The crypto G: First photo of Sam Bankman-Fried in jail posing with gangsters – as fellow inmates say ‘he’s strange as sh*t’ but ‘a good guy’

Sam Bankman-Fried, who was convicted last year of stealing from customers of his now-bankrupt FTX cryptocurrency exchange, has been pictured in prison for the first time.

The former billionaire, 31, is seen in the newly surfaced photo taken at New York’s Metropolitan Detention Center, where he is being held awaiting sentencing, for which he could face up to 115 years in prison. He will be sentenced next month.

The photo, believed to have been taken on December 17, shows Bankman-Fried with a beard as he stands next to five other inmates.

Crypto crime reporter Tiffany Fong originally got the image and spoke to an inmate pictured next to Bankman-Fried.

The inmate, known as G Lock, described Bankman-Fried as ‘weird as f***’ but considered him a ‘good guy’.

The photo, believed to have been taken on December 17, shows Bankman-Fried with a beard next to former inmate G Lock, an ex-gang member.

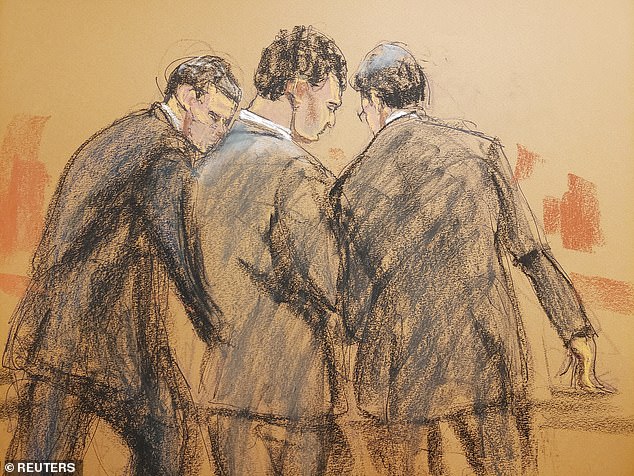

FTX founder Sam Bankman-Fried leaves Manhattan federal court on June 15, 2023 in New York

G Lock, a former member of the Blood gang, said: ‘Sam had a belly, he ate well. (Now) he’s skinny as a toothpick.

‘He doesn’t take a shower, he doesn’t do anything. He hasn’t betrayed anyone, Sam is a gangster.

‘Sam is more gangster than Tekashi69, Sam Bankman stood on all ten toes. Tekashi rattled.

‘He’s a good guy, he really is. As strange as it is, it can be strange. But he’s a good guy.’

Fong added, “He’s obviously lost some weight and I heard he doesn’t shower much.

“He’s not as clean-shaven as he used to be, but he’s clearly going through a lot now.”

Bankman-Fried was found guilty of all seven counts of fraud in November, with the jury taking less than five hours to reach a verdict.

His conviction last year marked the finale of his $10 billion fraud trial linked to the spectacular collapse of his crypto empire in November 2022.

Prosecutors alleged that Bankman-Fried, through FTX and its sister company Alameda Research, built a “pyramid of deceit” to “steal” billions of dollars in customer funds in the pursuit of “money, influence and power.”

Sam Bankman-Fried was part of a wave of crypto hype and before its collapse last November, FTX was worth $32 billion

Bankman-Fried is talking to his lawyers after the verdict. They later indicated that they plan to appeal

His lawyers, likening the dramatic trial to a movie, argued that the MIT mathematics graduate “never intended to harm anyone” but made “mistakes” while running two billion-dollar companies.

Bankman-Fried was part of a wave of crypto hype and before its collapse last November, FTX was worth $32 billion.

He was on the cover of Forbes magazine and appeared on stage with Bill Clinton and former British Prime Minister Tony Blair.

Bankman-Fried was hailed as the future of the financial world – Steve Jobs of cryptocurrency, who planned to give away his fortune as part of the doctrine of ‘Effective Altruism’ as he called it.

But as prosecutors argued in court, he “lied to the world” because in reality he simply stole FTX customers’ money.

The “house of cards” collapsed in 2022 amid falling crypto prices and media reports raising questions about how much of the $32 billion valuation was based on FTT, FTX’s native crypto token.

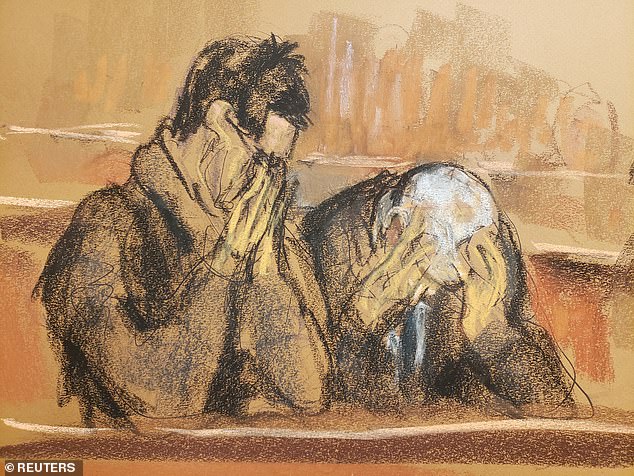

His parents Joseph Bankman and Barbara Fried broke down as the guilty verdict against their son was read

He was hailed as the future of finance, Steve Jobs of cryptocurrency, who planned to give away his fortune as part of the doctrine of “effective altruism,” as he called it.

As customers attempted to withdraw their funds, the crypto equivalent of a run on a bank occurred, and FTX was shut down.

Bankman-Fried has always maintained his innocence and continued to talk to journalists long after it became clear he would be arrested.

Federal prosecutors built their case against him around the testimony of his three top employees, all of whom quickly struck plea deals in hopes of receiving more lenient sentences.

They were Caroline Ellison, the CEO of Alameda Research, the predecessor to FTX and also his ex-girlfriend, Gary Wang, the co-founder of FTX, and Nishad Singh, the company’s top engineer.

During the trial, the court heard that Bankman-Fried grew up in Palo Alto to a mother and father who were both professors of economics at Stanford University.

Former US President Bill Clinton, former British Prime Minister Tony Blair and Bankman-Fried pictured during a panel discussion in May 2022

He studied mathematics at MIT, where he met Wang before joining Jane St Capital, a Wall St trading firm, and then founding Alameda in 2017, followed by FTX in 2019.

The company first operated out of a two-bedroom Airbnb in Berkeley, California, before moving to Hong Kong and eventually the Bahamas.

There they built out an office and a $30 million penthouse apartment, where Bankman-Fried lived with nine others in a bizarre mix of opulence and frat-house squalor.

In his testimony, Bankman-Fried tried to portray himself as an overworked and eccentric genius who sometimes slept on beanbags and drove a Toyota Corolla because he thought that was a better image.

He admitted that “a lot of people got hurt” and that he had made some “bigger mistakes,” but flatly denied committing fraud when asked by his lawyer Mark Cohen.