The rise and fall of Britain’s property millionaires – as £1million house prices fall, these are the areas with the most houses

Some British property millionaires have lost their £1million home ownership, according to a leading estate agent.

The number of homes over £1million in Britain peaked during the pandemic property boom but has now fallen after the race for space stalled and higher mortgage rates hit the market.

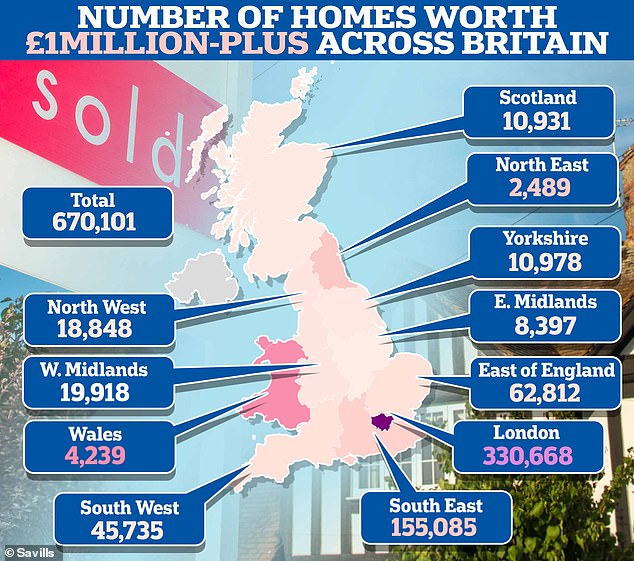

Savills said there were an estimated 670,000 homes with a price tag of at least £1 million across Britain at the end of 2023, a fall of 60,260 – or 8.3 per cent – from the previous year.

However, this is still an increase of 28 percent – an increase of 146,490 – compared to 2019, with the lion’s share of the increase coming from areas outside London.

The total value of the UK’s £1m domestic market now stands at £1.32tn, down from £1.43tn in 2022, the broker said.

The number of real estate millionaires has fallen since the peak of the pandemic, but remains 28 percent higher than in 2019

Lucian Cook of Savills explains: ‘The race for space and flight to the countryside from mid-2020 saw a sharp increase in the number of £1 million homes outside London and other urban environments.

‘However, increased mortgage costs and a rebalancing of demand for city living have meant that around 30 per cent of those whose homes crossed the £1million threshold have returned to becoming million-pound aspiring homeowners for the time being.’

Savills estate agents have revealed the number of property millionaires in Britain

| 2023 | 1 year change | % change | vs 2019 | % change | |

|---|---|---|---|---|---|

| London | 330,668 | -12,280 | -4% | 30,570 | 10% |

| Southeast | 155,085 | -23,166 | -13% | 44,268 | 40% |

| East of England | 62,812 | -9,688 | -13% | 21,120 | 51% |

| South West | 45,735 | -5,918 | -11% | 20,441 | 81% |

| West Midlands | 19,918 | -2,723 | -12% | 8,017 | 67% |

| North West | 18,848 | -2,230 | -11% | 6,180 | 49% |

| Yorkshire and The Humber | 10,978 | -1,694 | -13% | 4,297 | 64% |

| Scotland | 10,931 | -550 | -5% | 4,545 | 71% |

| East Midlands | 8,397 | -1,116 | -12% | 3,700 | 79% |

| Wales | 4,239 | -660 | -13% | 2,250 | 113% |

| North-East | 2,489 | -264 | -10% | 1,102 | 79% |

| Total | 670,101 | -60,290 | -8.30% | 146,490 | 28% |

| Total excl. London | 339,432 | -48,010 | -12.40% | 115,920 | 52% |

| source: Savills |

London saw the smallest decline in the number of property millionaires last year – down 4 percent, followed by Scotland, which fell 5 percent.

Areas outside London saw the biggest decline in the number of property millionaires. But the number of £1 million homes outside London still remains 52 per cent higher than in 2019.

Wales has seen a 113 percent increase, while the North East – where numbers have risen by 79 percent – and the East Midlands – at 79 percent – have seen the biggest increases in housing stock, worth £1 million or more up there. period of time.

| Rank | Local authority | Region | £1m+ agreed turnover 2023 | % of all agreed sales in LA |

|---|---|---|---|---|

| 1 | Kensington and Chelsea | London | 1,600 | 61.60% |

| 2 | Westminster | London | 1,554 | 48.60% |

| 3 | Camden | London | 883 | 37.80% |

| 4 | Hammersmith and Fulham | London | 908 | 37.00% |

| 5 | Richmond-upon-Thames | London | 849 | 31.90% |

| 6 | Elmbridge | Southeast | 759 | 29.30% |

| 7 | City of London | London | 43 | 26.90% |

| 8 | Islington | London | 684 | 26.20% |

| 9 | Wandsworth | London | 1,357 | 24.20% |

| 10 | Mole Valley | Southeast | 313 | 19.20% |

| Source: Savills Research with TwentyCI | ||||

It follows separate analysis of sales of more than £1m by TwentyCI last year, which found London venues continue to dominate the £1m chart.

The boroughs of Kensington & Chelsea, Westminster, Camden, Hammersmith & Fulham and Richmond-Upon-Thames had the highest turnover of over £1 million in 2023.

Indeed, London locations made up eight of the ten largest local authorities, along with Elmbridge and Mole Valley outside London.

Mr Cook added: ‘In the wake of the pandemic, new million-pound hotspots emerged across the length and breadth of Britain as affluent homebuyers changed their priorities in the search for more space.

‘However, in 2023, property prices in the capital held up more strongly than in the rest of the country – down 1.1 per cent versus down 4.8 per cent – meaning London’s boroughs could more easily get their share of £1 million were able to hold. real estate sales.’

Mayfair’s Grosvenor Square has been named Britain’s most expensive street, with an average price tag of £20.35 million

A square in the heart of London was recently named Britain’s most expensive place to live.

Mayfair’s Grosvenor Square led Halifax’s annual survey of Britain’s most expensive streets, with an average price tag of £20.35 million.

Heading west to the Kensington and Chelsea area of fashionable Notting Hill, Clarendon Road took second place with an average price tag of just under £20 million at £19.96 million.

The top three – and home to world-famous luxury shopping destination Harrods – was London’s Knightsbridge, where properties cost an average of £19.95 million.

If a house on one of London’s most expensive streets is to top the Christmas list this year, it will require deep pockets, with an average price tag now £14.5 million.