The Great Fake-Panic of 2024: Shark Tank star KEVIN O’LEARY reveals his advice to terrified investors who were wiped out – and how to protect yourself from market hysteria

On Monday my phone was red hot with calls from panicked investors.

They all wanted to know if I was going to sell my stock portfolio.

It must have looked ugly.

The market was shocked by a disappointing jobs report on Friday, which showed the U.S. economy added just 114,000 jobs in July, while economists had forecast 185,000.

The unemployment rate rose slightly to 4.3 percent, the highest level in nearly three years.

Global markets fell, with Japanese stocks suffering their worst day since 1987.

On Monday morning in America, Wall Street’s “fear gauge” – the Cboe Volatility Index, or VIX – rose to its highest level since the start of the COVID-19 pandemic. The Dow Jones and S&P 500 recorded their biggest daily losses since September 2022, falling 2.6 percent and 3 percent respectively.

Still, my advice was: Don’t panic. Don’t sell.

And I was right.

Global markets stabilize on Tuesday morning, and even Japan has clawed back much of Monday’s losses, rebounding 10 percent at the time of writing.

Americans on this financial roller coaster may feel like they have whiplash.

But there are also valuable lessons to be learned from Monday’s apparent panic.

My advice yesterday was: Don’t panic. Don’t sell. I was right.

RECESSION CONFESSION

The weak U.S. jobs report raised fears that the U.S. economy – the engine of global trade – was heading for a long-awaited downturn after the COVID-stimulus-fueled surges of recent years.

Is the US on the Brink of a Recession?

In short, maybe.

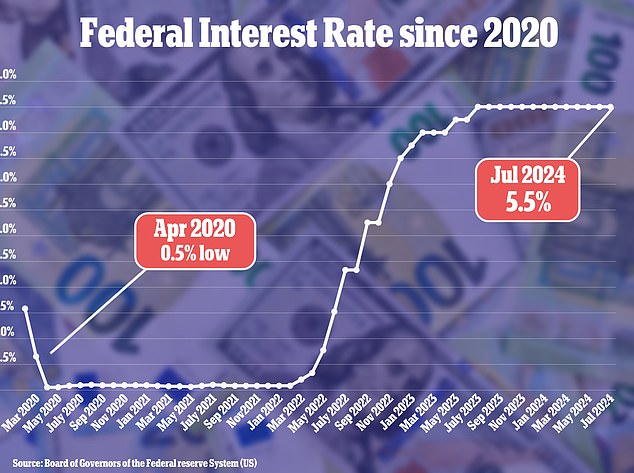

When the Federal Reserve began raising interest rates in March 2022 to curb investment and cool an economy that had been revved up by trillions of dollars in stimulus money, there was always a risk that economic activity would slow too much.

Ideally, the Fed—which manages the U.S. money supply in the pursuit of price stability and maximum employment—would halt rising inflation without causing stagnation. This goal is called a “soft landing,” and I believe that is still the most likely outcome.

Right now I’m predicting a 60 percent chance of a “soft landing” and a 40 percent chance of a recession.

A single piece of economic evidence – like Friday’s jobs report – doesn’t change my mind.

What happened on the stock markets on Monday was simply a healthy correction.

Stocks have hit record highs this year and technology shares in major indexes including the S&P 500, Nasdaq and Dow were overvalued.

Artificial intelligence companies, such as AI chipmaker Nvidia, have driven much of the market’s gains. But forecasts for these companies’ profitability have been overblown.

Shares of Nvidia, which hit a high in June, fell more than 6 percent on Monday, as the so-called “Magnificent Seven” tech stocks, which include Apple and Meta, lost $650 billion in value.

That’s a staggering amount – but these movements are a sign of a functioning market. There have been thousands of market corrections in the past and there will be thousands more in the future.

Moreover, the output of the US economy, as measured by gross domestic product, continues to grow.

Inflation is persistent and causing economic hardship for Americans in grocery stores and gas stations, but it is coming down.

However, if the August employment report shows another shortage of jobs, I think the probability of a recession will rise to 50 percent, and investors and retirees will need to reevaluate their investments.

The Dow Jones Industrial Average posted its biggest daily loss since September 2022 on Monday, closing down 2.6 percent.

The stock market was shocked on Friday after a report showed US job growth in July was lower than expected.

O’LEARY’S RULE OF THUMB

In fact, some investors may already be worn out by Monday’s fall.

If they panicked and sold their stocks, they would be even worse off on Tuesday because they would have missed the recovery.

If that happens, they will have learned an important lesson: the market gives and takes.

So don’t bet on one share or one market sector.

The S&P 500 is made up of 11 sectors, including technology, energy and real estate.

My rule of thumb, which I have used for decades, is to own no more than 20 percent of any sector and no more than 5 percent of any stock.

If you couldn’t tolerate Monday’s volatility, your portfolio isn’t diverse enough.

There is no way to predict the market, but investors can protect themselves.

And the closer one gets to retirement age, the less risk one runs.

Fed Chairman Jerome Powell faced calls yesterday to cut interest rates as a matter of urgency.

Since July 2023, the Federal Reserve has been applying an interest rate between 5.25 and 5.5 percent.

DON’T GIVE THE FED A FIGHT

Investors were hysterically wondering Monday whether the Federal Reserve had made a terrible mistake by keeping interest rates at their highest level in 23 years since July 2023.

Some even suggested that Fed Chairman Jerome Powell should issue an “emergency” rate cut, bypassing the Federal Reserve’s pre-planned, deliberate decision-making process and drastically cutting lending rates.

That has happened only seven times since 1987, and most of them followed traumatic events like 9/11 and the 2008 financial crisis.

The market’s recovery this morning proved those expectations were ridiculous.

The Fed’s job is not to react to a single economic data point like Friday’s jobs report. It’s the central bank’s responsibility to determine where the economy is headed in the coming weeks, months and years and to set stable and predictable policies.

The Fed’s next meeting is in September.

We would be wise to await their findings.