The ECB will be ‘backed into a corner’ with successive rate cuts as the eurozone economy falters

- Markets think ECB will cut key deposit rate to 3.25% on Thursday

The European Central Bank is expected to pull the trigger on another interest rate cut on Thursday as the eurozone economy continues to show weakness.

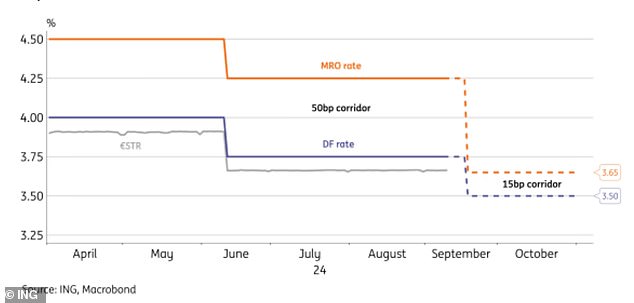

Markets are forecasting a 25 basis point cut in the ECB’s key deposit rate to 3.25 percent, following a cut of the same size last month and the third cut this year.

This is the result of a continued deterioration in economic output, especially in the crucial markets of Germany and France, weaker business and consumer confidence and declining inflation.

Cuts: Markets are pricing in two more interest rate cuts by the ECB this year, bringing it to 3%

Eurostat data show that inflation across the bloc fell to 1.8 percent in September, falling below the ECB’s 2 percent target for the first time since June 2021, while core inflation cooled to the lowest level in two year of 2.7 percent.

Head of economic research at St James’s Place Hetal Mehta said: ‘The ECB has seemingly been backed into a corner by a succession of rate cuts following weak sentiment data and a faster-than-expected decline in inflation.’

However, Mehta added that the ECB is unlikely to commit in advance to a monetary easing path given the uncertainty of the global economic outlook.

Falling: The ECB cut its key deposit rate to 3.5% last month

Financial markets are currently pricing in one additional rate cut by the ECB this year and several more in the pipeline for 2025, with forecasts suggesting rates will remain at 2 percent or lower.

Similarly, markets believe the Bank of England could cut key interest rates twice more this year after consumer price inflation eased to 1.7 percent in September. However, the market thinks the BoE’s final interest rate is likely to be closer to 3.5 percent.

Senior rates strategist at ING Benjamin Schroeder warned that pessimism about the growth prospects for the eurozone “may have gone too far”, meaning interest rates will not fall as much as markets are currently pricing.

He said: ‘Yesterday’s ZEW index (an indicator of economic sentiment) saw a slightly bigger improvement in the expectations component than expected, and the ECB’s bank lending survey has also shown tentative improvements.

“At some point, the prospect of faster policy easing should help stabilize the longer-term outlook and limit the downward trend in forward rates.”

Raphael Olszyna-Marzys, international economist at J. Safra Sarasin Sustainable Asset Management, added: “Should wages and underlying inflation rise unexpectedly in the coming months, the ECB could simply stop cutting rates further and can be kept constant for longer.

“Instead, not cutting rates quickly enough could be a policy mistake. If inflation were to fall faster than nominal interest rates, real interest rates would rise and weigh unnecessarily on economic activity.’

DIY INVESTMENT PLATFORMS

A. J. Bell

A. J. Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund trading and investment ideas

interactive investor

interactive investor

Invest for a fixed amount from € 4.99 per month

Sax

Sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account fees

Affiliate links: If you purchase a product, This is Money may earn a commission. These deals have been chosen by our editors because we believe they are worth highlighting. This does not affect our editorial independence.