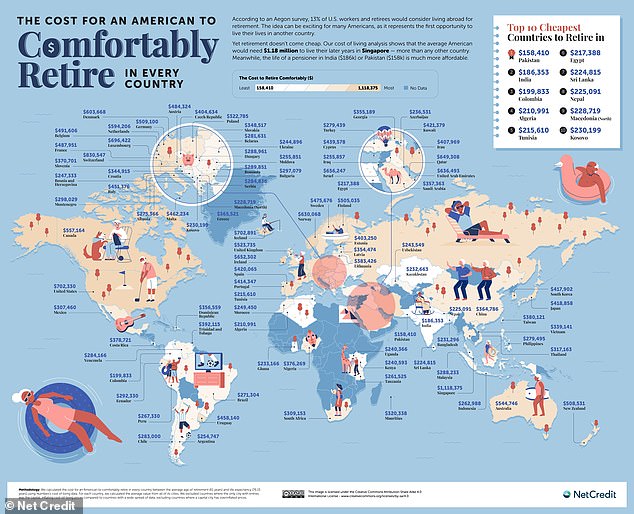

The costs of pensions around the world have been mapped out: from affordable settlement in Pakistan, Egypt and Algeria for $225,000 to expensive Singapore where $1 million is needed

A survey has revealed how much money a retiree needs to retire around the world, with Pakistan taking the top spot at $158,410.

Aegon conducted a study using Numbeo's cost of living data to calculate how much money Americans would need to retire comfortably in different countries between the average retirement age of 61 and life expectancy of 76.15 year.

Besides Pakistan, data showed that in India and Colombia, a person needs less than $200,000 to retire comfortably.

In countries like Tunisia, Egypt, Sri Lanka, Nepal, North Macedonia and Kosovo, Americans would need less than $300,000 to retire – and in Algeria just $210,991 to live comfortably.

Aegon conducted a study using Numbeo's cost of living data to calculate how much money Americans would need to retire comfortably in different countries between the average retirement age of 61 and life expectancy of 76.15 year.

Besides Pakistan, data showed that in India and Columbia, a person needs less than $200,000 to retire comfortably.

Among the most expensive countries to retire in are Switzerland ($830,547), the US ($702,330), Luxembourg ($696,422), Denmark ($603,668), the UAE ($636,493) and Canada ($557,164).

The most expensive country to retire in is Singapore, while Americans need almost $1. 2 million to live comfortably, according to the data.

Many people living in America prefer to retire in South Asian countries, including India, Pakistan, Nepal and Sri Lanka, due to the lower cost of living.

Housing and healthcare are relatively cheaper, leading to longer-term retirement savings and more freedom to follow passions.

The most expensive country to retire in is Singapore, with Americans needing nearly $1.2 million to live comfortably, according to data

Many people living in America prefer to retire in South Asian countries, including India, Pakistan, Nepal and Sri Lanka, due to the lower cost of living

This comes after it was revealed that nowhere in the US would $1 million in savings last longer than 22 years, 8 months and 12 days.

That's how long seven figures would stretch in Mississippithe state where a $1 million pension fund would last the longest, according to the analysis by GOBankingRates.

But in Hawaii, savings would run out after just 10 years, three months and 22 days – the shortest time of any state.

The study assumed a retirement age of 65 and analyzed the annual cost of living, including expenses for groceries, housing, utilities, transportation and health care, based on the latest figures from the Bureau of Labor Statistics.

A $1 million pot was once considered the benchmark for a comfortable retirement, but the sum doesn't go as far as it used to as rampant inflation and rising interest rates have taken their toll on the cost of living.

Your browser does not support iframes.

In 2022, the same study found that $1 million could support a retiree in Mississippi for just over 25 years.

GOBankingRates estimates that retirees on a fixed income in Hawaii would have to spend as much as $96,982 a year on living expenses, throwing away a $1 million nest egg much faster than in the Magnolia State, where annual expenses are estimated at $44,059. .

After Hawaii, the study found that $1 million in retirement savings would be used up most quickly in New York and California.

In New York, the nest egg would last fourteen years and one month, while in California it would only last thirteen years and nine months.

Next on the list was Massachusetts, where the fund would last twelve years and nine months, and Alaska, where it would last fifteen years and three months.

Meanwhile, in retirement hotspot Florida, the study found that $1 million in savings could sustain a retiree for 18 years and 4 months.

The analysis found that there was slightly more buffer in many states in the Midwest and South.

As in Mississippi, the funds would extend over 22 years in Oklahoma and Alabama, according to GOBankingRates.

In Hawaii, savings would run out after just 10 years, 3 months and 22 days – the shortest time of any state – the study found (Photo: Kualoa Beach Park)

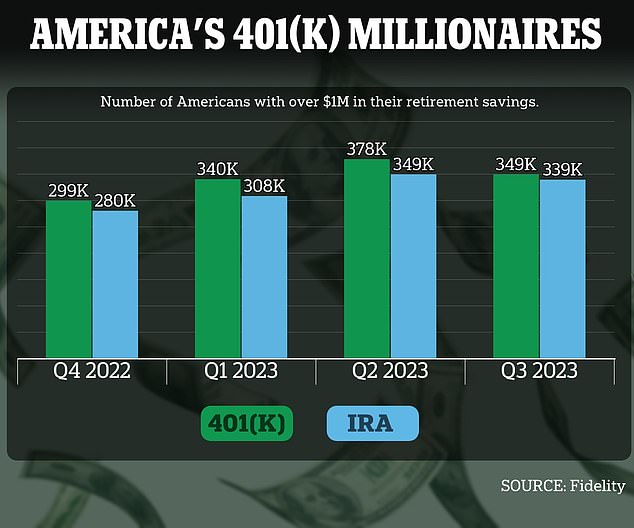

While $1 million may not be enough to see a saver through the twilight of their lives, the number of Americans with this amount in their retirement accounts exploded last year.

Thanks to a booming stock market, the number of 401(K) millionaires will increase by about 100,000 people by 2023.

About 349,000 401(K) owners and 339,000 workers with an individual retirement account (IRA) ended the year with a seven-figure balance, according to Fidelity Investments.

Although there is a slight decrease from earlier this year, the number is still well above 2022 levels, when the figures were 299,000 and 280,000 respectively.

The number of savers with $1 million in their retirement accounts will increase by about 100,000 people by 2023, thanks to the booming stock market

Retirement accounts have benefited from a strong stock market, with the S&P 500 ending the year 24 percent higher than in 2022.

It comes after experts uncovered how much workers of each age group would need to save in their 401(K) to reach $1 million by the time they retire.

According to a personal finance company The motley foola 22-year-old would have to save $325 a month throughout his career to retire with $1.01 million by the time he turns 62.

If a worker didn't start saving in his 401(K) until age 27, he would have to set aside $500 a month to reach $1.03 million by the same age.

The figure rises to $750, $1,200 and $1,900 for a 32-year-old, 37-year-old and 42-year-old respectively.

According to The Motley Fool, a general investing rule is to subtract your age from 110. The result is the percentage of your portfolio you should then allocate to stocks.