The five financial lessons you can learn from maverick footballers – including how much you need to save to avoid being left penniless after your career

The country is holding its breath with hope today as the Three Lions take on Spain in the final of Euro 2024.

Although the England squad has yet to miss a penalty this tournament, many of the teams are likely to score an own goal at home, at least when it comes to their money.

Despite Premier League players earning an average of £70,000 a week, footballers are notoriously bad at managing their finances. Sports charity Xpro claims that 40 per cent of footballers go bankrupt within five years of retirement.

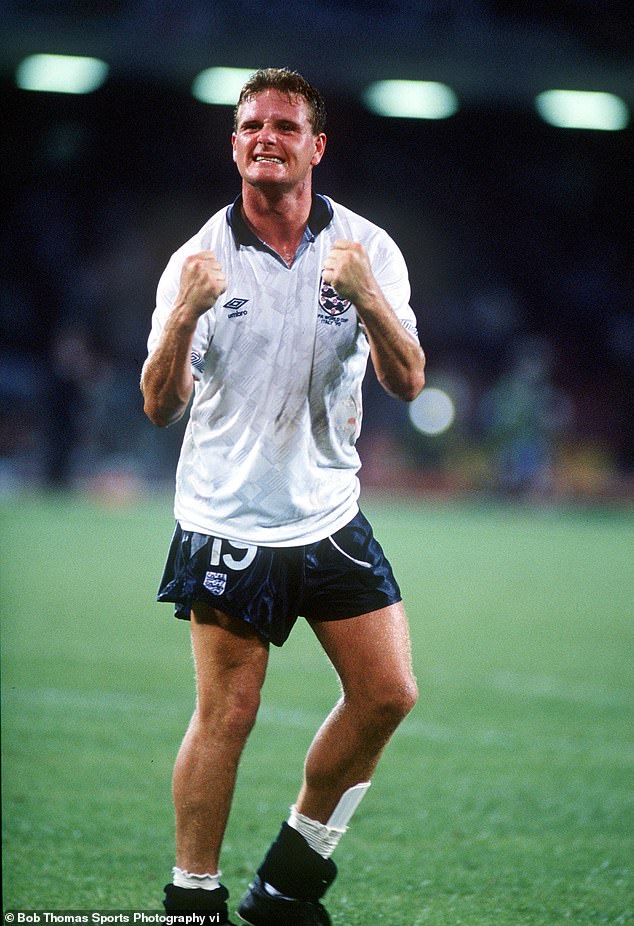

Former England internationals Emile Heskey and Wes Brown have reportedly been declared bankrupt recently. In 2009, Heskey was worth an estimated £12 million. And former stars David James and Paul Gascoigne are also struggling to keep their heads above water financially.

So what lessons can we learn from their mistakes? We ask financial advisors.

Former England international Emile Heskey was worth an estimated £12million in 2009, but has reportedly recently been granted a bankruptcy order

Former football star David James struggles to keep his head above water financially

Their biggest financial vices are unrestrained spending and a lack of a savings plan. Chris Reed, of Stonehill Financial, who manages the finances of eight Premier League stars, says: ‘Most footballers come from fairly humble backgrounds, with working parents.

“They’re often scouted at a young age to go from a normal life to a five-figure a week salary. That’s a lot of money for any of us, but for someone in their teens with no financial experience, it’s a lot to take on.”

Footballers are known for their extravagant lifestyles, but their spending can quickly spiral out of control. With their short-lived careers, reckless spending could mean running out of money by the age of 35 unless they save.

Reed says, “It’s tough because they’re getting tens of thousands of dollars every month. If they blow it all, they know the money will come back the next month.”

“It makes sense that they want to see all the things they’ve seen on social media: the boat parties, the big holidays, the fancy cars.”

He advises his clients to set aside 10 percent of their gross income for savings, investments and retirement. “The cumulative effect of saving 10-12 percent of your income builds steadily and should leave them with enough,” he says.

If the average Premier League player followed this formula from the age of 19, he would have £7-8m by the age of 35, assuming an annual return of 4-5 per cent, the consultant said.

Former England player Paul Gascoigne is also struggling with his finances

‘This money can keep them alive, or be used for retraining or setting up a business.’

While you may not be able to retire at 35, this rule of thumb for saving can apply to everyone, Reed adds. Putting aside 10 percent of your pre-tax income can help you reach your personal financial goals. Adam Osper of Evelyn Partners, who also works with soccer players, says he even recommends saving 50 percent of your net income.

The next mistake is in their retirement planning. Most of us fail to save enough for our later years – but we have over 40 years to plan for it.

According to Reed, many footballers only try to put money into their savings accounts when it is too late, for example in the last five years of their career.

This is similar to when 60-year-olds realize they need to pump their pension. “By then it’s too late,” he says. “You’re not getting the cumulative effect of investing that money over time through compounding returns. You’re also limited by surcharges.”

You can pay up to £60,000 into a pension each year, or £10,000 for those earning more than £260,000 a year. Similarly, you can put up to £20,000 a year into Isas, which are a tax-efficient way to invest in shares.

Footballers also quickly get caught up in flashy but risky investments. These often end in disaster, with investors losing a large part of the capital they invested in the project.

Reed says, “They shouldn’t be spending money on sexy, exotic investments that are high risk, high return. Instead, we’re going for mainstream investments that are 4-5 percent a year.”

The financial advisor prefers Vanguard’s range of market-tracking funds, which are low-cost and offer a lot of diversity.

“Boring is good when it comes to investing,” he says. Osper agrees: “We build simple investment portfolios and don’t do anything too complicated.”

Footballers are just as likely to buy into the hypes that financial influencers spread on social media, such as cryptocurrency. But these can prove to be disastrous decisions if executed incorrectly.

Reed says, “If you’re going to take risks, it has to come out of your spending budget, not your savings. You wouldn’t put the money you’ve set aside for retirement on a dog at the races. We’re not trying to make a quick buck, it’s about long-term growth.”