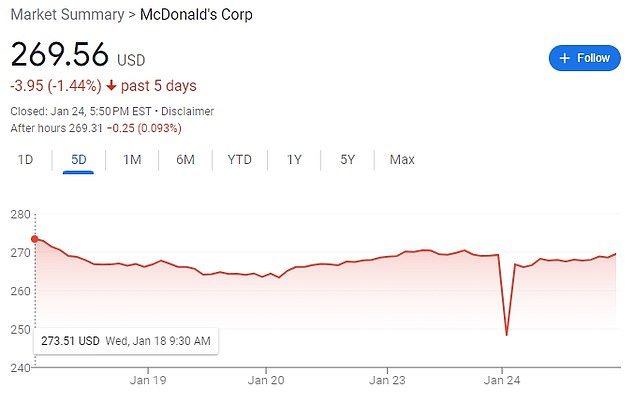

McDonald’s shares fell 9% in the first seconds of trading after the ‘system error’

A trader is seen during the glitch that caused the New York Stock Exchange to go out on Tuesday morning.

“Obviously, there were a lot of stocks that had major problems,” said Joe Saluzzi, co-head of trading at Themis Trading in Chatham, New Jersey. ‘It’s a bit of a mess.’

Saluzzi said there was ‘zero tolerance for fault’ among traders for failure to open and close key trades.

“This is a failure, there is no way to sugarcoat it,” Saluzzi said. “There are definitely people who are losing money today who are not happy.”

The opening auction bug comes as the SEC is considering routing most orders for retail shares through auctions, with the goal of getting better prices for individual investors.

“The SEC’s plan to make us all cool with consumer auctions leaves a lot to be desired,” said James Angel, a finance professor at Georgetown University.

Auctions are much more complicated than it seems. A lot of things can go wrong,” said Angel, who helped work on the auction process for Nasdaq Inc.

Stocks listed on the NYSE are listed on all 16 US stock exchanges, which use NYSE prices.

Saluzzi said having multiple exchanges doesn’t help in a situation like this, since the only place to trade an open order on a stock listed on the New York Stock Exchange is that same exchange.

Traders look at screens indicating that some stocks have been stopped on the floor at the New York Stock Exchange

The NYSE is the only major US stock exchange that still uses a trading floor, along with electronic trading, a hybrid model that the exchange says makes it easier to discover prices during market open and close and during periods of imbalance or trade instability.

Technical errors on exchanges can erode market confidence.

“I had some discretionary trading to do, but I opted to wait an extra 30 minutes after things seemed to normalize to make sure there were no issues,” said Seth Hickle, a portfolio manager for derivatives at Innovative Portfolios in Indianapolis, Indiana.

To hold exchanges accountable for such failures, the SEC adopted a broad set of business continuity and disaster recovery rules called Regulatory System Integrity and Compliance (Reg SCI) in 2014.

In March 2018, NYSE was the first exchange to be fined under Reg SCI. The $14 million fine was related in part to a nearly four-hour suspension of operations in July 2015 that resulted from a faulty software implementation.