THE MERCHANTS TRUST: City Loyalists Find Value in Strong Companies That Have Fallen Out of Favor

The Merchants Trust is a stalwart investment trust with a history stretching back 135 years. Yet there is nothing old or old-fashioned about the £889 million trust that continues to provide investors with an attractive mix of income and capital returns from the UK stock market. It stands out among its peers.

The trust is managed by Allianz Global Investors and benefits from a steady hand at the helm in Simon Gergel, who has been responsible for investments for more than 18 years. He is supported in managing the portfolio by Richard Knight and Andrew Koch.

The fund’s performance figures are impressive. Over the past one, three, five and ten years, it has outperformed its UK equity income peer group average. For example, last year it delivered a total return of 20 per cent, compared with a peer group average of 18. Over five years, the outperformance has been greater – 70 per cent versus 38.

There is no magic formula behind its success – just hard work and a dedication to an investment style that focuses on identifying undervalued companies that the team believes will perform well over the long term.

These companies typically offer dividend yields that are above the market average. The trust’s current annual yield is 4.8 per cent, which compares with a yield on the mainstream FTSE100 Index of 3.5 per cent.

Income is indeed central to Merchants’ investment proposition. Along with a small group of other investment trusts, it has a history of annual dividend growth going back decades.

While other trusts have longer histories, such as Alliance, Bankers and City of London, 42 years of consecutive annual dividend increases is impressive.

Gergel and the Trust Board are keen to keep the administration running. They are reassured by the fact that the fund has more than half a year’s income in reserve. These reserves can be used if dividends from existing investments decline.

Dividends are paid quarterly and the first payment for the current financial year was 7.2p per share, up 0.1p on the equivalent payment 12 months earlier. The trust’s shares are priced at just under £6.

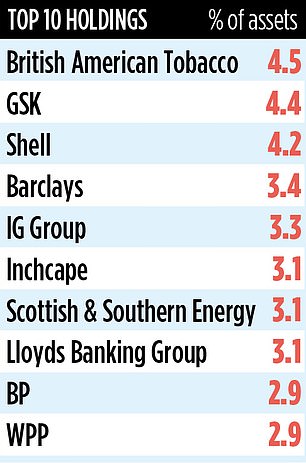

The portfolio currently consists of over 50 stocks, with well-known dividend-friendly companies among the main investments, such as oil companies BP, Shell and British American Tobacco.

Gergel and his team are bold investors who take positions in companies that have fallen out of favor. One of the latest additions to the trust’s portfolio is luxury goods maker Burberry – a company that has struggled with poor sales, culminating in the appointment of a new CEO in Joshua Schulman.

Although the trust bought the company before the boardroom turmoil and the suspension of dividend payments,

Gergel says he is prepared to “preserve strong business franchises during a restructuring period where we can see significant value.” Burberry shares are down nearly 70 percent from this time last year.

Gergel added: ‘There is a lot of value in the UK stock market, particularly in companies like Burberry, whose share price has fallen significantly.’

Other recent additions to the portfolio include high-tech engineering company Dowlais and student housing specialist Unite.

Gergel said: ‘Dowlais is an attractive business with a decent yield (6.5 per cent), while Unite continues to benefit from strong demand for student housing and its share price has considerable potential to rise.’

The trust’s total annual charges are competitive at 0.55 percent. Its identification code is 0580007 and ticker MRCH.

DIY INVESTMENT PLATFORMS

AJ-Bel

AJ-Bel

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive investor

interactive investor

Fixed investment costs from £4.99 per month

Saxo

Saxo

Get £200 back on trading fees

Trading 212

Trading 212

Free trading and no account fees

Affiliate links: If you purchase a product, This is Money may earn a commission. These deals are chosen by our editorial team because we think they are worth highlighting. This does not affect our editorial independence.