The death of the bank statement! Citibank orders cardholders they must go paperless or they will lose their online accounts

- Citibank escalates fight against mailed statements with ‘beta program’

- Customers were told to move to paperless or they would lose access to online accounts

- The move to force consumers to make paperless declarations is controversial

Citibank has told some of its customers that if they don’t opt out of paper statements, they will lose access to their online accounts.

The move is the latest in a series of attempts by the banking industry to encourage customers to provide physical statements – which costs them paper and postal fees.

The effort is part of a “beta program” and was rolled out to a small number of credit card customers, a Citigroup representative told the Wall Street Journal.

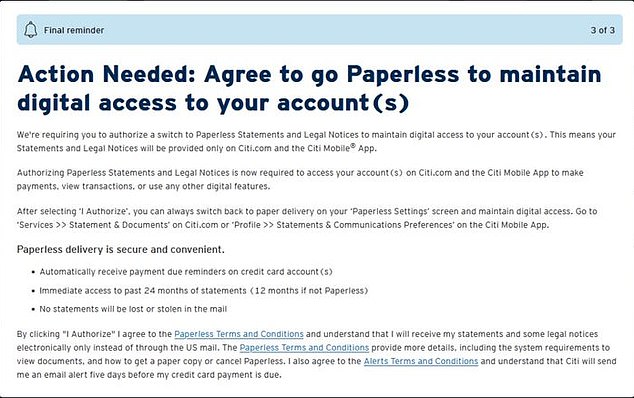

A message from Citibank to credit card holders via its website, a screenshot of which was shared by the Journal, said: “We require you to consent to a move to paperless statements and legal notices to maintain access to your account.”

Citibank told some credit card customers that if they don’t opt for paperless billing, they will lose access to their online account

A screenshot of an online notice requiring a customer to sign up for paperless statements to maintain access to their online account, shared by the Wall Street Journal

While the policy reportedly requires customers to enroll in paperless billing to maintain access to their online account, they can later switch back to paper statements and still be able to log in, a representative told the outlet.

Shifting customers to online statements is a contentious issue, and consumer advocates have urged the Consumer Financial Protection Bureau (CFPB) to take action against banks that force its adoption.

According to the CFPB, that adoption has accelerated in recent years. About two-thirds of credit card customers signed up for paperless billing last year, up from 36 percent in 2015.

The CFPB stated at the time that people who opt for paperless statements are more likely to become disconnected from their finances.

It noted that for consumers, “opt-outs (from paper statements) largely amount to not fully reviewing their statements.”

The effort is part of a “beta program” and was being rolled out to a small number of credit card customers, a Citigroup representative said

The CFPB found that 10 percent of digital PDF statements were ever opened and about 25 percent of credit card account holders were enrolled in paperless accounts.

It has also cited federal law in the past that requires “a credit card issuer to establish procedures to ensure that statements are sent to cardholders at least 21 days before a payment is due.”

The agency advises people who still want to receive a statement in the mail to review their cardholder agreement or contact the customer service department of the financial institution in question.

Ira Rheingold, executive director of the National Association of Consumer Advocates, told the Journal that Citibank’s latest action appeared illegal.