The great rush to go private! Searches for insurance hit all-time high

>

Searches for private medical insurance have hit an all-time high in the wake of the NHS’s worst ever winter.

Brits in their droves used Google to look for policies and information on the ins-and-outs of making the switch every day in January, analysts say.

It marked the busiest ever month for such queries, according to myTribe Insurance.

NHS pressures began to ease in January, after the ailing £150billion-a-year service was battered by what insiders branded the worst month on record.

December saw heart attack and stroke victims face average waits of 90 minutes for an ambulance to turn up.

In January 2023, searches in Google for terms relating to health insurance exploded to the highest level seen in a decade, according to myTribe Insurance. 100 per cent represents when the searches were most rife

People are turning to private health insurance in their droves, as the health service continues to struggle providing basic care for patients in the wake of the pandemic

Around 7.2million patients in England remained stuck in the backlog in December (red line)— about one in eight of the population. More than 400,000 have queued for at least one year (yellow bars)

A&E queues were at an all-time high, with almost 1,800 patients forced to wait more than 12-hours each day in the final month of 2022.

The health service’s backlog has also hit record highs.

Meanwhile, the NHS was hit by strikes, record bed-blocking levels, a staffing crisis and a ‘twin-demic’ of flu and Covid.

Chris Steele, founder of myTribe Insurance, told MailOnline: ‘The interest in private health insurance has surged in the last year, compared to the last decade, in part due to the challenges facing the NHS, but also with insurers bringing new, more affordable options to market.’

He added: ‘Despite the well documented pressures on the NHS in the latter part of 2022, we didn’t see much change in the number of people requesting quotes for health insurance via our website.

‘In January, we saw a huge influx of visitors and the number of quotes requested, particularly from people that have never had health insurance are at an all time high.

‘When we looked at the month of January in particular, there are clear spikes in the number of people searching for health insurance in the days around the NHS strikes.’

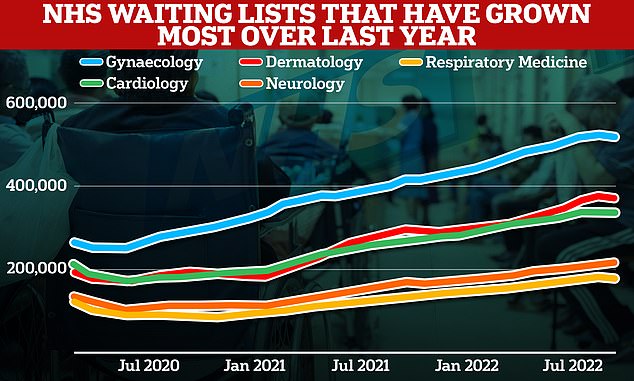

The number of people waiting for hospital treatment has nearly doubled since the pandemic began among some medical specialties.

NHS hospitals cancelled swathes of ops so that staff could prioritise coronavirus patients.

The overall NHS backlog for elective care hit 7.2million in December, according to data released by NHS England yesterday — slightly below the record 7.21million recorded in October.

It comes after an Institute for Fiscal Studies (IFS) analysis this week warned that waiting lists wouldn’t start to drop until 2024.

The latest data shows over 400,000 people in England have waited over a year for their operation, with nearly 55,000 of these having waited over 18 months.

Some 21,273 operations were also cancelled at the last minute in the three months to the end of December 2022, with 4,593 patients not treated within 28 days of their cancellation, in a breach of the standard.

Health bodies say surgeons are now also ‘frequently’ seeing more complex cases, as ‘patients conditions deteriorate while on long waiting lists’.

Tim Mitchell, vice president of the Royal College of Surgeons of England, said: ‘Too many patients are still suffering the distress of having their operations cancelled at the last minute.

‘Their lives, and sometimes livelihoods, remain on hold while they wait for a new date and the relief from pain that surgery will bring.

‘In some areas, surgeons are telling us that they are dealing with more complex cases, more frequently, as patients’ conditions deteriorate while on long waiting lists.’

He added: ‘No surgeon wants to be in the position of telling a patient their surgery has to be cancelled but the very high demand we have seen in emergency departments since the summer, and problems discharging patients who are ready to leave hospital when there is a lack of social care, mean this is too often what has to happen.’

But myTribe Insurance director Mr Steele warned that new private health insurance policies exclude the cost of treatment for patients already stuck on NHS waiting lists.

He told MailOnline: ‘People often get in touch with us when they’re on a waiting list for NHS treatment looking for health insurance to cover the cost of private treatment.

‘Unfortunately, we can’t help, as all insurers exclude pre-existing medical conditions you’ve suffered symptoms from in the past five years.

‘The only option for those people is to wait or try to raise funds for treatment themselves.’

He added: ‘Health insurance is specifically for conditions that come on after you take out a policy.’

According to latest available data from the Private Healthcare Information Network (PHIN), there were 67,080 self-pay admissions to private hospitals between April and June 2022.

This is a rise of 33 per cent on the 50,325 admissions recorded during the same time period in 2019.

The government-backed body has had a legal duty to collate comprehensive data on private healthcare activity since 2016.

But many people may not realise that patients have had the right to choose where they receive their NHS care for around 20 years.

This was then enshrined in the NHS Choice Framework, published in 2016, and the NHS Constitution for England, last updated in 2021.

It means you can be treated in any hospital that provides NHS care, whether it is an NHS or private hospital, for any kind of routine, planned treatment or diagnostic test.

Around 280 private hospitals treat NHS patients, with 1.2million procedures a year carried out in private clinics.

On average, a private hip replacement costs £12,825, a knee replacement £13,925 and cataract surgery on one eye £2,775, according to myTribe Insurance

For those seeking private healthcare, there are two levels of health insurance to consider – treatment only which is a basic policy that you can add or remove services from -or comprehensive cover. myTribe Insurance director, Mr Steele told MailOnline: ‘The cost of your policy depends on many factors, not least, your age, where you live and what options you choose when you configure your policy’

Looking at the latest 12 months, the number of respiratory medicine patients queuing surged 33 per cent, while backlogs in neurology, dermatology, cardiology and gynaecology jumped by up to 29%

Rachel Power, chief executive of the Patients Association, told MailOnline: ‘We support patients being able to choose who treats them and where they receive care.

‘Some patients will choose private healthcare but we don’t believe it’s a free choice if patients are going private because they can no longer wait to be treated by the NHS.

‘The right to choose where patients receive care is in the NHS constitution but research we did with the Independent Healthcare Providers Network last year showed very low levels of awareness among the public of this choice.

‘This lack of knowledge reduces many patients’ ability to exercise choice and receive care on the NHS, potentially within a timeframe they find acceptable.’

She added: ‘That’s why we’ve called on the NHS to ensure patients know they have the right to choose where they have their treatment, and that healthcare professionals actively support patients to make choices that work for them.

‘Exercising choice may not speed up every patient’s wait for treatment, but for some it may be better than paying for treatment out of their own pocket.’

For those seeking private healthcare, there are two levels of health insurance to consider — treatment only which is a basic policy that you can add or remove services from — or comprehensive cover.

The kind of care that’s covered, along with age and where you live, are what influences monthly premiums.

Mr Steele told MailOnline: ‘The cost of your policy depends on many factors, not least, your age, where you live and what options you choose when you configure your policy.

‘While our research is useful and helps people understand the rough cost of health insurance, it’s only meant as a guide, and you should speak with a broker and get a personalised quote and advice.’

On average, a private hip replacement costs £12,825, a knee replacement £13,925 and cataract surgery on one eye £2,775, according to myTribe Insurance.

London and Manchester are currently the most expensive places to seek treatment, while Wales and Scotland are among the cheapest.

Mr Steele added: ‘We’ve been tracking the cost of private treatment in the UK for the last couple of years, and while prices remained fairly consistent through the pandemic and even until late last year, they’re now starting to rise.

‘Across the 27 surgical procedures we’re monitoring, we’ve seen an increase of under 10 per cent between August 2022 and January 2023.

‘Given these hospitals are all facing a significant increase in costs such as heating and electricity, we see this increase as relatively modest.’

A spokesperson for NHS England told MailOnline: ‘Since the referenced period last year, NHS staff have worked flat out to virtually eliminate two year waits and they continue to make progress on reducing waits of over 78 weeks by April.’

They added: ‘A year on since the elective recovery plan was launched, the NHS had made good progress despite a winter of record pressure — as the IFS has acknowledged.

‘As part of the biggest catch-up programme in NHS history the health service continues to stand up additional capacity by increasing the number of tests, operations and appointments on offer, including through dozens of new surgical hubs and by making use of the independent sector.’